The well is Aethon’s fourth in the deep-gas far western Haynesville step-out that industry members have dubbed “the Waynesville.” (Source: Shutterstock)

Aethon Energy brought online another far western Haynesville wildcat north of Houston, this one making 2.6 Bcf its first 3.5 months online, according to new Texas Railroad Commission (RRC) data.

The well, Golf Lake #1HB in Robertson County, Texas, IP’ed 34.1 MMcf in its initial test in mid-January with flowing tubing pressure of 11,706 pounds per square inch absolute (psia) on a 19-inch choke.

The 9,000-ft lateral was landed at 13,100 ft in the Cotton Valley overlying the Haynesville, according to completion data.

The well is Aethon’s fourth in the deep-gas far western Haynesville step-out that industry members have dubbed “the Waynesville.” Comstock Resources Inc. has 12 wells producing now.

The 12th well, Ingram Martin A #1H, tested 37.9 MMcf in Robertson County at 13,100 ft with a 7,764-ft lateral. Flowing tubing pressure was 10,827 psia on a 28-inch choke. Total vertical depth is 17,748 ft.

RRC production data is through April 30; data for the Ingram Martin A #1H does not yet appear in the records.

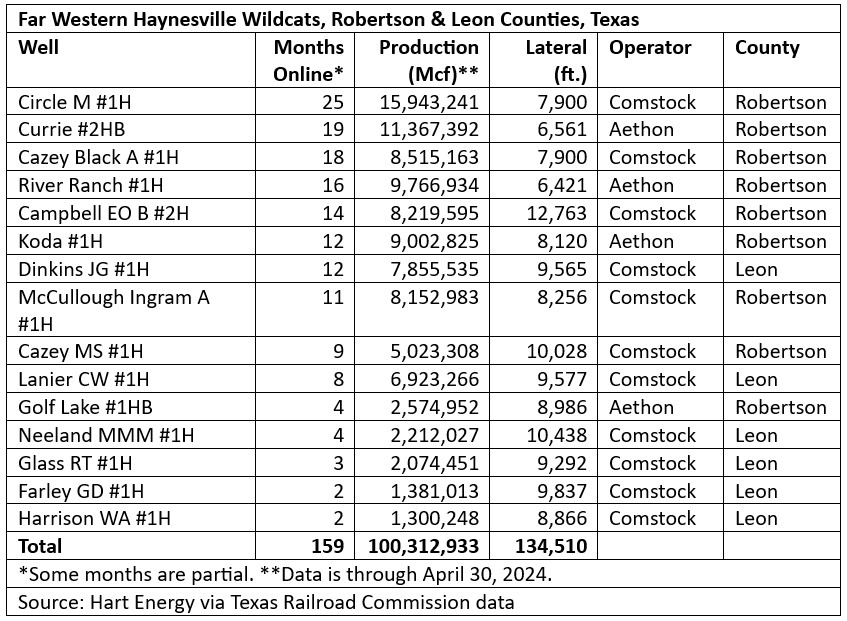

100.3 Bcf

Public data show production altogether from the new play’s first 15 wells totals 100.3 Bcf from a combined 159 months online through April 30, the RRC shows.

The average is 21 MMcf/d, including wells ranging in age from two months to 25 months.

Comstock reported three additional new wells in its earnings report in May.

Harrison WA #1H tested 35.0 MMcf with flowing tubing pressure of 11,560 psia on a 28-inch choke, according to the RRC file. Production in its first two months online was 1.3 Bcf from an 8,866-ft lateral. True vertical depth (TVD) is 19,361 ft.

Farley GD #1H tested 38.4 MMcf with 11,518 psia of flowing tubing pressure on a 28-inch choke. In its first two months online, it made 1.4 Bcf. TVD is 18,700 ft.

Glass RT #1H tested 35.5 MMcf with 11,937 psia flowing tubing pressure on a 26-inch choke. It made 2.1 Bcf in its first three months. TVD is 18,346 ft.

An additional Leon County well brought online this year, Neeland MMM #1H tested 31.3 MMcf with 9,050 psia flowing tubing pressure on a 28-inch choke. In its first four months, it made 2.2 Bcf.

Drill days from 80 to 54

Comstock CEO Jay Allison told investors in May that it’s now drilling two-well pads and has pared drill days from 80 days to 54 days in the play. Comstock has more than 450,000 net acres in the step-out.

Neither Comstock nor Aethon has revealed well costs.

Andrea Westcott Passman, Aethon COO, was asked at Hart Energy’s DUG Haynesville conference in March if a rumor is true that the price is between $30 million and $40 million.

“That's a horrible rumor,” she quipped. But “we tend to be lower than that.”

Roland Burns, Comstock president and CFO, told investors in May that its wildcats are more expensive than those in its traditional Haynesville play in East Texas and northwestern Louisiana.

But the EUR is greater—3.5 Bcf per 1,000 lateral ft—he added. The reserves to recover are greater, “but it also takes longer to get them out. We're not flowing the western Hayesville wells at double the rates of the traditional Haynesville.

“It's possible we could, but we're choosing not to do that in this early stage, especially with the low-price environment,” Burns said.

Net, though, the western Haynesville’s returns are similar to the traditional Haynesville’s Tier 1 and superior to Tier 2 and Tier 3, he added.

Deep Haynesville

Comstock anticipates producing some 2 Bcf/d from the play upon moving into the development phase.

Dan Harrison, Comstock COO, said early emphasis was on landing in the Bossier, overlying the Haynesville, but the 12-well count is now 50:50 Bossier/Haynesville.

“Part of that early on was we were obviously concerned with the high temperatures and increasing our chance of success and having a better drilling performance,” Harrison said.

“We targeted the Bossier early on, but we've made such great progress with dealing with the temperatures that we now basically don't see the Haynesville as so much of a challenge compared to the Bossier.”

Passman said in March at the Hart Energy conference, “They say if you can drill in the Haynesville, you can drill anywhere, and certainly our latest wells in Robertson County look a lot like offshore gas [wells] because they're just monsters.”

Privately held Houston-based Hilcorp Energy bought into Robertson County in January from Exxon Mobil Corp.’s XTO Energy unit, gaining 486 legacy wells that produced 847 MMcf in March.

Hilcorp did not respond at press time to a query as to whether the leases came with rights below Cotton Valley.

Recommended Reading

Amplify Energy Cancels PRB, D-J Deal on ‘Extraordinary Volatility’

2025-04-25 - Amplify Energy terminated an acquisition of oil-weighted assets in the Powder River and Denver-Julesburg basins from Juniper Capital after Amplify’s stock fell 58% since the deal was announced.

‘Last Owner’ XMC Buys, Transforms Aging Oil and Gas Assets

2025-04-23 - XMC Strategies acquires and manages depleting oil and gas assets to transform them into sustainable energy sources.

US Shale Gas Investor Wincoram Acquired by Stone Ridge Energy

2025-04-22 - PureWest Energy investor Wincoram Asset Management was acquired by Stone Ridge Energy, the companies said April 22.

Crescent Energy Sells $83MM in Permian Assets to Reduce Debt

2025-04-22 - Crescent Energy has divested non-operated Permian Basin assets for $83 million as part of the company’s plans to sell $250 million of non-core divestures.

Infosys Acquires Tech, Business Firm MRE Consulting for $36MM

2025-04-18 - Infosys said its all-cash deal to buy MRE Consulting will add newer capabilities and risk management to its offerings.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.