The industry can’t afford to be slow in adopting new technology. (Source: PGS)

Despite the cliché that “lower for longer” is quickly becoming, its impact on the oil and gas industry is becoming increasingly clear—the way business was done five years ago is unlikely to be sustainable again anytime soon.

Given that somewhat harsh reality, much of the discussion at the recent European Association of Geoscientists and Engineers (EAGE) conference revolved around the new business paradigm. What does a successful business look like these days?

During one of the EAGE forums, participants agreed that one of the main impediments to a successful industry is the lag time between discovery and first oil. Luca Bertelli, chief exploration officer for ENI, said the 30 months of low prices the industry has endured have called for a “complete reset” as it struggles to cope with $50 oil prices. Some of the companies that have done well in this environment, he added, are those involved in the unconventional plays.

“Unconventional companies are making skinny margins at $50 oil,” Bertelli said. “They’ve been able to get high-quality acreage and attain high operating efficiencies.”

Players in the conventional space, particularly in deep water, have yet to achieve similar success, and they’re still struggling to find the right recipe. Bertelli said cutting the workforce is not the solution because skills and expertise are lost. Shortening the cycle time, he said, is a better solution.

“We need an unconventional focus on conventional assets,” he said.

One solution is to cooperate with the geophysical contractors throughout the entire upstream cycle, he said. Another step is to take advantage of the latest technology such as high-performance computing and scalable algorithms.

It also helps to find assets in areas with established infrastructure. He cited ENI’s Nooros Field in Egypt as an example. This gas and condensate field in the Nile Delta contains 85 MMcm (3 Tcf) of reserves. ENI was able to reach a final investment decision (FID) within a month of the discovery and reached first gas two months after discovery. The field is now producing 28 MMcm/d (1 Bcf/d) and is the largest gas field in Egypt. Proximity to existing infrastructure enabled the company to be agile in its development plans.

Current business climate

CGG’s CEO Jean-Georges Malcor reminded the audience that talk of collaboration is meaningless if the parties don’t trust each other and if standardization is not emphasized. He cited several other points that are affecting the current business climate.

One is cost reduction. The geophysical contractor industry has seen a 50% to 70% reduction in costs in the last three years, which he said was “good and probably necessary,” but he questioned whether the sector could remain sustainable after such serious cost-cutting.

“This is a strongly capital-intensive business,” he said. “We need visibility, long-term commitments and R&D. With poor visibility, it’s hard to make decisions.”

He also feels the industry needs to be a bit more daring. It’s hard to shorten the cycle time when the industry is so slow to adopt new technology. “The world around us is moving so fast,” he said. “Unless we adapt, we’ll be left behind.”

Seismic collaboration

Erik Oswald, vice president of exploration Americas for ExxonMobil, used his time to tell a story about a worldclass discovery, the Liza discovery in the deep waters offshore Guyana. While not a classic quick-turnaround type of story, Liza is a good example of a phased development that helped keep the lease alive.

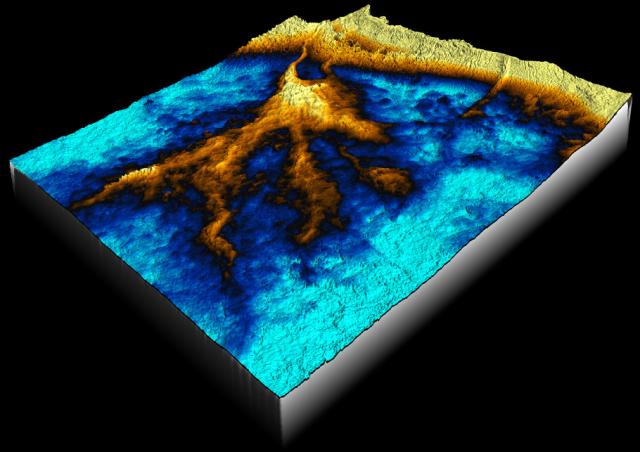

In the late 1990s the company’s geologists were trying to work out the plate configuration in the Caribbean Sea, a very complex environment. They developed a story that indicated that source rocks might have built up offshore Guyana, and a regional seismic line led them to believe this story might be true.

ExxonMobil worked with the government to tie up much of Guyana’s offshore area, only to be delayed by several years because of a border dispute between Guyana and neighboring Suriname. But by 2008 the company was able to shoot more 2-D seismic, and by 2013 it felt it had a good enough handle on the area to shoot a 3-D survey. The discovery well was drilled in May 2015.

Given the small size of the 3-D survey compared to the total size of the concession, Oswald said it was difficult to build a development concept. The company needed more 3-D but was running out of time on the licenses. So it worked with CGG to continue to shoot seismic while a rig stayed on location to drill up the lease. Ultimately, ExxonMobil acquired 17,000 sq km (6,564 sq miles) while continuing to drill up and develop the field.

“Within 10 weeks of the discovery we were working with CGG to acquire this huge survey,” he said. “The normal time frame is one year plus. We’re still down there drilling because of the great collaboration on the seismic.”

Overall, ExxonMobil arrived at its FID two years after the discovery and expects first oil within four years. “That’s pretty quick for an ultradeepwater discovery,” he said. “When you know you can accomplish something in less time, you challenge yourself and the industry to do better.”

Knowledge sharing

In an industry as competitive as oil and gas, the concept of sharing information might seem out of place. But panelists at EAGE’s Executive Session agreed that this concept will be critical in the future.

Four panelists—Gary Ingram from OMV, Tim Dodson from Statoil, Remi Eschard from Total and Dirk Smit from Shell—gave brief presentations on different aspects of knowledge sharing followed by a Q&A from the audience after each presentation.

Smit started by looking at the potential for knowledge sharing with other industries, particularly medical imaging. Advances in medical imaging over the years are truly remarkable. Smit showed a comparison of an MRI image of a brain taken in 1980 to a similar image today. Modern imaging shows much more detail about the structure of the brain. A computed tomography (CT) image resembles a scale model more than a scan.

“High-resolution imaging has taken significant steps forward,” he said. “This is something to look at in geophysics.”

The medical industry has made huge strides in machine learning to improve the quality of its images, a technique that could also make 3-D interpretation easier, although the panelists agreed that computers will never fully replace the value of a skilled interpreter. It also is taking advantage of augmented reality to, for instance, place a schematic of a heart valve over an image of a real beating heart to model the fluid flow and properly position the valve.

Already technology like CT scanning is being used in core analysis, but Smit said this could be taken further (e.g., imaging the chemical reaction in a rock/fluid interface). Shell also is applying medical imaging techniques to ocean-bottom seeps, studying the behavior of the escaping fluids and gases to determine their origin.

“This is a field that’s open for further advances,” he said. “This is the tip of an iceberg.”

Eschard described Total’s approach to forming a division devoted to basin mastery and knowledge retention. Faced with a large exploration group and massive retirements, the company realized that it needed to strengthen its knowledge sharing capabilities among its geoscientists.

Two years ago the company restructured, creating five regional hubs. The goal was to emphasize accountability, promote the initiative of local teams, acquire regional knowledge and provide exposure to different cultures and ideas.

The restructuring also signaled a return to basic geology. “Exploration teams can get in a rush and forget the original context,” he said. The back-to-basics approach is helping the teams select the best acreage while reducing risk at the prospect scale, he added.

Dodson addressed the very real challenge of knowledge transfer in the face of the “great crew change.” Noting the industry is facing the retirement of 50% of its workforce in the next five to seven years and that there’s a huge demographic gap between the oldest and youngest workers, he said the average age of his exploration staff is 45 and the average date of their university graduation was 1997. He characterized the industry’s future workforce as “fewer and older,” adding, “Knowledge does need to be transferred. This will be even more important in the digital age.”

To facilitate this, he said, recruiting efforts should focus not only on future geoscientists and engineers but also on data scientists who can work together with the geoscientists to handle the increasing amount of data the industry will face. This will require some “rebranding” efforts to make the energy industry a more attractive option to IT specialists.

“They have the opportunity to work with a huge amount of data and face complex challenges,” he said. “This has always been part of our industry, but it’s not the message we’re sending.”--Tom Dodson, Statoil

Ingram finished the presentations by discussing knowledge sharing among industry players, including competitors, government entities and university consortia.

He noted it’s rare to have all of the knowledge about a particular basin residing within one company. Knowledge sharing can facilitate country investment during licensing rounds, lead to higher quality investment decisions, ensure safe and efficient operations, enable higher success rates and help shorten the lead time to discovery and monetization.

“Knowledge sharing can be seen as a competitive edge,” he said.

He cited two successful examples of companies working together to improve their success rates. In one instance, OMV and others partnered with ExxonMobil for a concession in the Black Sea. OMV’s regional knowledge coupled with ExxonMobil’s technical capabilities, including its proprietary full waveform imaging algorithm, led to a discovery. In another example, Shell shared its knowledge about drilling into an overpressured reservoir in Turkey to help OMV drill another discovery well safely.

He cited several governments, including those of Norway, New Zealand and the U.K., as having open data policies that allow interested companies easy access to data while encouraging investment in the country.

“It levels the playing field,” he said.

Finally, the industry has several research consortia that facilitate a “comfortable environment” for companies to share their data and knowledge, Ingram said.

Overall, the panel agreed that the days of holding corporate data close to the vest are vanishing. “Those who have the best data are being eclipsed by those who can interpret it best,” Smit said.

Recommended Reading

Industry Players Get Laser Focused on Emissions Reduction

2025-01-16 - Faced with progressively stringent requirements, companies are seeking methane monitoring technologies that make compliance easier.

Pioneer to Adapt Emvolon’s Flare Gas-to-Methanol Tech

2025-01-13 - The Department of Energy awarded Pioneer Energy $6 million to demonstrate the technology at an oil and gas facility in the Eagle Ford Shale for 12 months.

Pickering Prognosticates 2025 Political Winds and Shale M&A

2025-01-14 - For oil and gas, big M&A deals will probably encounter less resistance, tariffs could be a threat and the industry will likely shrug off “drill, baby, drill” entreaties.

Corrolytics Diagnoses Corrosive Microbes Before Symptoms Appear

2025-03-18 - Cleveland startup Corrolytics offers a solution to detect microbial corrosion rates on site and in near-real time—and head off a problem that costs trillions of dollars to industrial assets worldwide.

Burgum: US Electrons are ‘Mission Critical’ in Cyber War with China

2025-03-28 - Natural gas will play a key role in feeding energy to tech providers like Microsoft Corp. as China innovates in the AI arms race at breakneck speed, Interior Secretary Doug Burgum said at CERAWeek by S&P Global.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.