In less than five years, private E&P Avant Natural Resources has built two businesses in the Permian Basin, sold them off and is ready to do it again. Co-founders and co-CEOs Jacob Nagy and Skyler Gary spoke exclusively with Oil and Gas Investor about their winning formula.

Deon Daugherty, editor-in-chief, Hart Energy: Your deal selling to Coterra Energy should close any minute now, so what’s next?

Jacob Nagy, co-founder and co-CEO, Avant Natural Resources: We are back at it again, just consolidating acreage in the Delaware Basin. We built a pretty big team and a big platform, a big acquisition-driven enterprise, and it doesn’t really slow down for much. We’re raising additional money and we’re closing on our first set of deals over the next few weeks.

—Jacob Nagy, co-founder and co-CEO, Avant Natural Resources

DD: Avant is more than just an E&P, too. You’re involved in minerals, and you’re involved in infrastructure projects. Are you looking at these acquisitions from an E&P perspective or from minerals and infrastructure?

JN: Our bread-and-butter business at this stage of our company’s evolution is working interests, buying leaseable drilling wells. We started off as a minerals and royalty aggregator, and we thought we did a pretty good job with that. We sold our first package to Brigham [Exploration] in 2022 for $132 million and that was a good proof-of-concept exercise. And so, we continue to aggregate minerals and royalties and sell them when we think the market [is ready], when it makes sense to sell, and otherwise continue to aggregate. We’ll always have a minerals and royalty presence.

And then, infrastructure is something more recent that dovetails pretty nicely with how our upstream operations work. There’s often a lot of overlap there. But we built out a water recycling system as part of our operational footprint in the Delaware Basin, and we were actually in the process of selling that right before Coterra came and started talking to us. Coterra decided they wanted that, too, so that went with the sale.

DD: The Brigham deal was specifically Midland assets, but in the time that’s elapsed, have you decided you’re more interested in playing in the Delaware now?

JN: We sneakily do both. I think our Midland Basin royalty footprint was always more prominently featured, but we were always dabbling in the Delaware. Our Delaware working interests and operating footprint are more prominent, but we are exploring and actively looking at stuff in the Midland Basin as well.

So, we’re really Permian focused. I think we’re staying away from the conventional areas as well as some of the more exploratory extensional plays, but the Midland and Delaware basins for us, especially in this new venture, will be fair game. And, it’s two areas that we’ll be heavily focused on for working interest in minerals and royalties.

DD: How much can you tell us about this new venture?

JN: We’re calling it Avant II, and we’re raising capital currently. We’re structured differently than most other private companies in the Permian. You have the legacy, family-owned companies, and then you have a significant chunk of private equity-backed teams. We’re a little bit different. We’re privately funded, so we went directly to investors and cobbled together an investor base of about eight core individuals or groups for institutions and did it the old-fashioned way, I guess, and provided a little bit more flexibility on our mandate and ability to put capital to work, which is helpful in the Permian because things just tend to move superfast.

That’s been a crucial part of our strategy in terms of capital. We’re at probably about half a billion [dollars] to deploy here in the near-term with a lot more behind it if we find the right opportunity set.

DD: It’s almost as if Avant is a private equity firm unto itself.

JN: Correct.

DD: How did it come about?

JN: The genesis of it really was that when we first started the company, there were a lot of challenges across the industry. This was 2018, 2019, and we frankly weren’t sure exactly how we wanted to capitalize the business. [We] were afraid of getting stuck in a path or with a single sponsor that might not be dynamic enough to evolve with the shifting landscape.

The way we counteracted that was to raise a smaller amount of money and then do it privately with a handful of investors. That gave us the autonomy to pivot if we needed to or shift direction or if it made sense. With the success we had early on with the royalty strategy, we were able to build upon that and expand our investor base.

Skyler Gary, co-founder and co-CEO, Avant Natural Resources: I do think, too, the switch from our royalty strategy, which was quite successful, to running an operating business was by virtue of that flexibility we had at that point. We always wanted to work towards being in the position we’re in now. And that’s one of the most exciting pieces of getting a deal done with Coterra. We have a great investor group and we’re really well-positioned to keep doing what we do best, which is putting acres together and drilling good wells.

—Skyler Gary, co-founder and co-CEO, Avant Natural Resources

DD: I wanted to follow up on your investors. Family offices have been very engaged of late. Are they part of your core, or what is the composition of your investor group?

JN: We kind of have the full spectrum of capital sources. I guess we don’t have any endowments, but institutional sources, family office, multifamily offices—it’s a diverse group.

DD: We’ve been writing about large private equity fund closings and while it’s still not easy, bigger funds have had some success. At least, it’s certainly better than it was a few years ago. Is that the case that you’re finding, especially in the Permian, where there’s a lot that has been bought up?

JN: I think the landscape, while it’s gotten easier, is still challenging. It’s still an asset class that [has] a differentiated level of scrutiny on the allocation side. But in terms of our track record and experience and fundraising, I think we have a good track record of execution, both putting capital to work and returning it back to investors. That makes life a lot easier. We’ve done a good job of getting into positions and executing on strategies quickly and then also recognizing when there are windows to exit.

We’ve done that twice now, with the second time being the Coterra trade. And I think our investors really appreciate the mindfulness and the wherewithal we have around market conditions and ability to exit.

DD: Avant formally started in 2019, so that’s two raises and two exits in a period of less than five years, much of which included COVID. How did you manage to pull that off when a lot of folks really struggled during the COVID years?

SG: We’ve been able to put together a really effective group. It’s a pretty young firm and we have a strong culture of hungry young folks who just push really hard. At the end of the day, it is very difficult to aggregate and, at some point, you have to just get a lot of shots on goal and keep pushing. There’ll be slow months and then there’ll be great months. But we feel like we’ve never been better at this at any point in our history than we are right now.

JN: I think we do a good job at identifying either soft points in the market that might be within a basin in a certain geographical area, or just soft times in the market from a cyclical nature. And we’ve really tried to push as much capital out the door to execute when we see those types of opportunities. The obvious one with our royalty strategy was during COVID and no one else was buying; that gave us a leg up, being well-capitalized during that stretch, with folks that trusted our judgment on putting that money to work.

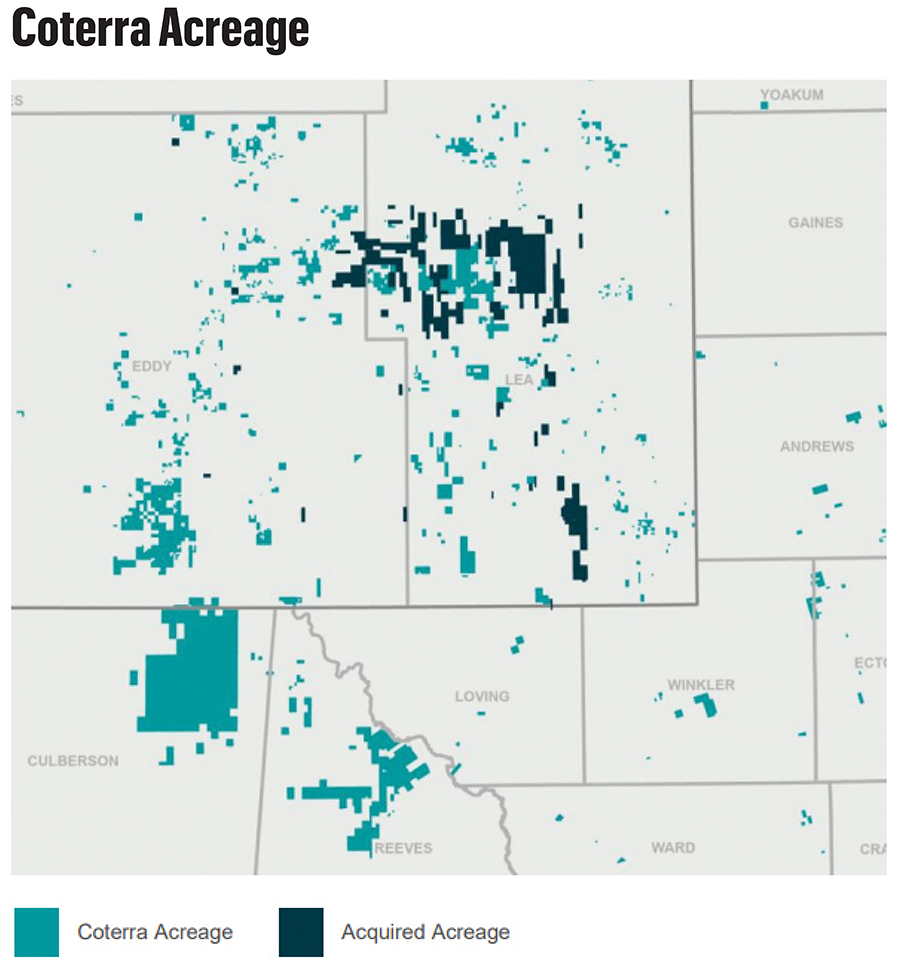

Most recently, with our New Mexico strategy, we were just seeing the world a little bit differently than folks had in the past in terms of the area in which we were deploying our capital. We believed in the rock, in the well results.

I think the bigger companies weren’t paying enough attention just because they had a lot to chew on in other parts of the basin. And all the corporate M&A, the consolidation going on, kind of left them distracted from the day-to-day ground game. We saw an opportunity to execute and we did. It’s really just a multitude of factors. There’s not one secret ingredient. And as Skylar mentioned, I think it’s the hard work that everyone puts in across the whole team.

DD: We’ve been through 18 months, two years of consolidation. Conventional wisdom says that’s going to create A&D opportunities as these companies sell off noncore assets. Is that an opportunity set specifically for you to continue to focus on the Permian?

SG: I think that’ll be one piece of the puzzle that we look for in terms of putting capital to work. The reality is there are a lot of other teams that are banking their strategy on being competitive from A&D processes that are marketed broadly.

While we’ve been successful in a couple circumstances there, to us that’s not a strategy that we really want to build our company around. We’re going to stick heavily to our roots, which is the ground game consolidation. And what we tend to find and what we found in this last one was, there’s always opportunity. If you look diligently and look hard, it might not be as obvious and it might not look as traditional in terms of this giant block of acreage in the core of the basin, but at the same time, one drilling unit, you can put $100 million, $200 million to work through the drill bit and that’s a lot of capital, especially given our size.

We don’t need 20,000 acres—that’s a giant block to be successful. It only needs to start with one and then we’ll start looking at the second, third and so on and so forth.

DD: The assets you’d amassed in New Mexico were included in the Coterra deal, right?

JN: We love working and operating on the Texas side. Frankly, we had kind of a three-pronged strategy in terms of areas we wanted to deploy capital in the Delaware. This spot in New Mexico just was an area in which we felt like we could deploy the quickest and most effectively. But we still like a couple other spots on the Texas side and intend to revisit those as part of our next strategy.

DD: You’ll remain Permian-focused?

JN: Yes, absolutely. It’s been good to us and we enjoy working in that region. We know a lot of the folks and it’s a great universe of operators and counterparties and competitors and peers, and we look forward to hopefully working in that basin for many, many years.

DD: Let’s pop back over to something that Skyler was talking about earlier—switching from a minerals and royalties focus to where you are today. That’s sort of counter to the industry trend in which it appears that minerals and royalties has really heated up in the last year or so.

SG: We were trying to be intentional about how we grew this platform and how we built our track record. Jacob and I were quite young when we started this company. At the time, we felt like minerals and royalties in the Midland Basin were maybe a bit undervalued relative to other opportunities we’re looking at. And it seemed like the right time for us to push towards that strategy. And we were quite effective putting together a really nice position there.

We felt similarly when we were kind of wrapping that up that there was an interesting opportunity to push into the Delaware Basin on the operated side. There was some regulatory uncertainty, given politics at the time. So, we were just trying to be opportunistic and make the right business decision. I think a lot of our peers and perhaps even some of our investors expected us to do a bigger royalty-focused fund to follow up on the success we had, but we felt like it made a lot of sense to pivot into what we viewed as maybe a better opportunity to buy effective on the ground by working interest in the Delaware.

We like to make sure that we’re paying close attention to everything that’s happening and try to anticipate changes perhaps a bit early, earlier than the industry. And so, at the time it made a ton of sense and I think our perspective at that point has been validated since then. We were effective again, putting land together to go operate.

I think also one of the most exciting pieces about that pivot was that we started a very small operating company at a time when I think the perception was that it was turning into a game that was largely dominated by very large operators. We wanted to make sure that we could prove to our investors that we could be an effective low-cost operator, and we were very successful drilling wells right out of the gate. We had some really fantastic well results, and that allowed us to accelerate the growth of that business. An interesting part of the pivot was making sure that we could be effective and maintain the level of excellence we expected from our group drilling wells, not just buying acreage. And the team did an incredible job. So, a big part of the story, I think, was the operational success that we had, and we wanted to go prove that we could do that. I think we’ve proven that now.

DD: Your focus will continue to be acquiring working assets as opposed to non-op deals?

JN: That’s right. We’ll be focused on putting together an operated position in the Permian. Sometimes that’s by acquiring a bunch of non-operated [assets] and doing some trades or getting creative with deal structures to get your way into some of these units. But our intent is certainly to stay on the operated side.

DD: How long will it take to put together a new set of assets for Avant?

JN: We started this last iteration, it really got going at the beginning of 2023, and we had a five-year plan to put together about 4,000 acres. We got to 17,000 within two years.

Look, there’s no question that it continues to get more competitive out there. We feel like we have a good team, our track record is really strong on aggregation, so we’re hopeful we’ll have a rig up in pretty short order.

DD: By the end of the year?

JN: That’d be the hope. New Mexico certainly gets a little tricky with the regulatory and pooling and permitting timelines, but I wouldn’t be surprised if we had a breakup by the end of the year on the new assets.

DD: What is your end game? Will you keep doing this process of buying assets, fixing them up and then selling? Or are you planning to become the next mega independent?

JN: I think I’ll steal one of Skyler’s lines so he can think of something else to say, but I think we’ve never been better at what we’re doing than right now, so it’d be almost a crime to stop. Our team’s really effective at this stage. We’ve built in a lot of really good structures and protocols and tactics, and everyone’s learned a lot. We’ve made some mistakes, no doubt, but we’ve learned a lot from those. And so, we feel like we’re really hitting stride on the aggregation game and also operationally, so we’re going to keep going. It’s too much fun. We feel like we’re doing a good job with it, and our investors are incredibly supportive. So, I think we’re certainly laser-focused on this next iteration. Haven’t given too much thought about what comes after that, but as Skylar mentioned, we’re all pretty young and want to be in this business for our careers.

SG: The only thing I would really add is that Jacob and I just love the oil and gas business. We have a team that loves the oil and gas business. We’re all pretty close over here and when we hang out with each other, we’re having beers talking about oil and gas deals. It’s been really fun. So, plenty of horsepower and ambition on the team. I think everybody’s really enjoying it right now. I also think we’ve been really well served, being kind of agnostic about what our end goal was as long as it was a success for our investors.

We’re not married to the idea of empire building, but if we think getting bigger is important for us to deliver the types of returns our investors expect, we can do that. If we see an opportunity to put a big win up on the board that’s a really short timeframe like what we did in this round, then we’ll decide that perhaps that’s the right strategy and that’s what we’ll do. At the end of the day, if we do right by the capital partners that have supported us to this point, we know we’ll be able to just do another company. We’re always just going to focus on what the market dictates and make sure that we’re delivering the best result for our capital group.

Recommended Reading

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

BP Makes Gulf of Mexico Oil Discovery Near Louisiana

2025-04-14 - The "Gulf of America business is central to bp’s strategy,” and the company wants to build production capacity to more than 400,000 boe/d by the end of the decade.

McDermott Completes Project for Shell Offshore in Gulf of Mexico

2025-03-05 - McDermott installed about 40 miles of pipelines and connections to Shell’s Whale platform.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Liberty Bolsters Mobile Power Business with Acquisition of IMG Energy

2025-03-05 - Liberty Energy Inc. said March 5 it had purchased IMG Energy Solutions as the company expands its mobile power business.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.