Aethon Energy will acquire Tellurian Inc.'s Haynesville Shale assets for $260 million, further expanding Aethon's growing Haynesville footprint. (Source: Shutterstock)

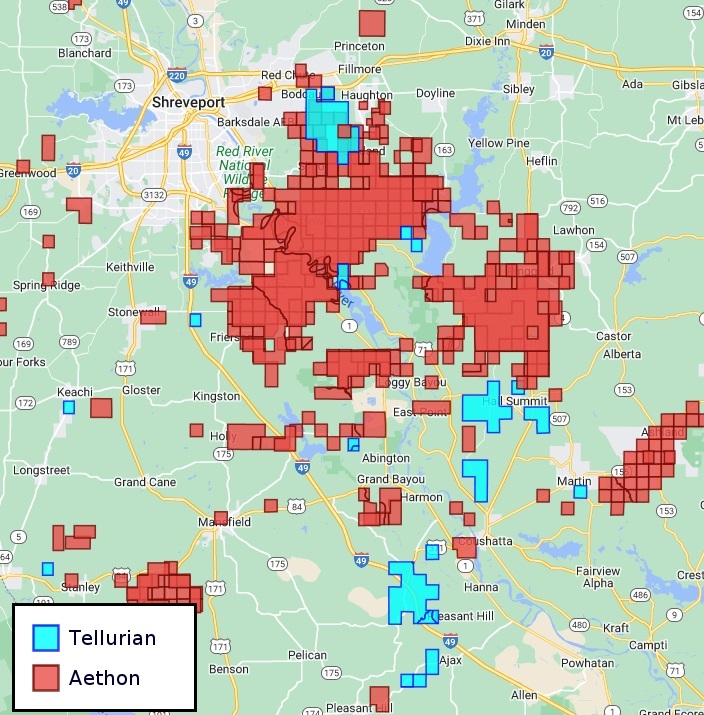

Editor's note: This article has been updated with an acreage map showing the approximate locations of Aethon Energy and Tellurian's acreage positions in the Haynesville Shale.

Aethon Energy will acquire Tellurian Inc.'s Haynesville Shale assets for $260 million, allowing Aethon to continue growing as the basin's top private producer and for financially struggling Tellurian to prioritize its flagship Driftwood LNG project, the companies announced May 29.

The deal expands Aethon's growing Haynesville footprint with integrated upstream assets in the Louisiana Haynesville and Bossier shale basins with 31,000 net acres, including gathering and treating systems with capacity of about 100 MMcf/d, bringing Aethon’s pro forma gathering and treating capacity to more than 3 Bcf/d.

Tellurian will use the proceeds for debt reduction. But, notably, the agreement includes the parties negotiating a 20-year offtake agreement that would be indexed to Henry Hub pricing plus a liquefaction fee, with appropriate credit support, to provide the basis for project financing of Driftwood LNG. Aethon said it will continue to explore additional opportunities to bring value to Driftwood LNG following the transaction.

The deal is expected to close by the end of June.

Aethon has emerged as the top private producer in the Haynesville, and it would be second overall only to Chesapeake Energy after its pending merger with Southwestern Energy. Chesapeake is expected to adopt a new name after the deal closes.

For Tellurian, the deal helps it focus on and finance its crown jewel Driftwood LNG project, which is permitted but lacks the necessary financing and offtake deals to achieve a final investment decision.

"Today’s agreements with Aethon take us several steps closer to developing the Driftwood LNG project, for which Aethon is a vital partner," said Tellurian Executive Chairman Martin Houston in a statement. "The offtake agreement for 2 mtpa provides the foundation to accelerate Driftwood and demonstrates that we have successfully aligned our commercial offerings to meet the needs of potential customers.

"For Tellurian, the proceeds from the sale of our upstream assets allow us to retire senior secured notes and strengthen our balance sheet for the long term. This is an important moment for our company, as Tellurian continues to make progress against our strategic plan."

Aethon CEO Albert Huddleston touted the deal as offering more vertical integration for his business.

"The expanding scale of our vertically integrated business continues to deliver capital efficiency and industry-leading margins as we work to accelerate the role of natural gas in the broader energy transition," Huddleston said.

"Our partnership with Tellurian will provide our downstream LNG customers with the lowest methane emission intensity in North America," he added.

Recommended Reading

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Exclusive: LNG Takes Control in Meeting Data Center Reliability, Capacity Needs

2025-04-02 - William Seller, solutions architect at DartPoints, shares insight on the impact that data center power demand will have on the natural gas industry, in this Hart Energy Exclusive interview.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.