Alliance Resource Partners closed more oil and gas mineral interest acquisitions in fourth-quarter 2024, adding to portfolio that includes the Midland, Delaware, Anadarko and Williston basins, the company said in its earnings report. (Source: Shutterstock, Alliance Resource Partners)

Alliance Resource Partners closed more oil and gas mineral interest acquisitions in fourth-quarter 2024, adding to portfolio that includes the Midland, Delaware, Anadarko and Williston basins, the company said in its earnings report.

Alliance said that it closed $9.6 million in acquisitions in the quarter and recorded full year oil and gas royalty volumes of 3.4 MMboe—up 9.6% year-over-year. The company didn’t specify where the interests were acquired.

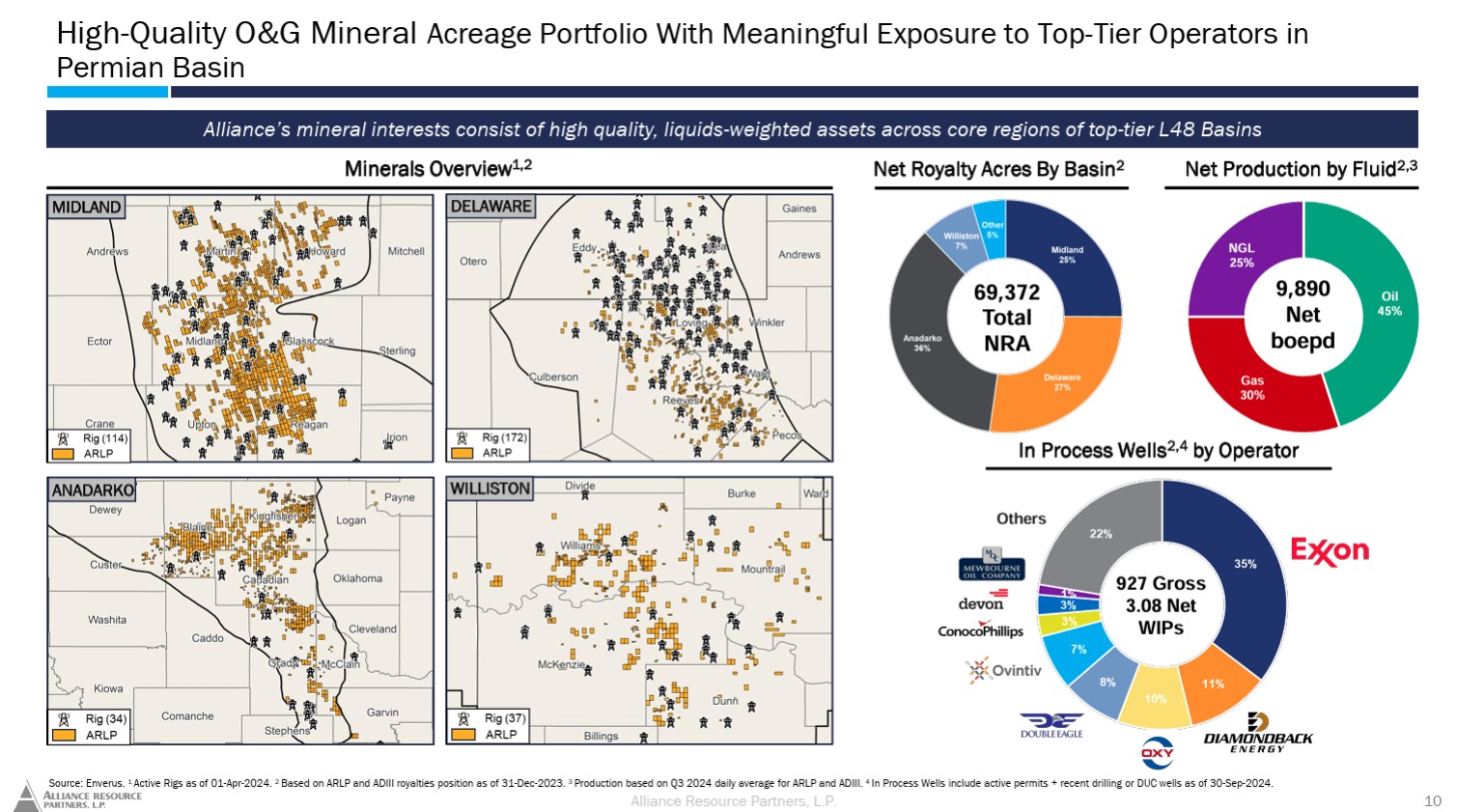

As of December, Alliance reported owning 69,372 net royalty acres, with 53% of its interests in the Midland and Delaware.

For the quarter, oil and gas adjusted EBITDA decreased to $25.6 million (a 17% drop from third-quarter 2024) due primarily to lower average sales prices per barrel of oil equivalent.

"In the oil and gas royalty business, we achieved record production volumes for the 2024 full year despite only making modest additions to our overall acreage position,” Joseph W. Craft III, chairman, president and CEO, said in a Feb. 3 earnings release. “We continue to favor the cash flow generation profile and ability to self-fund growth in the oil and gas royalties segment, and therefore, will actively pursue growth in this segment in 2025."

Alliance invests in both coal and oil and gas interests.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Lion Equity Partners Buys Global Compression from Warren Equipment

2025-01-09 - Private equity firm Lion Equity Partners has acquired Warren Equipment Co.’s Global Compression Services business.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Artificial Lift Firm Flowco Seeks ~$2B Valuation with IPO

2025-01-07 - U.S. artificial lift services provider Flowco Holdings is planning an IPO that could value the company at about $2 billion, according to regulatory filings.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.