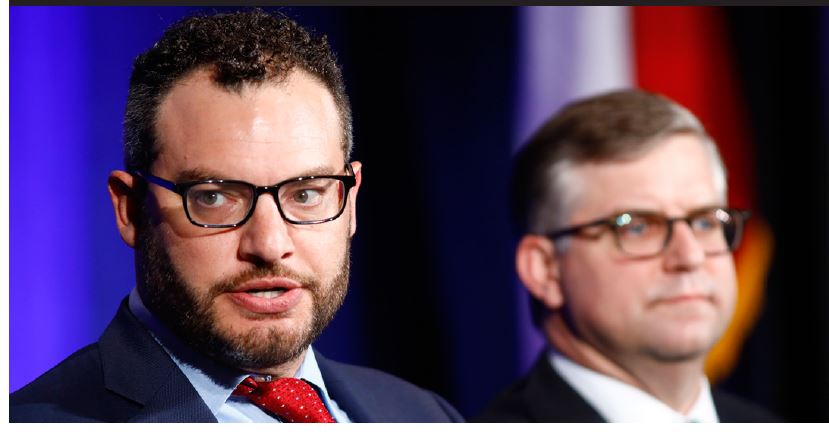

A&D math is changing because the structure of the upstream industry has changed. This is directing activity and capital inflows, said Doug Reynolds, speaking at Hart Energy’s 16th annual A&D Strategies and Opportunities conference in Dallas.

“A key benchmark is net economic locations, which is a better indication of undeveloped value. So we’re starting to think about metrics differently,” said Reynolds, managing director and head of U.S. investment banking for Scotiabank.

“A couple of years ago, we talked about acres. Then we were talking about effective acres where you stacked things up, but now we’re talking about economic effective acres,” he said. “We think the economics of individual locations are really starting to matter. A location that doesn’t earn 20% at strip prices is being dropped out of the M&A analysis.”

"To drill 10 pads in a play at 10 or 20 wells apiece will require a lot of pipe, a lot of people, a lot of capital and a lot of everything else—that's tough to do if you're a small company," Doug Reynolds, Scotiabank's managing director, said.

Metrics on A&D deals are imprecise and change depending on who writes the press release, he said. Some buyers are big on acres, others on effective acres, others on locations. “Now we are thinking in terms of undeveloped economic locations … based on the perceived riskiness of a play.”

The U.S. shale business is changing as activity in every basin shifts from discovery to full multipad development. In the past, operators were delineating single zones with single wells and trying to find new, deeper layers to drill. Today, they are well past that phase because of the cube concept—pads where wells are drilled in a large areal extent such as 2-mile laterals, into multiple stacked producing formations.

This change requires much more capital, however, which in the end will be favorable to larger E&P companies, he said, perhaps necessitating a new round of corporate M&A to build up the size of larger independents. “To drill 10 pads in a play at 10 or 20 wells apiece will require a lot of pipe, a lot of people, a lot of capital and a lot of everything else—that’s tough to do if you’re a small company.”

What’s more, a bigger corporate structure, one that has larger scale, more properties, more capital, is being rewarded by the stock market, Reynolds said. E&P companies with market caps of $8- to $60 billion are those that are driving production volume growth in the most active plays, not the majors and not the smaller players. They are getting rewarded in the market.

It will be important to see more equity issuance come back to the market to help A&D deals take place this year, he said. Private companies have made up about half of the sellers’ universe in 2016 and 2017, by selling assets to larger public E&Ps.

In the past, large private E&Ps and international oil companies were active buyers, but now these large caps have been better sellers than buyers, he said. The international buyers have been almost completely out of the market in the past two years, but he sees Asian buyers starting to make inquiries again for the first time since the downturn.

Smaller E&P companies that are not well-valued face challenges: They have to differentiate and grow quickly, or find a new format, he said. Large E&Ps with stronger multiples are the buyers, but they will be “super picky,” he said. He also sees more private-equity capital coming into the sector as buyers.

Non-Permian, non-Scoop/Stack plays

Buyers are rushing to non-Permian, non-Scoop/Stack basins as prices for these assets have exceeded their entry-level economics, according to Geoff Roberts, BMO Capital Markets Corp.’s managing director and head of U.S. A&D.

“The Permian is still the king, of course,” in terms of basins buyers would like to own, Roberts said at the conference. “You can’t have a conversation about the upstream without starting with the Permian.”

But it’s expensive. “We’ve seen the logical results of that kind of focus. Over the last three years, we had that many people trying to spend that much money in one place—if you want to combine the Delaware and Midland [basins] into ‘one’ place.”

What they’re encountering? “The competition is severe,” he said. “The supply [of available land] is inadequate. And there’s a lot of money looking to be spent.”

In the past two years, BMO’s asset-marketing group has seen “overflow money that couldn’t be spent in the Permian but needed to be spent by [operators] looking for ways to expand through acquisitions, and they had to go to the next best areas.”

That money began buying in the Eagle Ford, the Haynesville and the Scoop/Stack, “which, I guess, is now the Stack/Merge,” he said. “Those basins benefited and, for a while, we were pretty much commodity agnostic—oil or gas, so long as it was a decent acquisition—if there was less competition, and they could get in at the PV-10s [for PDPs] and the PV-20s [for PUDs].”

Now prices in those plays are exceeding many entry economics; they’ve “heated up too much.” So, the BMO team is seeing “a lot of people moving up to the Rockies now.” Interest is in the Piceance Basin “and a couple other basins in the area,” he said.

“There is a lot of activity headed that way now. And,” he added, “people are starting to talk about the Marcellus again. It’s kind of a food chain in reverse.”

Randy King, managing director of Anderson King Energy Consultants LLC, concurred that money is looking again at older plays. He added that upstart E&Ps would do well to consider a business strategy of enhanced exploitation of old unconventional resource wells.

"We are creating a huge inventory of older horizontal oil wells that will eventually fall back into that 'food chain' category," King said.

“We are creating a huge inventory of older horizontal oil wells that will eventually fall back into that ‘food chain’ category,” he said. “You could argue that a good strategy would be to put the expertise together to manage the artificial lift, restimulation, cleanouts, plugging and repair of these horizontal wells to milk them over long periods of time.”

Jimmy Crain, director at EnCap Investments LP, said the private-equity dollars EnCap and some other firms are deploying today are going to business plans that aren’t necessarily typical of five years ago. “We’ve seen a big push in private equity to get into minerals and nonoperated properties,” he said.

“We’ve seen over $1 billion buying minerals largely in [the Permian and Oklahoma] as ways in which to continue to be able to create value in those basins that don’t look like our traditional operated E&P companies.”

Among the traditional start-ups, however, Crain concurred with Roberts and King that money is looking for better entry-level economics. “I’ve seen two trends. One is you’ve seen a lot of private equity [start-ups] go to non-Permian, non-Scoop/Stack basins because they feel like it’s too competitive and too expensive to reinvest back in those plays [they just exited]. We’ve seen a lot of transactions outside of those basins.”

Meanwhile, the other trend is of start-ups trying to get back into these basins—if they can. “In those areas, you have to be creative to be able to compete with big capital coming into the door. For us, that was, in many cases, kind of pushing the edges of the basins, extending whatever the core looks like today.

“In some cases, some of our teams with just incredible business-development capabilities have been able to buy assets in the core, but that’s tough to do—very competitive and expensive.”

A&D deal-making

Rising oilfield service costs are contributing to the slower pace this year of A&D deal-making since the first quarter, according to Billy DeArman, a principal with private-equity investor Tailwater Capital LLC.

“People who were using low service costs to underwrite valuations are now looking at prices going up, so you don’t have that tailwind,” DeArman said at the conference.

In addition, “people over the last 18 or 24 months that were willing to make bets on [commodity] prices … are not anymore. So that changed.” As a result, “stuff’s not happening as quickly.”

Prospective sellers are beginning to come back to the table with a revised expectation, though. “People [looking to sell] were probably prouder of their assets than we were in terms of buying them.” But improved parity in bid/ask is being found.

Chris Atherton, president of asset marketer EnergyNet LLC, said deals were more difficult to get to the finish line in the second and third quarters, “but we’re getting them to the finish line.”

DeArman said a handful of processes have failed, but he’s in the midst of four deals now.

Travis Nichols, a managing director for investment banker Tudor, Pickering, Holt & Co., said reduced access to public-equity markets to fund acquisitions is making public buyers “more choosey about what they’ll buy.” They’re having to look at funding a deal with debt and the effect this will have on the leverage ratio.

Deals were more difficult to get to the finish line in the second and third quarters, "but we're getting them to the finish line," Atherton said.

“Without that equity, there is some reluctance—unless it’s a bolt-on,” Nichols said. “If it is an obvious fit, there will always be money. … We’re just not seeing a lot of folks on the public side excited about adding in a new strategic area or doing anything to really stress the company.”

Meanwhile, said David Edwards, an executive director with UBS Investment Bank, “there is still a whole suite of private equity out there for acquisitions, so most of the assets are finding a home.”

Nichols expects more family-owned E&Ps to divest, such as the John Yates family sale to EOG Resources Inc., the George Yates sale to Matador Resources Co. and the Bass family sale to ExxonMobil Corp.

“It’s generally a very pristine part of our ecosystem where they’re never sellers—until, one day, they sell,” Nichols said. “For a lot of those folks, having lived through this downcycle, which has been prolonged, and now the … ability to trade assets” for equity to a high-quality buyer, “that’s going to pay a dividend, I think, is going to be very compelling.

“I think we’ll see more of these in the next 12 to 24 months.”

Edwards agreed, adding that the logical buyers will continue to be majors and large independents.

As for who will be the buyers of long-lived, cash-flowing properties in the absence of the MLPs from the buyside of the table in that space, Nichols said, “I’m hoping everyone in this room.”

Those who may not want to pay $50,000 for a Permian acre, “there is a way to make money in the business, and that’s buying cash-flowing assets.”

Reduced access to public-equity markets to fund acquisitions is making public buyers "more choosey about what they'll buy," Travis said.

Will more of this type of property come on the market? Nichols said, “They’re coming. … There will be a lot of packages over the next 12 months that will hopefully provide the supply for folks in this room.”

Recommended Reading

Freshly Public New Era Touts Net-Zero NatGas Permian Data Centers

2024-12-11 - New Era Helium and Sharon AI have signed a letter of intent for a joint venture to develop and operate a 250-megawatt data center in the Permian Basin.

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

2024-12-02 - Spurned or simply ignored by the big publics, the Permian Basin’s conventional zones—the Central Basin Platform, Northwest Shelf and Eastern Shelf—remain playgrounds for independent producers.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Blackstone Buys NatGas Plant in ‘Data Center Valley’ for $1B

2025-01-24 - Ares Management’s Potomac Energy Center, sited in Virginia near more than 130 data centers, is expected to see “significant further growth,” Blackstone Energy Transition Partners said.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.