Production from the Mississippian extends from the south-central region of eastern Colorado through southwestern Kansas and northern Oklahoma, generally considered the “sweet spot” for current production along trend. As with many conventional and all unconventional plays, the factors controlling production are multiple and are not always easily quantified. One common challenge of this trend remains excessive water cut and the increasingly negative impact it has on the economics of the play as well as water disposal restrictions.

Considerable attention has focused on Mississippian reservoir characterization due to the extensive array of lithofacies and pore types, including fractures, all contributing to substantial variations in production characteristics. Since the explosion of unconventional exploration, key geological, petrophysical and geomechanical attributes have been extrapolated from available well data and often back-calibrated to seismic data. Each parameter is intended as input to engineering models constructed to optimize horizontal drilling and completion parameters and realize optimal production performance.

The influence of faulting and fracturing with respect to water production in the Mississippi Lime reservoirs is difficult to assess due to lack of reported water data in states such as Kansas. Of course, operators familiar with local trends can sometimes avoid problematic areas, but consistent risk reduction requires calibration to known data and the ability to extrapolate knowledge to surrounding areas.

Area of interest

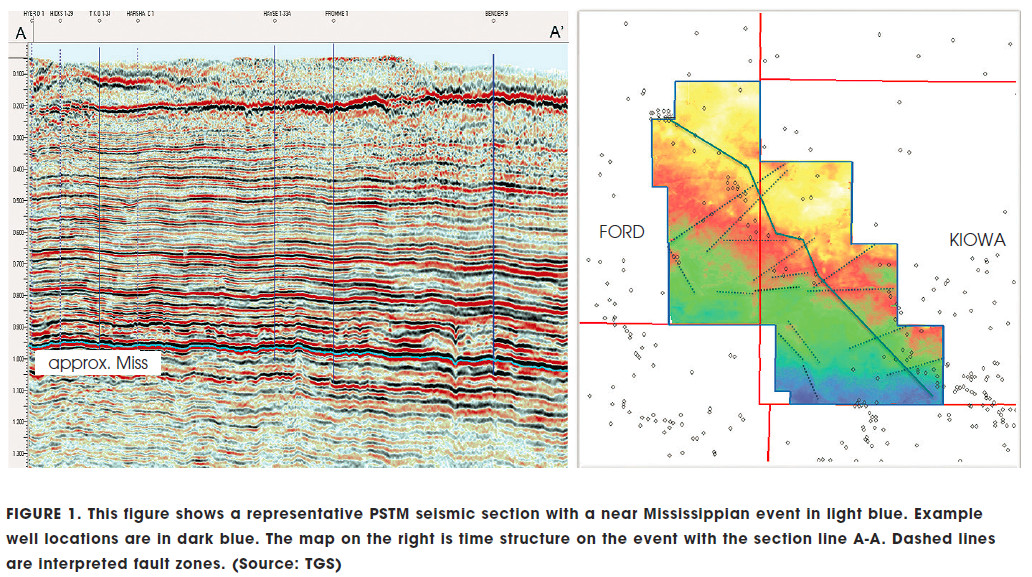

To gain some perspective on possibilities with existing data, a recent scoping exercise looked for correlations of current production trends and IP test data with significant fault and fracture zones highlighted on a recent TGS Bucklin 3-D prestack time migration (PSTM) seismic survey. This scoping exercise focused on Ford and Kiowa counties in southwestern Kansas, with the 3-D survey covering about 673 sq km (260 sq miles) over modest Mississippian production.

Figure 1 displays a northwest-southeast seismic time section as well as a map view illustrating near–Mississippian time structure and interpreted fault zones. The seismic in the area has significant localized structural complexity that is not recognized in mapping from well control. Fault trend orientation in the area is remarkably consistent with a dominant northeast-southwest and northwest-southeast fabric as well as an east-west trend. Faults are dominantly near-vertical and normal in offset; however, a number of areas display more complex deformation.

The left image in Figure 2 is a simplified display of Mississippian lease oil production with bubbles representing one year’s relative cumulative production. To deliver data at the well level, TGS runs the lease volumes through a lease-to-well allocation algorithm each month. The algorithm leverages test data results and production start and stop dates to assign a logical and weighted “ratio” to each individual well.

The display on the right shows Mississippian IP tests for the same well set with proportionate volumes of oil, gas and water. TGS well performance Kansas production data are obtained directly from the Kansas Geological Survey (KGS). Starting in 1987 KGS began reporting monthly oil and gas volumes at a lease-level, but it does not report water volumes. Until KGS mandates reporting monthly water production, one alternative is to use IP test records, also reported by the KGS, which reflect water volume flow captured during a well test event. Water flow is reported in barrels, typically during a 4-hr or 24-hr test period.

Even this sparse IP dataset affords some opportunity to explore multiple relationships when leveraged with seismic attributes. However, every observation needs to be correlated and validated against the available geology and reservoir characteristics.

Test data must be validated with KGS completion reports and compared to known local data. An example of this is the Stewart 1-H well indicated with the red arrow. The IP recovered 3,000 bbl of water over a 24-hr period. Water recoveries from tests in the area of interest are typically less than 100 bbl, so this large volume is the result of fracture fluid recovery rather than proximity to an aquifer.

The correlation of fault zones to the Mississippian oil production data range selected in this survey area appears to be minimal; however, some relationships do need to be investigated.

Figure 3 shows a coherency display with a lease oil relative first-year cumulative bubble overlay. The coherency attribute highlights areas of discontinuity (dark lines) on the Mississippian event which, in this play trend, might indicate features such as karsting, fracturing and faulting. Some linear features are observed, but in general the image shows patches and clusters of low coherency.

Some correspondence to oil production might exist in the southeast and northwest of the survey. Well data in these patches might shed some light on the nature of the deformation.

Observations on the seismic most positive and most negative curvature attributes on the Mississippian event provide more support to the structural interpretation. Figure 4 shows the curvature volume as a chair display. The curvature attribute clearly highlights major faults and fault trends consistent with the interpretation presented in the previous figures. The combination of most positive and most negative curvatures with coherency data might prove to be a powerful interpretation tool in this trend.

Understanding the volumes from all hydrocarbon phases (oil, gas, liquids and water) is instrumental to maximizing results. The lease production reporting system in Kansas imposes significant limitations in the complete understanding of the reservoir and the ability to effectively explore and identify sweet spots.

TGS continues to work on ways to enhance available production and test data. The Bucklin 3-D survey area provides a practical test with some basic 3-D seismic data and tools that, when validated and leveraged with strong reservoir knowledge, could be helpful in improving identification and risking of prospective trends and assumptions and estimates on reservoir potential.

Recommended Reading

Kissler: Wildcards That Could Impact Oil, Gas Prices in 2025

2024-11-26 - Geopolitics and weather top the list of trends that will determine the direction of oil and gas.

Adkins: Saudi Cuts to Stay, EVs are Overrated and China Matters Less

2024-12-03 - Marshall Adkins, head of energy at Raymond James, isn’t buying the prevailing wisdom that weakening Chinese oil demand, EV encroachment and a potential OPEC supply increase are legitimate threats to the oil market.

Long-Debated Alaskan NatGas Project Comes Into Focus

2024-11-20 - Pantheon Resources steps up with proposal to bring natural gas to the southern part of the state.

Suez Canal Economic Zone Set for Rapid Expansion: Chairman

2024-11-05 - Egypt's Suez Canal Economic Zone is a collection of six ports and four industrial areas alongside, or near the waterway.

Marcellus Waiting to Exhale But Held Back by Regional, Economic Factors

2024-11-06 - After years of exploitation as one of the country’s first unconventional shale plays, the Marcellus still has plenty of natural gas for producers, even if regional and economic factors have kept much of it bottled up.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.