Rigs drill the 16-well Megalodon pad for Aethon Energy Management LLC in East Texas, landing eight wells each in the Haynesville and Bossier formations. (Source: Aethon Energy)

Aethon Energy is planning to drill new western Haynesville wells in 2025 as it learns more about the emerging—and expensive—natural gas play.

Privately-held Aethon has drilled 10 horizontals so far in the super-deep, super-high-pressure western Haynesville play, President and Partner Gordon Huddleston told Hart Energy.

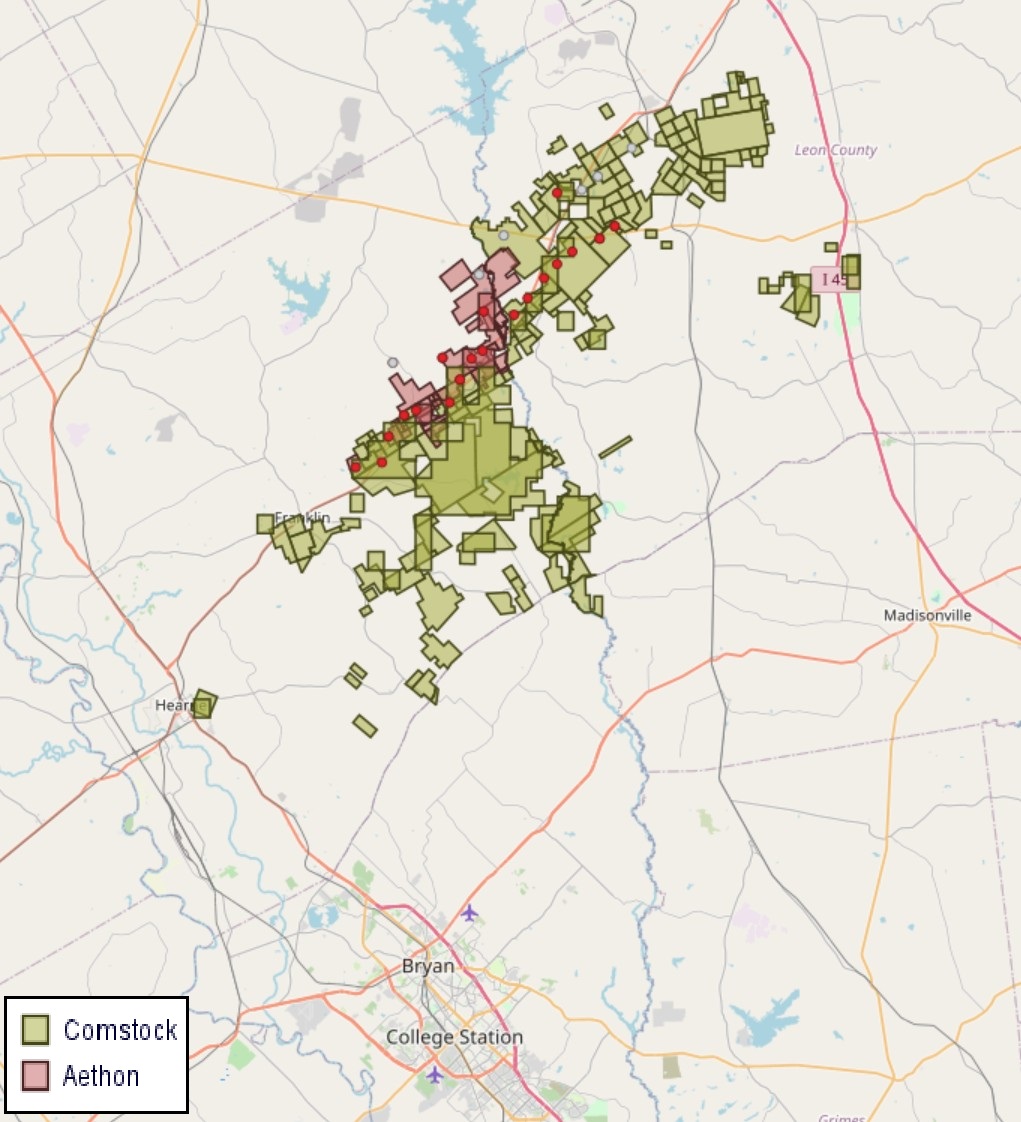

Aethon and Comstock Resources are the two companies delineating the western Haynesville extension in Robertson and Leon counties, Texas.

But Dallas-based Aethon is taking a wait-and-see approach to the western Haynesville, where drilling costs are more than double the cost of a well in the legacy Haynesville.

“They’re expensive [wells],” Huddleston said. “We’re around the $23 million [to] $24 million mark.”

That’s higher than the roughly $8 million to $10 million it takes to drill a gas well in the legacy Haynesville Shale play in East Texas and northwestern Louisiana, according to a Hart Energy D&C cost analysis.

Comstock has reported that its 2-mile-plus western Haynesville wildcat wells have cost more than $30 million to drill and complete.

Costs for Comstock’s 13th completed well in the play averaged $2,814/ft for the 11,405-ft lateral, Comstock executives told investors in third-quarter earnings last October. Comstock’s western Haynesville position totaled over 450,000 net acres at that time.

Industry rumors have been that western Haynesville well costs range between $30 million and as much as $40 million for a 10,000-ft lateral.

RELATED

Exclusive: Aethon M&A Gambit Pays Off with Woodside-Tellurian Deal

No ‘significant declines’

Aethon’s western Haynesville wells are expensive, but the company is seeing “really great results” and monster gas output to justify the D&C costs.

“These wells are tubed up but they’re producing around [25 MMcf/d to 26 MMcf/d],” Huddleston said. “So, we’re very excited.”

Comstock is also flowing its western Haynesville wells up tubing when they’re turned to sales due to high initial flowing pressures—unlike a traditional Haynesville well where an operator may return years later and tube the wells.

Tubing up wells results in a different production profile, with more pressure dropping downhole before reaching the surface.

Still, Aethon is “not seeing significant declines” from the prodigious western Haynesville wells, he said.

One of Aethon’s latest wells in Robertson County—Johnson Ranch #1HB (~9,000-ft lateral)—produced 6.6 Bcf from coming online in March 2024 through November 2024, according to the Texas Railroad Commission’s (RRC) most recent data.

From January through November 2024, Aethon’s western Haynesville wells in Robertson County produced 33.7 Bcf, per RRC figures.

Aethon plans to drill “a couple more” western Haynesville wells this year as the company continues to refine the D&C process, Huddleston said.

The company will look to increase development of the play across the Haynesville and Bossier formations over time, he said.

RELATED

Comstock: Monster Western Haynesville Wildcats Cost $30MM-plus

Plenty of options

Aethon has plenty of options at its disposal moving further into 2025. The company is reportedly engaging with investment bankers to evaluate its options, including a potential sale or an initial public offering valuing Aethon at about $10 billion.

Aethon continues to be “IPO-ready,” Huddleston said.

It’s already one of the largest gas producers in the Haynesville shale, and one of the top private gas producers in the nation.

Aethon operates midstream infrastructure across the bulk of its Haynesville position, another value-add for the company, he said.

Aethon’s assets also easily connect into the expanding Gulf Coast LNG corridor. Aethon is already one of the largest suppliers to Cheniere’s liquefaction sites on the Gulf Coast, and Aethon aims to expand its LNG business over time.

Simply put, Aethon has what other buyers are after—both domestically and internationally.

Huddleston said Aethon is seeing significant interest from counterparties trying to understand their exposure to U.S. natural gas pricing over time, like offtakers for long-term liquefaction contracts.

Asian buyers, Japanese buyers in particular, have increasingly sought to own a piece of upstream Haynesville gas production.

Tokyo Gas Co. grew its U.S. shale position with a $2.7 billion acquisition of East Texas producer Rockcliff Energy II in late 2023.

Haynesville E&P Sabine Oil & Gas is a subsidiary of Osaka Gas Co. after acquiring 100% ownership of Sabine for $610 million in 2019.

Huddleston said other long-term LNG buyers are wondering, “Where am I going to get this from for 20 years, and at what price?”

“There are very few companies like Aethon—and certainly I think we’re the only private along the Gulf Coast—that have 20 to 30 years of inventory,” he said. “I think that’s what’s unique about Aethon.”

Aethon aims to keep drilling and production roughly flat in 2025 compared to last year. The company will operate between five and six Haynesville rigs—down from seven in 2024, Huddleston said.

Aethon is seeing significant rig efficiency gains across its Haynesville acreage, allowing the firm to keep production flat while using fewer rigs.

The company has several completed-but-deferred wells that it plans to turn to sales during 2025, Huddleston said.

RELATED

Investment Firm Aethon Explores Options for $10B US Natgas Assets, Sources Say

Recommended Reading

Colonial Shuts Pipeline Due to Potential Gasoline Leak

2025-01-14 - Colonial Pipeline, the largest refined products pipeline operator in the United States, said on Jan. 14 it was responding to a report of a potential gasoline leak in Paulding County, Georgia and that one of its mainlines was temporarily shut down.

Colonial’s Line 1 Gasoline Service Restored, Company Says

2025-01-20 - Colonial Pipeline Co. stopped flows on the gasoline transport line following reports of a leak in Georgia.

MPLX Acquires Remaining Interest in BANGL for $715MM

2025-02-28 - MPLX LP has agreed to acquire the remaining 55% interest in BANGL LLC for $715 million from WhiteWater and Diamondback.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Tallgrass, Bridger Call Open Season on Pony Express

2025-02-14 - Tallgrass and Bridger’s Pony Express 30-day open season is for existing capacity on the line out of the Williston Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.