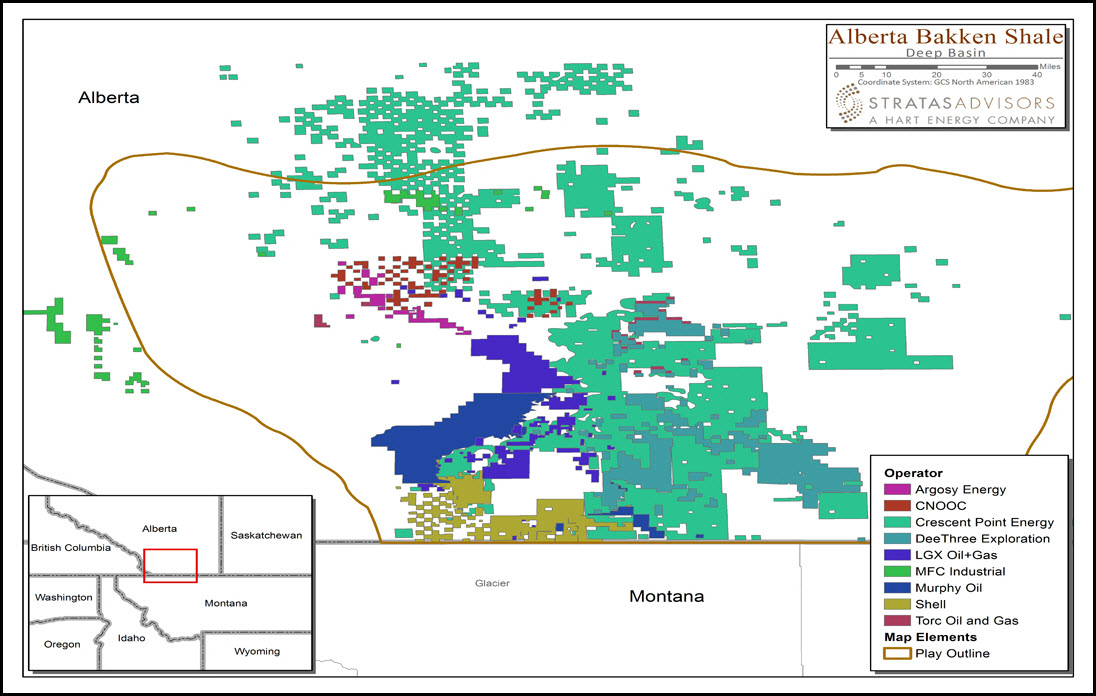

| Company | Net Acreage |

|---|---|

| Crescent Point Energy | 1,000,000 |

| DeeThree Exploration | 200,000 |

| ARC Resources | 179,200 |

| LGX Oil + Gas | 167,838 |

| Murphy | 150,000 |

| Shell | 120,624 |

| Encana | 115,200 |

| Torc Oil and Gas | 96,000 |

| CNOOC | 61,000 |

| Spyglass Resources | 55,000 |

| Penn West Exploration | 51,200 |

Recommended Reading

Appalachia, Haynesville Minerals M&A Heats Up as NatGas Prices Rise

2025-04-03 - Several large Appalachia and Haynesville minerals and royalties packages are expected to hit the market as buyer interest grows for U.S. natural gas.

NOG Spends $67MM on Midland Bolt-On, Ground Game M&A

2025-02-13 - Non-operated specialist Northern Oil & Gas (NOG) is growing in the Midland Basin with a $40 million bolt-on acquisition.

Nabors SPAC, e2Companies $1B Merger to Take On-Site Powergen Public

2025-02-12 - Nabors Industries’ blank check company will merge with e2Companies at a time when oilfield service companies are increasingly seeking on-site power solutions for E&Ps in the oil patch.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Ring Energy Closes Central Basin Platform M&A from Lime Rock

2025-04-01 - Ring Energy added 17,700 net acres and 2,300 boe/d of production in the Central Basin Platform through an acquisition from Lime Rock Resources IV.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.