Prior to 2016’s drawdown, the last summer withdrawal happened in 2006 and triggered the failures of trading firms Amaranth Advisors and MotherRock, EDA said in an Aug. 15 report. (Source: Shutterstock)

A natural gas storage withdrawal for the Lower 48 may be in the cards this summer due to heat waves and high demand for power generation, according to analysis of the U.S. Energy Information Administration’s (EIA) latest weekly report.

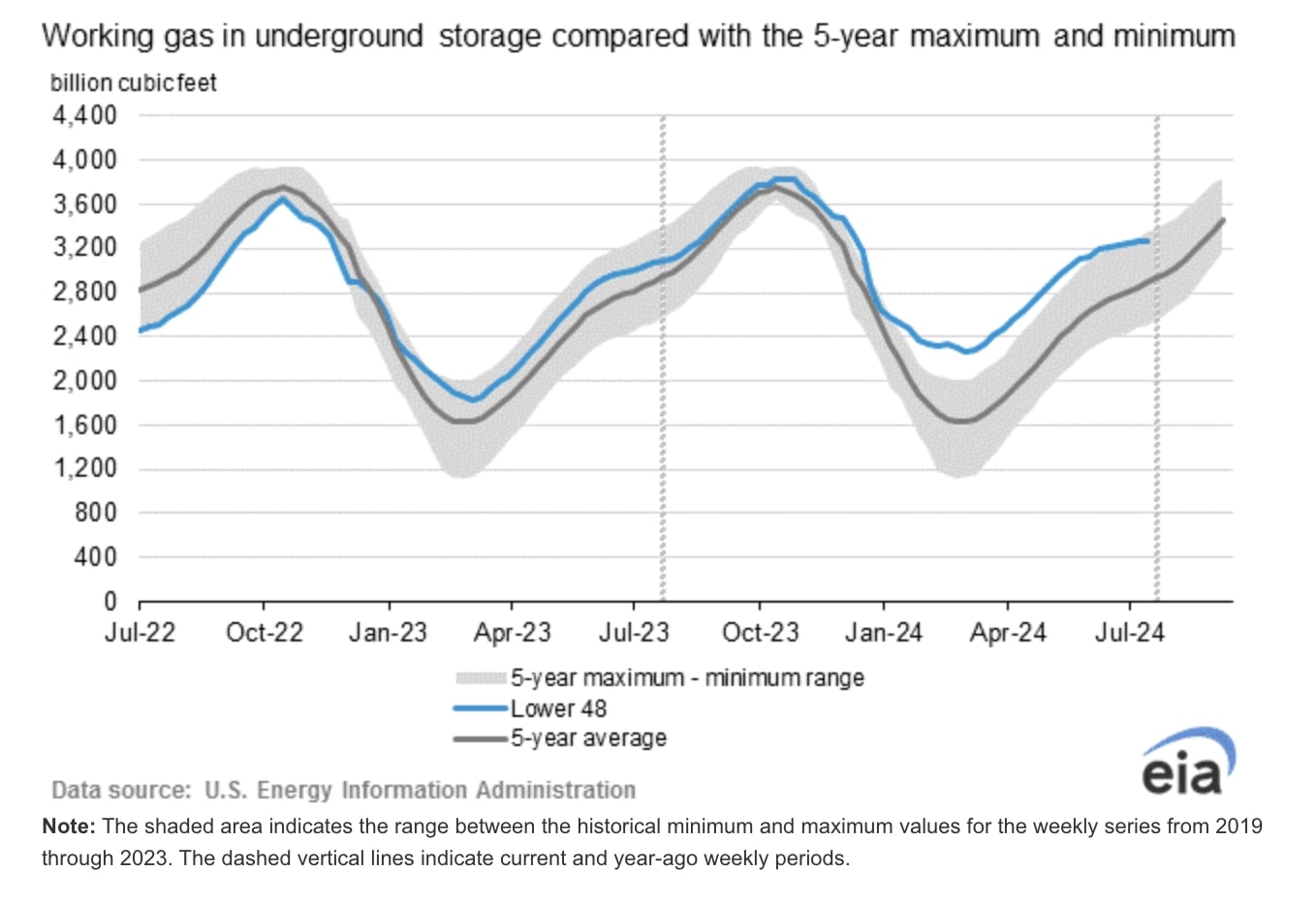

The EIA reported 3,264 Bcf of working gas in storage for the week of Aug. 9, a 6 Bcf decrease from the previous week, according to the administration’s storage report.

“EIA storage has tended to miss to the bullish side of the ledger in recent weeks, raising the possibility that natural gas could post the first summer storage draw since a draw of 6 Bcf in the report dated July 29, 2016,” wrote Robert Yawger, Director of Energy Futures, Mizuho Securities USA, in Mizuho Americas’ Aug. 15 Energy Daily Report.

East Daley Analytics (EDA) called a summer natgas drawdown “rare.”

EDA said it expects the EIA to report a net injection of 1 Bcf into working gas for the week of Aug. 9 and a monthly net injection of 66 Bcf, according to an Aug. 15 report. Market consensus estimates range from 40 Bcf to 80 Bcf, which is below last August’s 188 Bcf injection.

Prior to 2016’s drawdown, the last summer withdrawal happened in 2006 and triggered the failures of trading firms Amaranth Advisors and MotherRock, EDA said in an Aug. 15 report.

This summer, East Daley cited intense heat in the South Central region, “where demand from the electric sector could tip the EIA report to a net withdrawal.”

“The 2016 summer storage withdrawal occurred under similar circumstances,” said East Daley. Warmer winter weather had storage inventories at record highs for the time period, and more natural gas had been taken from the South Central region than what was injected in the East, Midwest and Mountain regions.

Mizuho’s report stated that “natural gas specs don’t seem to be very impressed by the prospect of a draw during summer,” with natural gas trading down 0.36% to a low of 2.198.

At 3,264 Bcf, total working gas remains in the five-year historical range, EIA said. This time last year, stocks were at 3,055 Bcf, according to the EIA.

EIA’s Aug. 6 Short-Term Energy Outlook, its most recent, said natural gas for power generation has increased demand in July but that falling consumption and flat production would likely lead Henry Hub price to stay relatively low, “remaining below $2.50/MMBtu through October.”

“However, we expect seasonal increases in consumption for space heating, along with a ramp up in liquefied natural gas (LNG) exports from new facilities in Texas and Louisiana, will push the Henry Hub price to average about $3.10/MMBtu from November through March,” EIA said.

Recommended Reading

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

NAPE Panelist: Occidental Shops ~$1B in D-J Basin Minerals Sale

2025-02-05 - Occidental Petroleum is marketing a minerals package in Colorado’s Denver-Julesburg Basin valued at up to $1 billion, according to a panelist at the 2025 NAPE conference.

Constellation Energy Nearing $30B Deal for Calpine, Sources Say

2025-01-08 - Constellation Energy is nearing a roughly $30 billion deal to acquire power producer Calpine that could be announced as early as Jan. 13, sources familiar with the matter said.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.