Amelia Resources said Jan. 3 that it would sell about 85,000 net acres in the Louisiana Austin Chalk while PetroQuest paid about $700 per acre in the play last month. (Image: Hart Energy)

Amelia Resources LLC will sell 85,000 net acres in the Louisiana Austin Chalk as the play enjoys a resurgence among operators and sparks of A&D activity and leasing activity.

The Woodlands, Texas, company said Jan. 3 that a large U.S.-based operator, which it did not identify, purchased the assets for $87 million.

Amelia’s President Kirk Barrell said in a news release the company sold its acreage position after only “recently acquiring” it. He told Hart Energy that Amelia had acquired about 115,000 net acres during a four-month period.

"With the rapid emergence of this exciting new play, this focused package of leases presents a large new player an excellent acreage foundation to build upon,” he said.

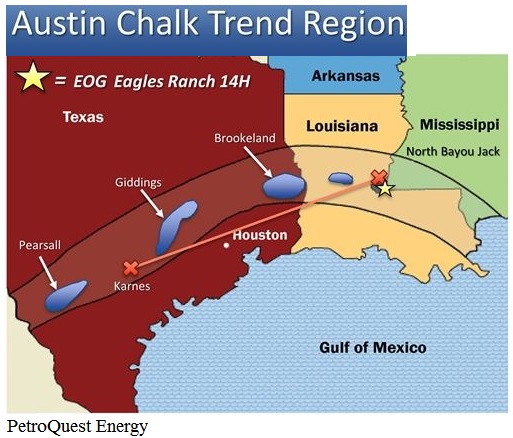

Interest continues to stir in the Louisiana Austin Chalk, where leasing is beginning to pick up after years as a virtual no-man’s-land. Partly the trend is linked to the success brought about in the Texas Austin Chalk, where innovations in drilling and completions have created consistent and impressive well results.

In late December, PetroQuest Energy Inc. (NYSE: PQ) had entered the play with the purchase of about 24,600 gross acres for $18.6 million in cash and stock—a cost of about $700 per acre. EOG Resources Inc.’s (NYSE: EOG) results in the Austin Chalk also indicate an IP-rate of about 1,400 barrels per day (bbl/d) of oil and cumulative production of more than 100,000 barrels of oil equivalent in two months.

Of particular interest to operators are frack design improvements in the Austin Chalk of Texas along with high initial flow rates that have attracted attention in Louisiana, Barrell said.

“We are excited to deliver an operator to the play with significant experience in drilling and completing these same reservoirs in Texas,” he said.

PetroQuest noted in a December presentation that several large-cap companies with Texas Austin Chalk experience had established leasehold positions in its Louisiana counterpart with more than “300,000 acres … leased with additional aggressive leasing activity ongoing in five to six Louisiana parishes.”

The company said that initial horizontal wells have already produced more than 100,000 bbl. Production mix in the Louisiana Austin Chalk is about 70% oil. At a base case of 600,000 bbl/d, the company estimates 60% internal rate of returns at $50 oil prices.

PetroQuest and other companies intend to attempt replicating successes in the Permian Basin, Eagle Ford, Scoop, Stack and other plays by exploring fields with variable production and developing them with the latest horizontal and completion techniques.

EOG’s success appears to center in Avoyelles Parish, La., Seaport Global Securities analysts said in December. The PetroQuest deal foresees initial costs of $9 million per well before bringing costs down to a more manageable $6 million to $7 million.

“Overall, while early, it’s hard not to think about the potential game-changing nature of this transaction–in the dream case scenario, in which the play becomes the next hot thing with acreage prices hitting $20,000 per acre,” Seaport said.

Amelia’s buyer has acquired a large acreage block in the updip, normally pressured region of the play. Barrell said its oil-rich acreage block is geologically focused on a shallower, normally pressured and porous reservoir across unfaulted monoclinal dip.

Additionally, the Tuscaloosa Marine Shale (TMS) lays about 700 ft below the Austin Chalk, creating a possible “stack play opportunity,” he said.

Barrell said the company plans to debut a second large acreage package at the NAPE Summit in Houston in early February.

Amelia Resources is a privately held E&P that generates drilling prospects and is engaged in several projects across the onshore U.S. Gulf Coast. Barrell founded the company in 2003.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

XCL Resources Team Launches X2, Targets Multibillion-Dollar M&A

2025-04-24 - X2 Resources, led by the team behind XCL Resources, is targeting $500 million to multibillion-dollar acquisitions across “premier” oil and gas basins with backing from EnCap and other investors.

TXO Partners CEO Bob R. Simpson to Retire

2025-03-20 - Gary D. Simpson and Brent W. Clum will serve as co-CEOs, effective April 1. Bob R. Simpson will remain chairman of the board, TXO said.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.