As global reserves become more challenging to exploit, it is not surprising that the importance of technology, reflected as R&D expenditure per barrels of oil equivalent produced, has increased with time. But perhaps more intriguing is the fact that by 2010 gross R&D investment of the industry’s largest national oil companies (NOCs) exceeded that of the major international oil companies (IOCs) for the first time (Figure 1). This milestone is surely confirmation of the growing desire of NOCs to reduce reliance on the technologies provided by IOCs and service company partners.

But if this is the case, why are the major IOCs still renowned for technology excellence and why have NOCs, perhaps with the exception of a few notable examples in specific technology areas, failed to close the technology gap?

If R&D spends were being used effectively, should NOCs not be moving rapidly toward self-sufficiency and delivering a never-ending supply of world-first technologies via the application of systems and processes that have proved to be so successful for IOCs before them? Of course, the answer is not straightforward, and the reasoning for this lies in the perception of value.

As custodians of a nation’s resource, NOCs find themselves in a unique position. They have the opportunity (many would argue a duty) to optimize production with the purpose of ensuring that maximum value is returned to the nation. However, this value extends beyond a fiscal metric and shareholder dividend as NOCs are tasked with a much greater objective. In addition to delivering their core business, NOCs also must stimulate the national economy; support industrial policy; drive forward education, health and welfare systems; and deliver prestige to the nation through demonstrations of technical excellence.

With such a responsibility, for an NOC (as it is for an IOC) the implementation of a structured technology management framework is vital to ensure that resources are used wisely. The most important ability is first to identify and prioritize operational challenges across the portfolio and to ascertain the options available to address them.

Challenges

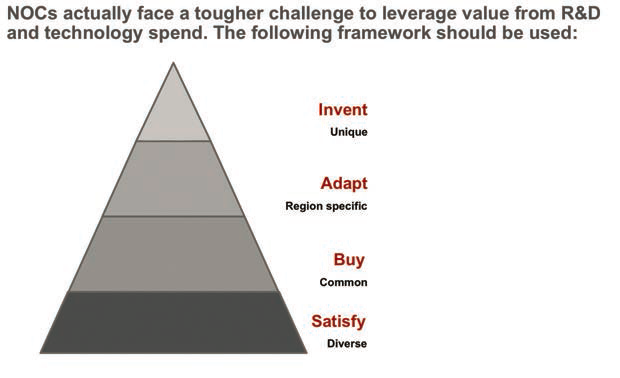

The challenge triangle (Figure 2) is a method of segmenting the challenges faced by an operator (in this case an NOC) into categories that correspond to how these challenges may be addressed.

• Tier I corresponds to challenges that are unique to the operator or that cannot be addressed with existing technology across the entire industry. These require the operator to actively drive the pace of innovation, to invent solutions;

• Tier II corresponds to challenges that cannot be immediately satisfied by off-the-shelf technology. These challenges require some adaptation of technology to fully satisfy the operator’s challenge within their specific application scenario; and

• Tier III corresponds to common challenges for which there exists an off-the-shelf solution.

Tiers I, II and III (the operating challenges) are experienced by all operators, IOCs and NOCs alike.

Tier IV

Tier IV, however, reflects the additional pressures placed upon NOCs that have little influence on IOC decision-making. These are challenges that exist within the nation outside of the day-to-day operation of the business that an NOC is obliged to address (i.e., national value drivers). For instance, these might include funding of research or education ventures (e.g., to increase annual Ph.D. outputs), the subsidising of infrastructure such as roads or hospitals and potentially even the seeding of other industries. Tier IV challenges compete equally, if not advantageously, for NOC resource and also might cause different decisions to be made in Tiers I, II and III.

The relative size of each tier will vary between operators by virtue of their asset base and strategic objectives, but typically speaking, in the order of 80% to 90% of operational challenges can be satisfied through adaptation or direct deployment of off-the-shelf solutions (Tier II and III). Despite this, there is a marked difference between the focus of R&D investment across the tiers between the major IOCs and NOCs. As was alluded to earlier, this is due to the way in which value is recognized.

Value quantification

For IOCs the quantification of value is arguably much simpler due to the fact that at its most basic level “value” can be crudely substituted for a fiscal (or sometimes an improvement in HSE) metric that quantifies the return on investment (ROI) once the technology has been deployed. Clearly, this is not strictly the case as factors such as staff retention, know-how and internal capability are all examples of intangible value returned from R&D even if the technology never reaches the field.

Nonetheless, IOC R&D efforts will focus on Tiers I and II with a view to delivering technology to the oil field in a timely and cost-effective manner ahead of or more effectively than their peers. After all, the objective of IOC R&D activity is to create a competitive advantage that enables continued access to reserves and, as a result, the satisfaction of shareholders.

For NOCs, with an additional layer of value factors to consider (Tier IV), the picture is more complex. These companies are influenced by pressures from their main stakeholder (the state) and tasked with developing national capabilities that can extend beyond the oil and gas sector. All of these factors must be considered and incorporated in the way that companies respond to their production-related challenges (Tiers I, II and III).

And given there will be very few areas where there is the justification to truly invent, NOCs tend to focus on Tiers II, III and IV where (arguably) the nation’s greater value opportunity lies—in being a great adaptor and buyer of technology.

Being a great buyer of technology is no less important for an IOC but, less influenced by Tier IV challenges, it is less of a burden as expertise sourcing is far more mobile on the international market; buying capability can be acquired rather than grown. For NOCs, building and retaining this capability requires continued investment to train staff, and consequently to achieve the same level of buyer (and adaptor) capability, NOCs find that they must invest more intensely and over longer time frames than their IOC counterparts.

In conclusion, it is clear that despite being motivated by different drivers, technology and R&D investment is equally as important for NOCs as it is for IOCs. However, the value to be gained from this investment (the ROI) lies in a different place for each. NOCs do not need to invent technology at the same pace as IOCs because they are rarely competing for resource and, in fact, influenced by pressures from the state, their greatest value opportunity lies in developing great adaptor and buyer capability while investing in the long-term prosperity of the nation. Consequently, not only will the focus of R&D vary significantly between IOCs and NOCs, but so too will management processes and technology acquisition strategies.

Recommended Reading

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

BKV Positions Itself to Meet Growing Power, CCS Demand

2025-02-26 - Electricity needs across the U.S. are expected to soar as industrial and manufacturing facilities, data centers and other consumers crave more power. BKV is exploring ways to bridge the gap between demand and energy supply.

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.