Scott Potter, managing director at RBN Energy, speaks at the Midstream Texas conference in Midland. (Source: Joseph Markman/Hart Energy)

MIDLAND, Texas—In less than four years, hydrocarbon exports have vaulted from a twinkle in Harold Hamm’s eye to a critical component of U.S. oil and gas economics.

“Our livelihood, the livelihood of the industry, is going to rely on exports for the next four to five years or longer,” said Scott Potter, managing director of business development for RBN Energy, at Hart Energy’s recent Midstream Texas conference. “We need exports of crude oil to keep going, we need exports of natural gas to keep going.”

The 40-year ban on U.S. oil exports ended in December 2015 as a result of a passage in an omnibus spending bill passed by Congress and signed by President Barack Obama. Harold Hamm, chairman and CEO of Continental Resources Inc., spearheaded lifting of the ban, in part to support an industry struggling with a plunge in oil prices.

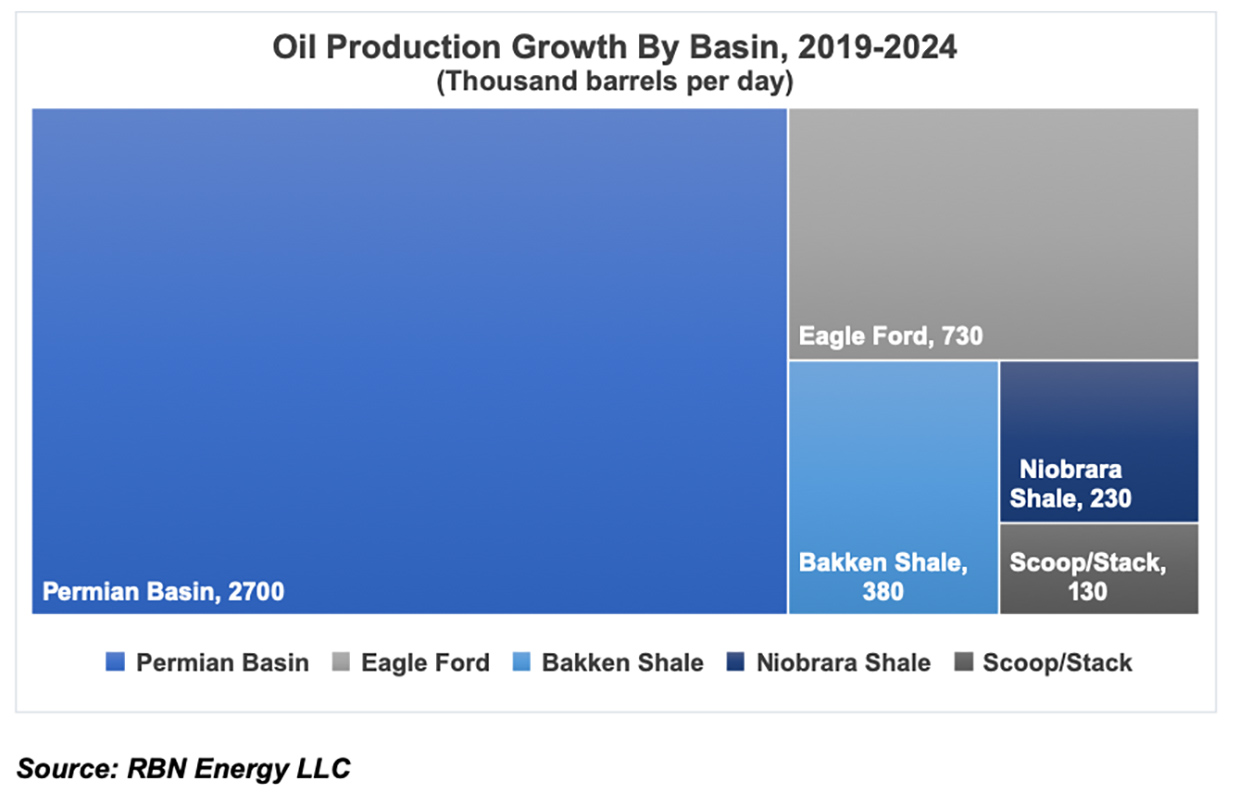

Prices have since stabilized and efficiencies have allowed producers to thrive even at lower breakevens. That has led to an oil production growth forecast that is strong across U.S. unconventional plays, but spectacular in the Permian Basin.

“Next year sometime or definitely in 2021, the Permian Basin will be at the point where we are producing as much crude oil in the Permian Basin as we produced in the whole U.S., including the Gulf of Mexico, back in 2004,” Potter said.

“Next year sometime or definitely in 2021, the Permian Basin will be at the point where we are producing as much crude oil in the Permian Basin as we produced in the whole U.S., including the Gulf of Mexico, back in 2004,” Potter said.

Which begs the question: where is it all going to go?

Shale plays provide an abundance of light oil (40 degree to 50 degree API) but the U.S. refining sector has maxed out on how much it can take. Refineries in this country require 8 million barrels per day (bbl/d) of imported heavy crude to keep running at full tilt. Potter said that means 20% of current U.S. crude output and all incremental barrels for at least the near future must be put on ships destined for overseas markets.

“We have to have the pipelines built, we have to have the docks, we have to have the ships because we can’t use it here,” he said.

The case with natural gas isn’t much different. The Permian Basin produces about 12 billion cubic feet per day (Bcf/d) and about half of that is exported to Mexico through pipelines and LNG tankers.

But the production growth prediction sometimes brings a skeptical response from industry operators. What if the price of West Texas Intermediate (WTI) drops to $50 per barrel? (On June 20, WTI spiked 5.5% to $57/bbl after Iran shot down a U.S. drone).

Potter isn’t concerned, noting that the price collapsed to around $26/bbl in 2015 and Permian production continued to grow, albeit not as dramatically as when the price recovered in 2017.

“Maybe [the price collapse] flattened out the growth but it’s still growing, so I don’t that think that $53 a barrel is going to slow the Permian Basin,” he said. The Permian price relative to the price at the Cushing, Okla., hub typically is pretty close but there have been times it’s been $20 a barrel less, he added. Every time it drops like that, he said, it means pipeline capacity is lacking.

That issue is on the way to being resolved, with 4.3 million bbl/d of crude pipeline capacity proposed to move product out of the Permian between now and 2021. The six projects include Wink-to-Webster, Cactus II, EPIC, Gray Oak, Midland-to-Echo III and Permian Express IV. When built, Potter said, the industry should be in pretty good position to get crude from the Permian Basin to Gulf Coast destinations of Houston, Corpus Christi and Nederland, Texas.

Then what? To paraphrase the Sheriff Brody character in “Jaws,” the export sector is going to need bigger boats.

“One of the questions people give me is, is anybody still trying to put money into this industry?” Potter said. “And I say, absolutely, they’re looking for the big projects and one of them is the VLCC [Very Large Crude Carrier].”

VLCCs can carry as much as 2 million barrels of oil. By comparison, Germany consumes 2.4 million bbl/d of oil. The proposed crude export terminals would boast a capacity of 12 million bbl/d, though Potter doubts all will be built.

If there is a headwind in the export scenario, it might be complacency. The solution to the U.S. supply/demand imbalance has been exports.

“For the last five, six years we just put it on ships and they sailed off into the horizon and we said, ‘great, problem solved,’” Potter said. “But no one really has their arms around the question of: is that demand for propane and natural gas, crude oil going to be there? We just assume it is, and nobody really knows for sure if it is going to be there in five, 10 years.”

Recommended Reading

WhiteWater-Led NatGas Pipeline Traverse Reaches FID

2025-04-04 - The Traverse natural gas pipeline JV project will give owners optionality along the Gulf Coast.

Brookfield Infrastructure Partners Buys Colonial Pipeline for $9B

2025-04-04 - Brookfield Infrastructure Partners LP has agreed to acquire Colonial Enterprises, the owner of the Colonial Pipeline, in a deal valued at $9 billion.

Boardwalk Project to Grow Southern Access for Appalachian NatGas

2025-04-02 - Midstream company Boardwalk Pipeline is holding an open season for future new capacity on the Texas Gas Transmission pipeline.

Williams Commissions Two NatGas Projects to Expand Transco Network

2025-04-01 - Midstream company Williams Cos. added to its network capacity in the southern U.S. with the commissioning of the Southeast Energy Connector and the Texas to Louisiana Energy Pathway.

WaterBridge Starts Open Season for Produced Water Pipeline

2025-04-01 - Water midstream company WaterBridge plans to develop transport capacity out of the Delaware Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.