Source: Hart Energy

Private-equity firms are often cited for their dry powder—the huge cash reserves available to buy into plays and ultimately shape A&D.

In July, Jefferies estimated energy-focused funds had $100 billion ready to spend. But private equity-backed E&Ps were largely on the receiving end of deals last year.

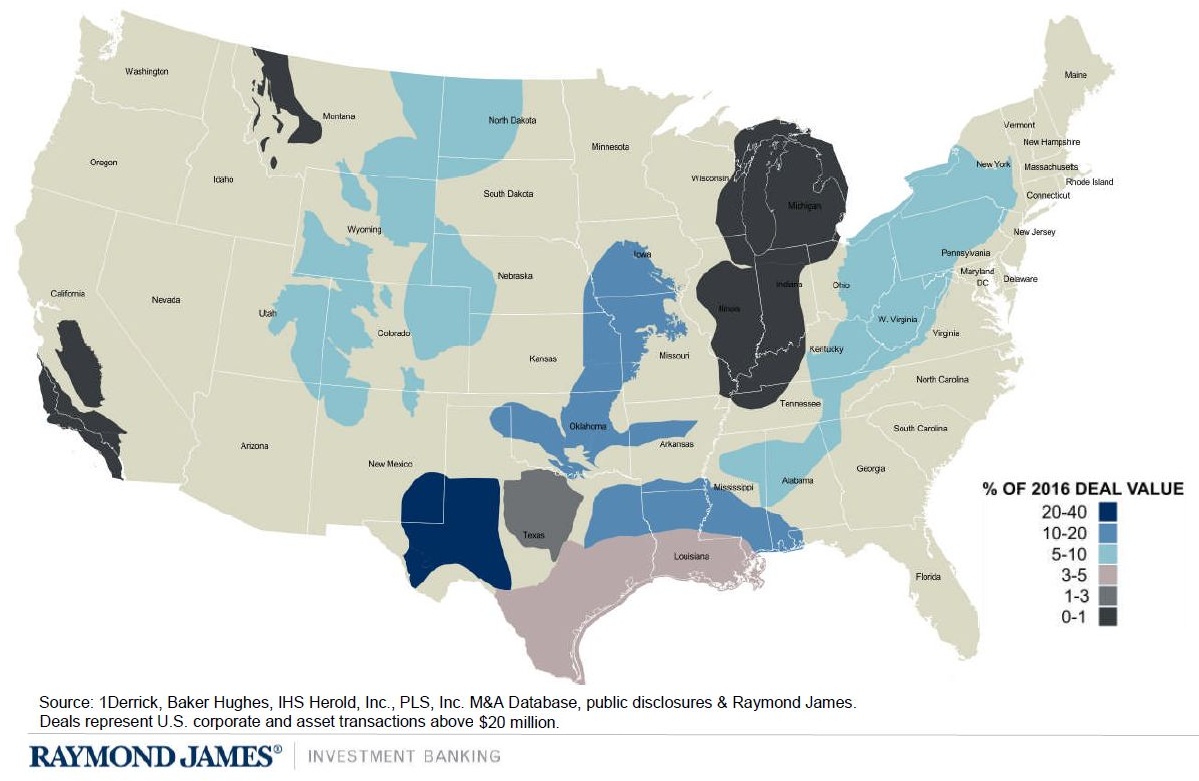

Private equity sold more than $26 billion worth of assets, mostly to the public market in the past year—including $17 billion in the Permian Basin, according to KeyBanc Capital Markets.

In fourth-quarter 2016, nearly all of the $11.9 billion in transactions were made by public companies purchasing from private-equity portfolio firms, according to Raymond James.

As former Chicago Mayor Richard J. Daley might have said—private equity isn't here to create disorder; private equity is here to preserve disorder.

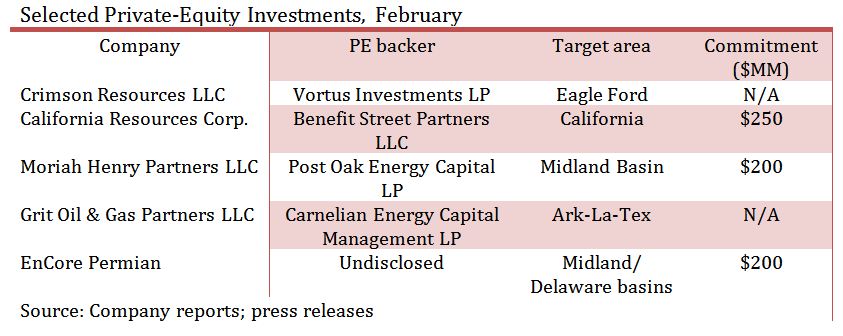

In February, at least five companies emerged in a slew of new private-equity sightings with initial commitments of more than $650 million. Investors’ piggy banks are emptying across the U.S.—in South Texas, California, the Ark-La-Tex region and, unsurprisingly, the Midland and Delaware basins.

Management teams include industry veterans, with one team headed by executives of the recently acquired Memorial Resource Development Corp., including the former COO and vice president of operations.

Crimson Stride

Crimson Resources LLC (CR) said Feb. 20 is would partner with Fort Worth, Texas-based Vortus Investments LP and other private investors to pursue oil and natural gas assets in South Texas.

CR, a newly formed Fort Worth-based company, is led by Frank Starr and Tripp Rivers, who formerly managed oil and natural gas companies such as Crimson Energy Co., Crimson Energy Partners II LLC and Crimson Energy Partners III LLC.

The CR management team has an extensive track record of identifying, purchasing, developing, operating and selling oil and natural gas assets in South Texas, where they have leased nearly 170,000 acres and drilled more than 200 wells. The CR team’s A&D activity since 1994 has included more than $1.5 billion in transactions and development.

Vortus is a private-equity firm focused on the lower- to middle-market upstream energy industry in North America.

Pure Grit

Grit Oil & Gas Partners LLC closed on an equity commitment from Carnelian Energy Capital Management LP through Carnelian's fund, Carnelian Energy Capital LP, on Feb. 14.

Grit, based in Houston, was formed to pursue an acquisition and exploitation strategy in select onshore basins in North America with an initial emphasis on the Ark-La-Tex region.

Founders Larry Forney, Greg Robbins, Anthony Sayre and Dennis Venghaus were most recently executives at Memorial Resource Development. They helped oversee the company from IPO to its sale to Range Resources Corp. (NYSE: RRC) in September for $4.2 billion.

Larry Forney, Grit’s CEO, said the company has a proven team able to create value through “focused drilling, completion and operational efficiencies.”

Carnelian Partner Tomas Ackerman said Grit’s “broad experience across multiple basins and asset types provides a unique competitive advantage in this environment.”

Starting Off: Encore

EnCore Permian plans to purchase leases in the Midland and Delaware basins with an initial funding agreement of $200 million from a private capital partner.

The firm is a successor to PetroLima LLC, a leasehold and mineral acquisition company. EnCore will pursue acquisitions as well as exploration and production.

The company has so far purchased operated assets in Martin and Howard counties, Texas, in the Midland Basin and Pecos County, Texas, in the Delaware.

Taken For Granite

E&P California Resources Corp. (CRC) and Benefit Street Partners LLC said Feb. 16 they would form a joint venture (JV) to develop CRC’s oil and gas properties in California.

Benefit Street will invest up to $250 million for development opportunities in both conventional and unconventional assets with an initial $50 million investment for drilling activities across properties subject to the JV. CRC will operate the properties.

Benefit Street will make subsequent investments in tranches up to $50 million at the discretion of the JV partners over a two-year investment window.

Benefit Street is an affiliate of Providence Equity Partners LLC, a leading global private-equity firm with $50 billion in assets under management across complimentary private equity and credit businesses.

Post Commitment

Post Oak Energy Capital LP said Feb. 21 it led a $200 million equity commitment for Moriah Henry Partners LLC.

Henry Energy LP and Moriah Energy Investments LLC will co-invest alongside Post Oak.

Moriah Henry Partners is a Midland Basin E&P focused on the acquisition and development of oil and gas properties in West Texas. The company is jointly managed by Henry and Moriah, which have a long history of collaboration and value creation in the upstream space, particularly in the Permian Basin.

The company will use proceeds from the investment to fund acquisitions in the core of the Midland Basin and subsequently develop those assets.

“We are delighted to partner with these industry veterans and leaders,” said Frost Cochran, Post Oak managing director. “Their deep experience in the Midland Basin will allow us to capitalize on numerous opportunities in one of the most economic basins in the country.”

Post Oak, based in Houston, was formed in 2006. Henry Energy is a privately-held Permian Basin oil and gas producer in business since 1969.

Darren Barbee can be reached at dbarbee@hartenregy.com.

Recommended Reading

Golar LNG Enters $1.6B EPC Agreement for FLNG Project

2024-09-18 - Golar said the floating LNG vessel has a liquefaction capacity of 3.5 million tons of LNG per annum and is expected to be delivered in fourth-quarter 2027.

Federal Regulators Give Venture Global Permission to Introduce Natural Gas Into LNG Plant

2024-11-06 - Federal regulators have given Venture Global LNG permission to introduce natural gas into its Plaquemines export plant in Louisiana.

Williams Files for Temporary Permit to Keep $950MM Project Online

2024-09-11 - A temporary emergency certificate is necessary for Williams to continue operating the Regional Energy Access Project after the Court of Appeals shot down an original FERC certificate in July.

FERC Gives KMI Approval on $72MM Gulf Coast Expansion Project

2024-11-27 - Kinder Morgan’s Texas-Louisiana upgrade will add 467 MMcf/d in natural gas capacity.

Electricity and LNG Drive Midstream Growth as M&A Looms

2024-09-26 - The midstream sector sees surging global and domestic demand with fewer players left to offer ‘wellhead to water’ services.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.