Dominion Energy and Amazon’s agreement to advance small modular reactor nuclear development was one of several moves made by Big Tech lately to advance lower carbon energy technologies. (Source: Shutterstock)

Dominion Energy and Amazon have partnered to advance small modular reactor (SMR) nuclear development in Virginia as the tech giant explores options for reliable and carbon-free power.

The agreement announced Oct. 16 was among the latest moves by Big Tech to advance lower carbon energy amid expectations for a jump in electricity demand driven by data centers. With net-zero emissions plans in place, many technology companies are adding nuclear power—embraced for its high energy density and nearly zero greenhouse gas emissions—to their renewable energy investments.

SMRs are being explored as a power option because of their smaller footprints, mobility and lower costs compared to larger nuclear plants, although the technology is still considered nascent. If the technology advances, it could prove to be a promising route to around-the-clock, low-emission, baseload dispatchable power.

“Bringing new sources of carbon-free energy to the grid is an important part of Amazon’s commitment to serve our customers and achieve net-zero carbon across our operations by 2040,” said Kevin Miller, Amazon’s vice president of Global Data Centers. “Nuclear energy is safe, reliable and can help meet the energy needs of our customers for decades to come.”

As part of the agreement, the two companies will jointly explore ways to advance SMR projects and financing, as well as ways to mitigate costs and development risks for customers and capital providers, according to a news release.

“It’s an important step forward in serving our customers' growing needs with reliable, affordable and increasingly clean energy,” said Dominion Energy CEO Robert Blue. “This collaboration gives us a potential path to advance SMRs with minimal rate impacts for our residential customers and substantially reduced development risk."

Backing SMR

Earlier this year, Dominion Energy sought proposals from SMR nuclear technology companies to evaluate the feasibility of developing an SMR at the company’s North Anna Power Station in Louisa County, Virginia. The company said the request for proposals was not a commitment to build an SMR at North Anna, but a step toward evaluating the technology and the feasibility of development there.

Several companies—including NuScale Power, Oklo, TerraPower, Westinghouse Electric Co. and X-Energy among others—are developing SMR technologies. So far, only one SMR design is certified for use by the U.S. Nuclear Regulatory Commission: NuScale Power’s VOYGR, a light-water SMR. The company says its VOYGR SMR power plants can generate up to 924 megawatts equivalent of electricity.

In addition to the agreement with Dominion, Amazon also anchored an investment of about $500 million in X-Energy to help fund completion of the company’s reactor design, licensing and the first phase of its TRISO-X fuel fabrication facility in Oak Ridge, Tennessee. In a separate news release, X-Energy said it is collaborating with Amazon to bring more than 5 gigawatts (GW) of new SMR projects online in the U.S. by 2039. Initial projects include a four-unit 320-megawatt (MW) project with regional utility Energy Northwest in Washington. The project includes an option to expand to 920 MW with 12 units.

The agreements followed Oct. 14 news from Google that it inked the “world’s first corporate agreement to purchase nuclear energy from multiple [SMRs]” being developed by Kairos Power. Having reached several milestones, including breaking ground this summer on its Hermes non-powered demonstration reactor in Tennessee, Kairos aims to have its first SMR online by 2030.

Gridlock ahead?

Currently, there are no SMRs operating in the U.S. However, companies are racing to change that to avert a crisis for already stressed electricity grids. Forecasts show electricity demand will reverse decades-long stagnation of new power generation, putting pressure on utilities and energy providers to power up.

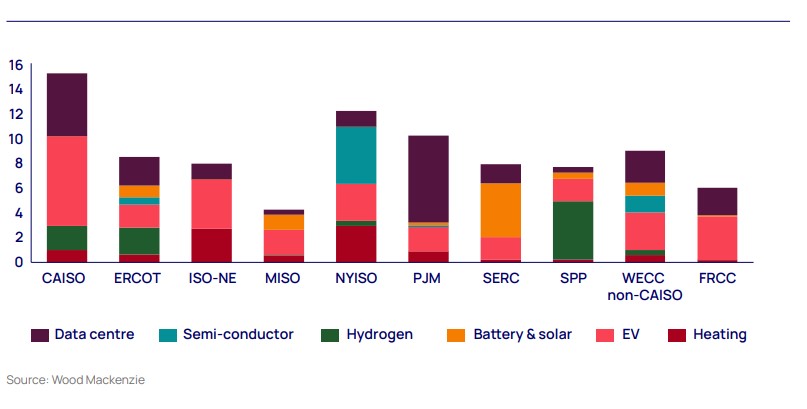

Wood Mackenzie said some regions in the U.S. could see electricity demand grow by 15% through 2029, according to an Oct. 17 report. Data center power demand is only one driver. Others include a rise in electrification, particularly in energy-intensive manufacturing, transport and heating. Manufacturing of battery, solar wafers and cells and semiconductors are projected to add up to 15 GW of high-load-factor demand over the next few years, according to the energy consultancy’s report.

RELATED

Behind the Hype: The 'Jaw-dropping' Expectations for AI, Natural Gas

Could Nuclear Rival NatGas, Renewables in Race to Meet Power Demand?

Forecasted demand growth for data centers has been wide ranging. Based on Wood Mackenzie’s estimates, 10% growth would add about 13 GW of demand over the next five years, while 20% growth would add 35 GW.

Already challenged by lengthy permitting and interconnection processes, coal plant retirements, the lack of transformers and breakers needed to interconnect new plants and large loads could impact the ability to meet demand growth, Wood Mackenzie said.

Chris Seiple, vice chairman of power and renewables with Wood Mackenzie, said most industries could easily manage 2% to 3% demand growth; however, new infrastructure planning in the power sector takes five to 10 years.

“This will be a major challenge. The last time the U.S. electricity industry saw unexpected new demand growth like this was during World War II,” Seiple said. “Between 1939 and 1944, manufacturing output tripled, and electricity demand rose 60%. It was a closely coordinated national effort that brought together industry and policymakers to address the challenge and find innovation along the way. A similar effort is needed now.”

Earlier this week, Dominion Energy released its long-term plan to meet growing power demand. About 80% of the power generation will come from renewables, including about 3.4 GW of new offshore wind, about 12 GW of new solar, about 4.5 GW of new battery storage and, starting in the mid-2030s, SMRs. The remaining 20% will come from natural gas, the company said.

With more than 475 data centers, according to the Data Center Map, Virginia is home to the world’s biggest data center market. Virginia-based Dominion Energy has connected 94 data centers since 2019, according to its latest quarterly earnings presentation. The utility plans to connect 15 more this year.

RELATED

The Nuclear Option: E&Ps See Promising Yield from Mobile Reactors

Recommended Reading

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Trump Says He Will Double Tariffs on Canadian Metals to 50%

2025-03-11 - President Trump said he would double his tariffs on Canadian steel and aluminum products in response to Ontario placing a 25% tariff on electricity supplied to the U.S.

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.