Most infamous for LNG companies was the Biden administration’s early 2024 “LNG pause,” in which a Department of Energy study on climate effects halted LNG facility permits being issued. (Source: Shutterstock)

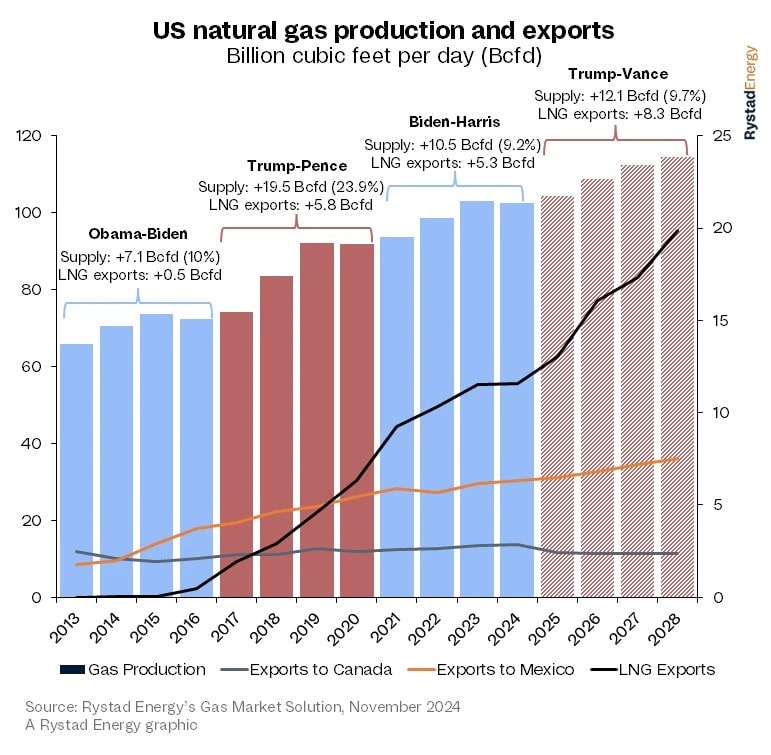

President-elect Donald Trump may be starting his second administration at just the right time for the U.S. LNG market.

But unleashing the current development restrictions could also lead to too much of a good thing, according to a report released Nov. 26 by Rystad Energy.

During his campaign, Trump pledged to speed up the permitting process and ease regulations that led to delays on projects either under construction or working toward a final investment decision. Most infamous for LNG companies was the Biden administration’s early 2024 “LNG pause,” in which a Department of Energy (DOE) study on climate effects halted LNG facility permits being issued.

A Louisiana federal judge ruled against the pause in July, but the DOE has yet to clear the way for any LNG permits to be granted to non-Free Trade Agreement countries.

Trump also pledged to increase leases on federal land for natural gas production. The policies could prime the LNG market for a “golden era,” the Rystad report said.

“Trump’s accelerated LNG approvals could further strengthen the U.S. position in the global energy market, meeting critical demand as the world transitions away from other energy sources,” Emily McClain, Rystad Energy’s head of North America gas & LNG research, said in the report.

If Trump’s policies are implemented, U.S. LNG exports could double to more than 22 Bcf/d by 2030, the report said, with major projects such as Texas LNG and Venture Global Calcasieu Pass both advancing despite environmental opposition.

The global market demand is expected to reach 600 million metric tons a year (MMmt/year) by 2030, with a 140 MMmt/year supply gap opening up by 2035, according to Rystad.

The additional supply created by LNG suppliers will have geopolitical consequences, giving Trump a strong negotiating position with the EU, which is still searching to replace natural gas supply alternatives from Russia. In the Pacific arena, China has also spent billions building a regasification infrastructure with the expectation of a growing LNG import market.

Trump’s policies may also get in the way.

On Nov. 26, Trump threatened massive tariffs on Canada, Mexico and China. Trump has a record of imposing tariffs during his first administration that hurt some sectors of the energy industry, the Rystad report noted. A 25% steel tariff in 2018 led to price increases on many construction projects, including LNG liquefaction plants. LNG exports to China were halted in 2019 during a trade dispute with the country.

McClain also pointed out the extreme price sensitivity of the natural gas market. If multiple LNG export projects currently waiting for federal permits go forward, the market will face a glut that will drop prices, making it difficult for the U.S. to compete with other nations such as Qatar and Australia.

“This rapid expansion risks oversaturating the market, potentially driving down prices and profitability for producers. The key challenge will be balancing domestic growth ambitions with global stability to ensure long-term market share and competitiveness,” McClain said.

Recommended Reading

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

APA's Apache Reports Another Oil Discovery on Alaska's North Slope

2025-03-17 - APA Corp. and its partners plan flow tests after the success of the Sockeye-2 exploratory well.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.