A&D DEAL SHEET

|

|||||

|

Sector |

Date Announced |

Buyer |

Seller |

Value (US$MM) |

Comments |

|

E&P |

5/6/19 |

Amplify Energy Corp. |

Midstates Petroleum Co. Inc. |

N/A |

To acquire Midstates through a merger; combined company portfolio includes CA, E TX/N LA, S TX's Eagle Ford and OK's Mississippian Lime. (Expected to close 3Q 2019) |

|

E&P |

5/5/19 |

Total SA |

Occidental Petroleum Corp.; Anadarko Petroleum Corp. |

8,800 |

To purchase Anadarko’s African assets which include assets in Algeria, Ghana, Mozambique and South Africa. (Expected to close 2H 2019) |

|

Mid |

5/6/19 |

Bison Oilfield Services LLC |

Big Star Trucking LLC; Vista Disposal Solutions LLC |

N/A |

Acquired Big Star's OK water hauling division and certain existing and pending saltwater disposal permits owned by Vista during 1Q 2019. |

|

Mid |

5/6/19 |

Bison Oilfield Services LLC |

Cobalt Environmental Solutions LLC |

N/A |

Purchased Cobalt, a water disposal business in the Scoop and Merge plays of OK's Anadarko Basin. |

|

E&P |

5/6/19 |

Ensign Natural Resources LLC; Warburg Pincus LLC; Kayne Anderson Capital Advisors LP |

Pioneer Natural Resources Co. |

475 |

Bought Pioneer’s Eagle Ford Shale assets comprising roughly 59,000 net acres in S TX with 14,000 boe/d of average net production during 4Q 2018; comprised of $25 MM at closing and $450 MM contingent payments. |

|

E&P |

5/6/19 |

Undisclosed |

Abraxas Petroleum Corp. |

15.5 |

To purchase certain nonoperated properties located in the Williston Basin in ND; represents roughly 5% of Abraxas' current Bakken daily production of 7,000 boe/d. |

|

E&P |

5/7/19 |

Undisclosed |

Diamondback Energy Inc. |

322 |

To purchase, in separate transactions, a package of 103,423 net acres in the Central Basin Platform, Eastern Shelf and the Northwest Shelf plus 6,589 net acres in the Southern Midland Basin in Crockett and Reagan counties, TX; estimated full-year 2019 net production is about 6,500 boe/d from over 3,000 producing wells. |

|

Mid |

5/8/19 |

MPLX LP; Marathon Petroleum Corp. |

Andeavor Logistics LP; Marathon Petroleum Corp. |

9,000 |

To acquire Andeavor, another midstream affiliate of Marathon Petroleum, in a unit-for-unit merger agreement. (Expected to close 2H 2019) |

|

E&P |

5/9/19 |

Occidental Petroleum Corp. |

Anadarko Petroleum Corp. |

57,000 |

To acquire The Woodlands, TX-based independent producer with a portfolio of international assets including 600,000 gross acres in the Permian's Delaware Basin; stock-and-cash transaction includes assumption of debt. (Expected to close 2H 2019) |

|

E&P |

5/9/19 |

Undisclosed |

Samson Resources II LLC |

N/A |

Purchased a portion of Samson's position in Converse County, WY, in exchange for cash plus 15,000 net acres bolt-on to an acreage position in Johnson County, WY, within the Powder River Basin; includes all depths below the Fort Union formation. (Expected to close May 31) |

|

Mid |

5/10/19 |

IMF Investors |

Buckeye Partners LP |

6,500 |

To acquire Houston-based Buckeye for $41.50 per unit in an all-cash transaction; includes networks of integrated midstream assets primarily in the East Coast and Gulf Coast regions of the US, as well as in Caribbean. (Expected to close 4Q 2019) |

|

Mid |

5/10/19 |

Prostar Capital |

NuStar Energy LP |

250 |

To buy the storage terminal facility in St. Eustatius located in the Caribbean consisting of 60 commercial tanks and associated deepwater jetties and pipelines, with a total storage capacity of 2.3 million cubic meters. (Expected to close 2Q 2019) |

|

E&P |

5/13/19 |

Equinor ASA |

Royal Dutch Shell Plc; Shell Offshore Inc. |

965 |

To acquire, through an exercise of preferential rights, an additional 22.45% interest in the Caesar Tonga deepwater US GoM field within the Green Canyon area; boosts Equinox's interest to 46% from 23.55%. |

|

Mid |

5/13/19 |

Shell Midstream Partners LP |

Royal Dutch Shell Plc |

800 |

To buy in a dropdown additional interests in the Explorer and Colonial systems, which have the capacity to deliver some 3 MM bbl/d of refined products. (Expected to close 2Q 2019) |

|

Mid |

5/14/19 |

NGL Energy Partners LP |

Mesquite Disposals Unlimited LLC; Mesquite SWD Inc. |

890 |

To acquire the Northern Delaware Basin-focused produced water disposal company through a combination of Permian assets in Eddy and Lea counties, NM, and Loving County, Texas. (Expected to close July 2019) |

|

E&P |

5/14/19 |

Spur Energy Partners LLC; KKR & Co. Inc. |

Percussion Petroleum LLC; Carnelian Energy Capital Management LP |

N/A |

To acquire Permian Northwest Shelf assets within the core of the Yeso formation in Eddy and Lea counties, NM, comprising 22,000 net acres and interests in roughly 380 gross producing wells plus associate water and midstream assets; produced 9,200 net boe/d (85% liquids) during 1Q 2019. (Expected to close 2Q 2019) |

|

S&S |

5/14/19 |

Wellbore Integrity Solutions; Rhône Group LLC |

Schlumberger Ltd. |

400 |

To purchase the businesses and associated assets of DRILCO, Thomas Tools, and Fishing & Remedial services, along with part of a manufacturing facility located on Rankin Road in Houston. |

|

Source: Hart Energy |

|||||

For more up-to-date information on the latest deals visit Hart Energy’s online database of transactions.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

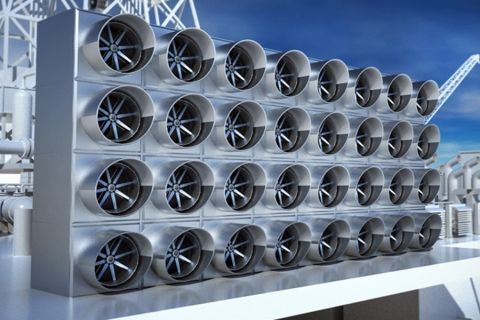

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Quantum’s VanLoh: New ‘Wave’ of Private Equity Investment Unlikely

2024-10-10 - Private equity titan Wil VanLoh, founder of Quantum Capital Group, shares his perspective on the dearth of oil and gas exploration, family office and private equity funding limitations and where M&A is headed next.

No Shortage of Capital, Shortage of Investable Low-carbon Projects

2024-09-30 - Investors are looking to the bankability equation—sustainability plus guaranteed returns—and finding that the energy transition’s problem is not a shortage of capital, but a shortage of investable projects.

Carbon Removal Company Equatic Appoints New CEO

2024-11-18 - Equatic appointed a new CEO in preparation to launch the world’s largest ocean-based carbon removal plant.

Exclusive: How E&Ps Yearning Capital can Stand Out to Family Offices

2024-10-15 - 3P Energy Capital’s Founder and Managing Partner Christina Kitchens shares insight on the “educational process” of operators looking at opportunities in the U.S. and how E&Ps looking for capital can interest family offices, in this Hart Energy Exclusive interview.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.