(Source: Aethon)

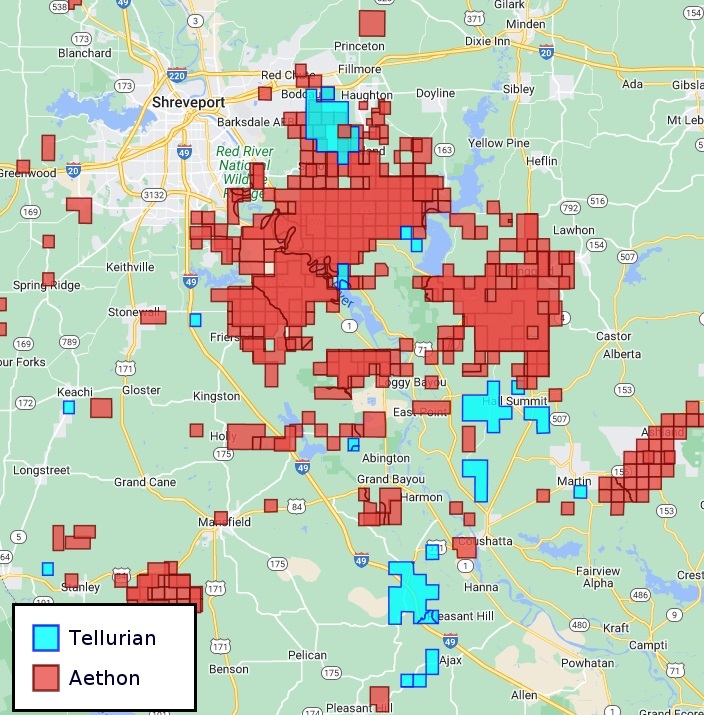

Aethon closed a deal with Tellurian Inc. to grow its Haynesville Shale assets to about 375,000 total acres and its natural gas gathering and treatment capacity to more than 3 Bcf/d, Aethon said on July 1.

Tellurian announced the $260 million deal with Aethon in May. The move transforms Tellurian into a pure-play LNG firm. Tellurian company said the proceeds from the sale would be used to reduce debt on its Driftwood LNG development on the Calcasieu River in Louisiana.

“This transaction is a significant step in securing our balance sheet and progressing Driftwood,” said Tellurian Executive Chairman Martin Houston in a press release.

As part of the deal, Aethon signed a heads of agreement (HOA) for 2 metric tons per year of LNG from the Driftwood project.

“As a private equity firm and operator, we are excited to enhance our strategic footprint by integrating Tellurian's upstream and midstream assets into our extensive Haynesville position,” said Gordon Huddleston, Aethon’s president and partner.

Recommended Reading

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

FERC Approves Enstor’s Salt-Dome Storage Expansion in Mississippi

2025-04-15 - The Mississippi Hub’s total natural gas capacity will reach approximately 56.3 Bcf, Enstor Gas said.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.