An LNG regasification terminal. (Source: Shutterstock)

China plans to beef up its ability to import LNG over the next four years, according to a new study released by analytics firm GlobalData.

“Despite growing domestic natural gas production, China continues to rely on gas imports, especially LNG imports, to meet its ever-growing gas demand,” said Bhargavi Gandham, an oil and gas analyst at GlobalData, in a press release. “As a result, there will be a strong growth in LNG regasification terminals in China by 2028.”

Regasification is the process of turning LNG back into natural gas once it arrives at its destination. China has allocated 47% of its midstream budget from 2024 to 2028 to develop the facilities.

The country already represents a major part of the U.S. LNG export market, said Oren Pilant, energy analyst at East Daley Analytics.

“China represents almost 20% of signed supply and purchase agreements (for the U.S.),” Pilant told Hart Energy via email. The 20% represents 3.26 Bcf/d of offtake agreements signed by Chinese purchasers.

The U.S. is now the world’s top exporter of LNG, owing to robust natural gas production and ongoing expansions in liquefaction capacity. Both are expected to continue rising in the future and give the country an edge in retaining its leading position well into the next decade, according to data from the Energy Information Administration (EIA) and other private independent research firms.

The U.S.’ low-carbon LNG feedstock advantage bodes well with LNG importers from Europe to Asia seeking to transition away from coal and other high-carbon energy sources.

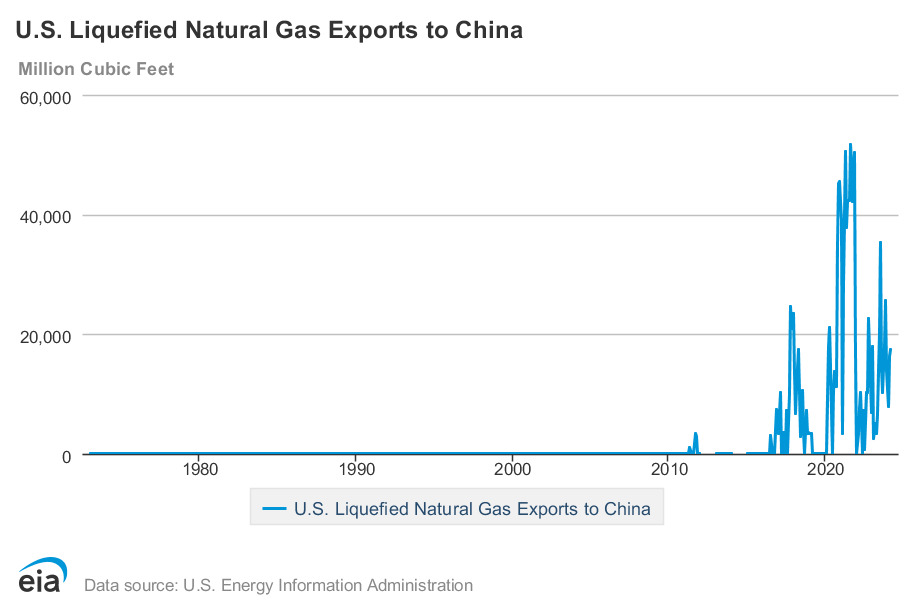

The U.S. first exported LNG to China in 2011, according to the U.S. Energy Information. Shipments to the country were sporadic until 2020. China received LNG shipments equivalent to 17.4 Bcf of natural gas from the U.S. in March 2024, the last month for which the EIA has data.

GlobalData’s report, “Asia-Pacific Oil and Gas Projects by Development Stage, Capacity, Capex, Contractor Details of All New Build and Expansion Projects to 2028,” forecasts that 97 midstream projects will come online in China by 2028. LNG regasification will comprise 46 of them.

Next year, China plans to open the Zhoushan III facility, which has an expected capacity of 341Bcf/y. Bhargavi said China’s government has emphasized increasing the role of natural gas in the country’s energy mix.

Any extra LNG for Asia could offset falling demand in Europe.

Price headwinds in Asia

“Lower European demand has depressed prices and pushed LNG into Asia with imports to China alone up 22%,” Wood Mackenzie Research Director, EMEA Gas & LNG Research Lucy Cullen said in a June 12 research report.

“Looking ahead, high prices are likely to provide some headwinds to near-term Asian demand growth,” Cullen said. “As a result, European storage levels remain on track to reach full capacity by the end of September and stay that way through October.”

Wood Mackenzie said the Title Transfer Facility (TTF) price is up 40% over the last three months and trading close to $11/MMBtu, owing to increased Asian demand and risks related to Russian supply and maintenance projects at Norwegian fields.

Prices are expected to undergo a structural shift, with more than 40 mtpa of LNG supply growth expected in 2026, according to Wood Mackenzie. Asian LNG demand is expected to absorb significant additional LNG supply, while Europe will have to absorb almost 20 mt of additional LNG in 2026, putting downward pressure on prices.

Recommended Reading

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

2025-03-05 - Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

TotalEnergies, Skyborn Commission Yunlin Wind Farm Offshore Taiwan

2025-03-04 - Located about 15 km off Taiwan’s west coast, Yunlin consists of 80 wind turbines.

US Tariffs on Canada, Mexico Hit an Interconnected Crude System

2025-03-04 - Canadian producers and U.S. refiners are likely to continue at current business levels despite a brewing trade war, analysts say.

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.