As Occidental spends $12 billion to add scale in the Midland Basin, analysts wonder if the E&P will divest assets in the Gulf of Mexico, the Rockies or other parts of its portfolio. (Source: Shutterstock)

As Occidental Petroleum adds greater depth in the Permian Basin through M&A, the company plans to divest up to $6 billion in less competitive U.S. assets. Analysts wonder: What assets might Occidental sell?

Occidental’s $12 billion acquisition of private E&P CrownRock LP includes more than 94,000 net acres across the core of the Midland Basin.

The deal also includes about 1,700 undeveloped drilling locations, which boosts Occidental’s unconventional sub-$40/bbl breakeven inventory by 33%.

Scooping up CrownRock will add approximately 170,000 boe/d of lower-decline unconventional production to Occidental’s Permian portfolio in 2024.

The deal is expected to be immediately accretive to Occidental’s free cash flow, including $1 billion in the first year post-acquisition based on a $70/bbl WTI price.

Analysts think the deal checks a lot of boxes for Occidental when it comes to balance sheet and inventory accretion. However, Occidental is piling on a considerable amount of debt to acquire CrownRock, one of the Midland Basin’s most coveted private operators.

Occidental says it will take out $9.1 billion in net debt—in addition to assuming CrownRock’s existing debt of $1.2 billion.

In order to support the CrownRock purchase, Occidental is launching a new divestiture program with hopes to monetize between $4.5 billion and $6 billion of its less competitive assets.

Occidental’s President and CEO Vicki Hollub, speaking during a Dec. 11 conference call with analysts, said that all of the divested assets will come out of the company’s U.S. portfolio.

RELATED

With CrownRock Deal, Occidental Wades Back into Deeper Debt

Perusing the portfolio

Occidental has quite a few different valuable assets in its U.S. portfolio that could become less competitive for development capital after the CrownRock acquisition closes, experts say.

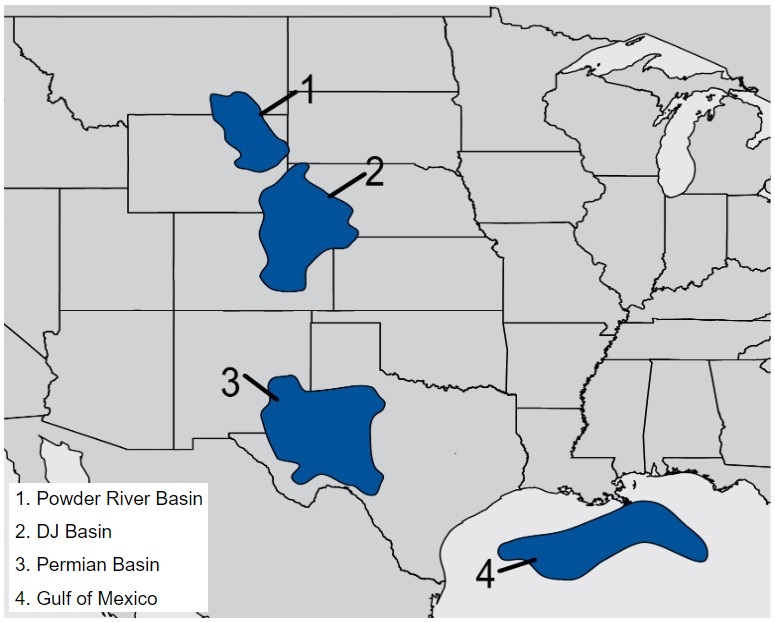

Robert Clarke, vice president of upstream research at Wood Mackenzie, said the firm considers Occidental’s Gulf of Mexico (GoM) position as a candidate for disposal.

Occidental started the year operating 10 deepwater floating platforms and producing from 18 active fields in the GoM, according to the company’s most recent annual report. Occidental owns a working interest across 252 GoM blocks, including about 1 million net acres.

“The U.S. [GoM] is fast becoming non-core in [Occidental’s] U.S. shale-rich portfolio, accounting for only 10% of current production,” Clarke said in a press note. “[Occidental] has an advantage in any GoM sale because it holds assets with 100% ownership.”

Other places that Occidental could look to monetize are its assets in the Rockies, Clarke said.

Occidental has about 800,000 total net acres in the Denver-Julesburg (D-J) Basin—including in Colorado, where oil and gas operators faced more stringent regulatory oversight to drill wells.

Occidental was the first oil and gas operator in Colorado to obtain approvals to drill under new Colorado Oil and Gas Conservation Commission (COGCC) standards adopted in early 2021.

The company said it doesn’t anticipate significant near-term changes to its development program in the D-J Basin based on COGCC drilling regulations. But Occidental noted that an inability to obtain new drilling permits in the future could impact its D-J Basin operations, according to regulatory filings.

Further north, Occidental also has interest in over 300,000 net acres in the Powder River Basin—primarily located in Converse and Campbell counties, Wyoming.

In an interview with Hart Energy, Petrie Partners Co-founder and Managing Director Mike Bock agreed that Occidental’s D-J Basin, Powder River Basin and Gulf of Mexico assets could hit the chopping block after closing the CrownRock deal.

But another area where Occidental could realize a lot of value with a sale is the Permian, where demand for undeveloped inventory is fueling a red-hot M&A market.

“Where they have chunky assets and market receptivity would argue for the Permian versus those other basins,” Bock said.

And the market shouldn’t presume Occidental is only going to sell off low-quality assets as part of its divestiture program, Hollub emphasized on the analyst call.

“Just because we’re divesting of something doesn’t mean that it’s not a quality asset,” Hollub said. “It just means that it doesn’t fit with our development plans and where we are, and doesn’t deliver the margins that we might need but might work for someone else.”

RELATED

Which Occidental Assets Will Hit Chopping Block After $12B CrownRock Deal?

Other options

Occidental also had an active divestiture program after its massive $38 billion acquisition of Anadarko Petroleum.

The company was able to limit those sales due to improving crude oil prices—but they could still be on the chopping block.

“We believe those assets may now be considered for divestiture,” analysts at UBS said in a market report.

There are also midstream investments Occidental could monetize: The company owns a total effective economic interest of 51% in Western Midstream Partners LP, including all of the 2.3% non-voting general partner interest and 48.8% of the limited partner units in WES, per regulatory filings.

“Examining [Occidental’s] assets, the stake in WES has often been discussed by the market as a potential divestiture candidate,” analysts at Jefferies reported.

RELATED

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

BP Pledges Strategy Reset as Annual Profit Falls by a Third

2025-02-11 - BP CEO Murray Auchincloss pledged on Feb. 11 to fundamentally reset the company's strategy as it reported a 35% fall in annual profits, missing analysts' expectations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.