The Water Lens system helps service companies and operators better understand the chemistry of fracture fluids and water within a reservoir. (Source: Water Lens)

Operators and service companies need to have a strong grasp on the chemistry of the water they are using to fracture a well. Chemicals such as boron, barium, iron II and iron III can have a detrimental effect on the fracture fl uids. In addition to understanding the water’s chemistry, companies are under pressure to reduce their use of freshwater and leverage more recycled water in their fracturing operations.

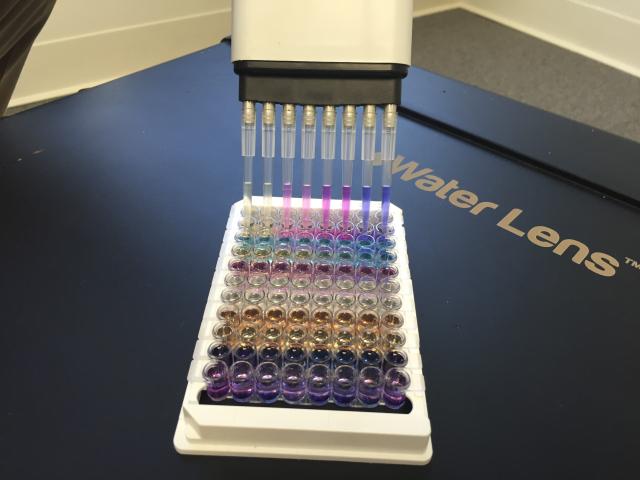

Houston-based Water Lens has developed a water-testing system it said solves the challenges of fully characterizing water chemistry and frees companies from relying on often unreliable field kits or outside laboratories. Its system works with a 96-well plate preloaded with all of the necessary chemistries to perform each analysis. The kit is configured to test for the most critical parameters that shale producers might require when preparing produced and fl owback water for fracture jobs.

“The principles of the operation are based on colorimetric detection,” said Keith Cole, CEO and founder of Water Lens.

“What differentiates Water Lens from other colorimetric systems is our ability to account for interferences,” said Adam Garland, chief science officer for WaterLens. “All of these chemicals are interfering with the other tests. Since we measure them all at the same time, we can account for their impact on the final results using our proprietary correction algorithms.”

The results of the test are formulated in about 10 minutes, Garland said, and can be conducted either in the field or in a laboratory.

“You load the water into the tray, and then you put the tray in the reader and press ‘Go,’” Cole said. “From there, everything is automatic, and [the system] just generates the report. The machine scans the plate, looks at the color changes and runs it through the algorithms to account for interferences, and then the software generates a report that lets the user know what’s in the water.”

Garland said the Water Lens system has been used around the world, including the Permian Basin, Eagle Ford, Bakken, the Middle East, Canada, Oklahoma and Utah. Cole said the system is easily adaptable for offshore use as well, where weight and space limitations exist and large-scale testing units may not be feasible.

In an example of the system’s effectiveness, Cole said a mid-size service company experienced cost savings by monitoring its fracture stages with the Water Lens system.

“They used our system to monitor every stage of the frack that they were pumping,” he said. “They were noticing that the fl uid was starting to change—it was a gel frack. The fl uid started to weaken, and because they were monitoring with our system, they caught it before it became a big problem.”

Cole explained the company was able to stop the fracture job for about 30 minutes and adjust the chemistry of its fl uids before going back online—a measure that the company said saved about $100,000 to $200,000.

Water Lens currently tests for 26 parameters in a single analysis. According to Water Lens, more parameters are under development and will be available shortly, including tests for sulfate-reducing bacteria, manganese, phosphate, silicate, chlorine and zinc.

“People get excited about what we have, but they get even more excited about what’s coming around the corner,” Cole said.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Eight Weeks

2025-01-31 - For January, total oil and gas rigs fell by seven, the most in a month since June, with both oil and gas rigs down by four in January.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-01-10 - The oil and gas rig count fell by five to 584 in the week to Jan. 10, the lowest since November.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Equinor Begins Producing Gas at Development Offshore Norway

2025-03-17 - Equinor started production at its Halten East project, located in the Kristin-Åsgard area in the Norwegian Sea.

US Drillers Cut Oil, Gas Rigs for First Time in Six Weeks

2025-03-07 - Baker Hughes said this week's decline puts the total rig count down 30, or 5% below this time last year.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.