Have you ever wondered why an MLP traded up 5% on no apparent news? Sure, it could have been the fickle nature of the market, but it also could have been because Alerian announced that the MLP is to be added to an index. This is shamelessly termed the “Alerian Effect.”

On the day of the announcement—always the second Friday of March, June, September and December for scheduled quarterly rebalancings—an MLP being added to one or both of the two most ubiquitous indexes has been worth 220 basis points of outperformance. The same effect also happens in reverse, although on a more muted scale.

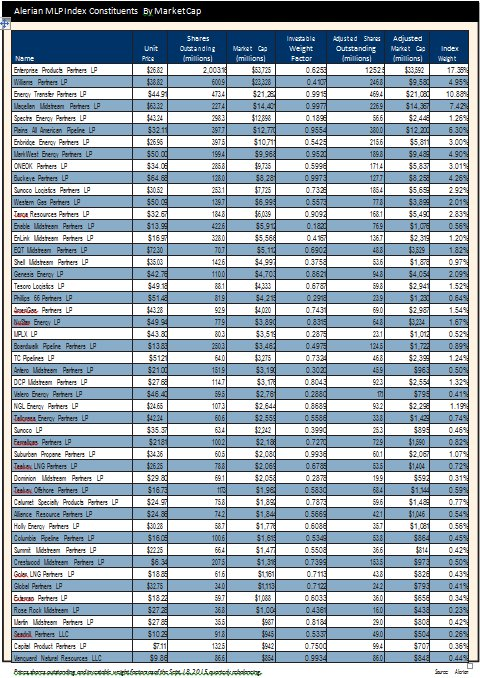

Why does addition to (or deletion from) an Alerian index matter for a person directly invested in MLPs? As of Aug. 31, there were $15.4 billion of investment products linked to the Alerian Index Series. Whether in the form of exchange traded notes, exchange traded funds, separately managed accounts, structured notes, variable insurance trusts, mutual funds or total return swaps, $4 billion is linked to the Alerian MLP Index (AMZ), composed of 50 energy MLPs, and $11.3 billion is linked to the Alerian MLP Infrastructure Index (AMZI), composed of only midstream energy MLPs. If an MLP is added to the AMZI with a 1% weighting, then $113 million worth of units would need to be purchased by the issuers of products tracking that index.

Material information

While Oprah forewarns small businesses when a new product will be featured as one of her favorite things, the management teams of MLPs find out about index inclusion at the same time as everyone else—when the press release hits the wires. It would be nice to provide advance notice, but the powers-that-be consider constituent changes to be material, non-public information.

What if you are an investor in one of the products tracking an Alerian index? A rebalancing brings the index up to date with any changes that have happened since the last rebalancing. It’s like hitting refresh on a news website: you get all the information that’s most relevant now.

That said, like most benchmark indexes, the Alerian Index Series is designed to minimize turnover, resulting in a five-year average of 16.5% and 14.3% (as of year-end 2014) for the AMZI and AMZ, respectively, largely as a result of M&A activity. Even when companies are added or removed, there is little change to the overall index yield. For example, if an AMZ constituent with a 7% yield and a 1% index weight is replaced with a company at a 2% yield and the same weight, the AMZ yield would only drop five basis points.

More cynical readers are probably wondering just who is behind these indexes and how the decisions are made. The indexes are constructed, calculated and rebalanced according to Alerian’s publicly available methodology guides. There is no black box or man behind the curtain.

The Alerian process isn’t just rules-based; it is designed to be transparent and replicable. With enough time, dedication, and—let’s face it—patience, anyone can take the methodology guide, company press releases and Security and Exchange Commission (SEC) filings and reproduce the indexes.

Units outstanding: Instead of relying on a data aggregator, Alerian calculates units outstanding by examining every MLP press release and SEC filing. Unlike most publicly traded companies, MLPs habitually issue paid-in-kind, convertible and other classes of units in a seemingly unending number of follow-on offerings and private placements, which data aggregators often fail to incorporate accurately into a company’s unit count.

Float and adjusted market capitalization: Many MLPs, having started as family businesses or having been spun off from larger energy companies, do not have a majority of their units available to the public. These units are owned by a parent company, management, private equity firm or any number of insiders who are not going to sell their position in the open market. Since the units are not available for the public to purchase, Alerian adjusts the market cap and does not consider these equity stakes to be part of the investable universe.

For example, consider Spectra’s adjusted market cap. Spectra Energy Partners (SEP) had a market capitalization of $12.9 billion at press time. However, Spectra Energy Corp. (SE), the general partner, owns 81% of SEP’s outstanding units, so only 19% of the float (or $2.47 billion) is available to the public. SEP has a 1.3% weight in the AMZ as of the September rebalancing. If Alerian did not make float adjustments, SEP would have a 6.7% weight. By contrast, insiders only own 0.2% of the outstanding units of Magellan Midstream Partners. Nearly the entirety of this $14.6 billion company is publicly held, giving it a 7.3%weight in the index.

Liquidity: This is important because a publicly traded company that the public doesn’t regularly trade can only nominally be considered publicly traded. This is a particular concern for MLP investors, with only 26 partnerships, or 21%, trading at least $10 million per day. As an example of how the liquidity criterion impacts an MLP’s eligibility, Tallgrass Energy Partners (TEP) satisfied all criteria except for trading volume until its July 2014 acquisition of an interest in the Pony Express Pipeline and attendant follow-on offering. After the transaction, volume nearly tripled and TEP was added to the AMZ shortly thereafter. Higher liquidity barriers tighten bid-ask spreads and lower costs for market makers, product issuers and investors in index-linked products.

Distribution policy: Since paying a steady distribution is something that most MLP investors expect, Alerian requires an MLP to pay a distribution equal to or greater than its minimum quarterly distribution and have a stated intention of maintaining or growing its distributions to be eligible for index inclusion. This effectively excludes variable distribution MLPs.

After the methodology guide is applied to the MLP universe and constituents are selected accordingly, the index is then weighted. For the AMZ, the 50 MLPs are weighted according to their float-adjusted market capitalization.

As of the September 2015 rebalancing, the largest constituent had a 15.9% weighting and the smallest had a 0.2% weighting. For the AMZI, Alerian has instituted a cap on the weights of the largest companies. The largest constituent is capped at an index weight of 10%. The next five constituents are limited to 7.5% each, and the remaining may be no more than 4.75% each. Without this capping system, Enterprise Products Partners would comprise 20%of the index, and the top five names would together represent over 56% of the index. The capping system consequently ensures that those using the AMZI as a benchmark are not merely comparing themselves to Enterprise Products, and that those investors in an AMZI-linked product receive diversified exposure to midstream energy MLPs.

Given all of the above, it is Alerian’s utmost priority that a great deal of thought, planning and testing goes into every methodology guide. Alerian formally reviews the guides on a monthly basis to ensure clarity and accurate representation of industry trends. Each quarter, Alerian also reviews methodology changes and rebalancing results with its independent advisory board composed of industry stakeholders.

Over time, the Alerian Index Series has co-evolved with MLPs. For example, when the AMZ was first launched in 2006, constituents were required to have a market capitalization of at least $250 million. Today, constituents are required to have a float-adjusted market capitalization of at least $500 million, because companies have gotten much bigger. If today’s market capitalization criteria were applied at the time of index launch, more than half of the constituents would be ineligible!

As MLPs continue to evolve, the Alerian Index Series will evolve with them. Alerian welcomes all conversations and proposals concerning how the indexes can continue to best represent MLPs and the energy infrastructure space.

Recommended Reading

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

EY: Three Themes That Will Drive Transformational M&A in 2025

2024-12-19 - Prices, consolidation and financial firepower will push deals forward, says EY.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.