The U.S. energy industry has written “an amazing story, really, when you think about what has happened in the shale oil and gas space” in the past decade, the federal government’s man with the energy numbers told the recent North American Gas Forum in Washington, D.C.

Adam Sieminski, administrator of the U.S. Energy Information Administration (EIA), said in his conference keynote address that the agency currently projects crude oil production could climb to as high as 13 million barrels per day (MMbbl/d) in the next decade before leveling off.

In contrast, “we don’t see a plateau for natural gas,” he added. EIA currently credits the unconventional shale plays with producing around 35 billion cubic feet per day (Bcf/d)—“that’s over half of our domestic gas production,” Sieminski pointed out. Oil output from the shale plays currently runs around 4 MMbbl/d, he said, or a little less than half of U.S. output. But shale’s share of both hydrocarbons will continue to rise.

He discussed differences in the EIA’s long-term Annual Energy Outlook and its more current—and more precise—Short-Term Energy Outlook.

“We’re beginning to see some daylight between the [reports’] numbers,” Sieminski added, indicating the industry continues to beat even the EIA’s rather optimistic production projections. “I’m pretty sure we’re going to show even more production when we come out with the 2015 Annual Energy Outlook in December. … Production just keeps growing,” he said.

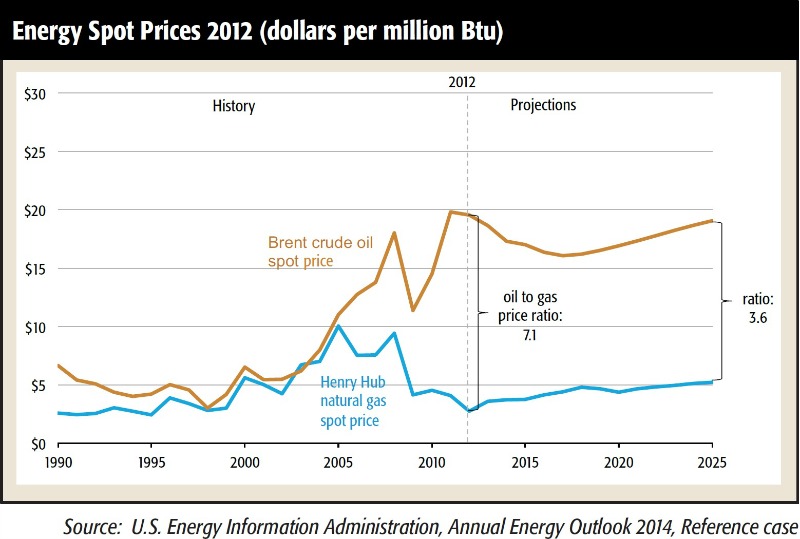

The administrator said the agency currently projects the ratio of oil to gas prices will narrow in the next decade and added “we project there will be plenty of gas around and plenty of interesting places for it to go.” Power generation will take a larger and larger share of gas output as the government encourages a move away from coal-fired generation. Industrial demand also will grow but use of gas as a transportation fuel will remain a comparatively small market, he predicted.

Recommended Reading

Talos Sells More of Mexican Subsidiary to Billionaire Carlos Slim

2024-12-17 - Talos Energy has agreed to sell another 30.1% interest in subsidiary Talos Mexico to entities controlled by billionaire Carlos Slim, whose companies also own at least 24% of Talos Energy’s common stock.

Battalion Oil Walks Away from Fury Resources Buyout

2024-12-20 - The Battalion Oil-Fury Resources merger had been in discussions for more than a year, but Battalion said Fury failed to meet financial deadlines to continue the talks.

Crescent Upsizes Stock Offering, Offers Debt for Ridgemar Acquisition

2024-12-04 - Crescent Energy is offering 21.5 million shares of its stock and borrowing additional funds to pay for the cash portion of a $905 million acquisition of Ridgemar Energy.

Crescent Energy Bolts On $905MM Central Eagle Ford Acreage

2024-12-03 - Crescent Energy will purchase Eagle Ford assets from Carnelian Energy Capital Management-backed Ridgemar Energy for $905 million, plus WTI-based contingency payments of up to $170 million.

Allete Gets OK From FERC for $6.2B Sale to Canada Pension Plan, GIP

2024-12-20 - Allete Inc. announced its acquisition by the Canada Pension Plan Investment Board and Global Infrastructure Partners in May.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.