Geophysical surveys, like the LWD and cased-hole log process shown, are designed to increase oil production. (Source: Aleksei Zakirov/Shutterstock.com)

[Editor's note: A version of this story appears in the August 2020 edition of E&P. Subscribe to the magazine here.]

As the oil and gas industry grapples with what appears to be a “new normal” associated with fluctuating oil price, technological innovations aimed at minimizing the overall costs of safely producing hydrocarbon are also becoming normal. New technological developments in drilling, reservoir evaluations, completions and production are on the increase. In reservoir evaluation, innovations aim at not just providing cost-effective means of acquiring reservoir properties but also novel approaches to acquiring quality measurements that will enhance knowledge of the reservoir.

Formation permeability measurement is one of the most critical parameters in the determination of hydrocarbon production. It drives a key part of the recovery factor in reservoir simulation, field development and reservoir management. In-situ permeability measurement can be derived from in-situ formation mobility data using formation testing, core analysis and well tests. All these direct permeability measurements provide intermittent station measurements and may not effectively address the varying porosities and permeability changes within the well intervals.

Other challenges with direct permeability evaluation methods are the associated costs and time it takes to complete such evaluation. A good example is the process of permeability evaluation from core samples. It takes a relatively long time to acquire and evaluate core samples, which affects the ability to make timely decisions on the well completion. Similarly, a well test approach is time- consuming and relatively expensive.

In resolving the need for an accurate continuous permeability profile, several techniques have historically been used by log analysts and geoscientists. The most common techniques include the use of porosity logs, geochemical logging, invasion profile (from resistivity measurement), nuclear magnetic resonance tools and acoustic Stoneley arrival.

The use of acoustic Stoneley arrivals for permeability has been a subject of discussion among geoscientists over the past four decades, starting with the early attempt to measure permeability from Stoneley wave by Rosenbaum in 1974. While significant work has been conducted over the years on Stoneley-derived permeability, doubts remain on the accuracy and reliability of this technique. Stoneley wave generation is highly sensitive to several downhole factors, so the reliability of the Stoneley wave presents a challenge. The Stoneley wave acquisition challenge is further amplified in an LWD environment.

The drilling environment in which the LWD acoustic measurement is acquired has its challenges with drilling noise and tool centralization.

Drilling noise

Drilling noise has a major influence on LWD acoustic measurement; therefore, the ability to detect Stoneley arrivals could be affected by it. Acoustic noise can be generated through vibrations of the drillstring as a result of its rotation. The LWD sonic tool position may experience complicated movements during drilling, which must be kept under control, otherwise it will hit borehole walls and generate significant drilling noise. Drilling noises are mainly low-frequency waves, which propagate along the borehole like Stoneley waves. This limits the ability to easily detect Stoneley waves.

Tool centralization

The presence of an LWD acoustic tool replaces a large portion of the fluid volume in the borehole, making the Stoneley wave in the remaining fluid annulus quite sensitive to the tool position in the borehole. That is, an off-centered tool reduces the Stoneley wave masking the effect of formation permeability. This concept makes tool standoff one of the critical factors that affect Stoneley measurement in LWD. Standoff relates the tool centralization and its relative position to the wellbore. A standoff-enhanced Stoneley permeability approach utilizes the Stoneley wave arrivals from a unipole LWD azimuthal sonic tool to derive a continuous permeability index.

Technology overview

The Weatherford CrossWave azimuthal sonic tool employs a unipole configuration with a single, directionally focused transmitter and one array of six directional receivers azimuthally aligned with the transmitter. The transmitter operates in monopole mode at about 12 kHz center frequency with a wide band. The acoustic waves from the transmitter travel along the wellbore until they are detected by the six receivers set at a spacing of 6 in. apart. Focused receivers that have limited radial sensitivity to fluid flow and drilling noise are used to maximize the receivers’ sensitivity to the sound waves traveling through the formation.

Like traditional monopole sonic tools, this tool measures the velocity of mud head waves associated with compressional and shear waves refracted through the formation at the critical angle parallel to the borehole. However, unlike radially symmetric monopole tools, this azimuthally focused sensor can differentiate the slowness of refracted compressional and shear waves from different azimuthal directions around the borehole. This is accomplished by using X-Y magnetometers to track the azimuthal orientation of the transducers as the drillstring rotates and sorts the measured waveforms into 16 azimuthal sectors.

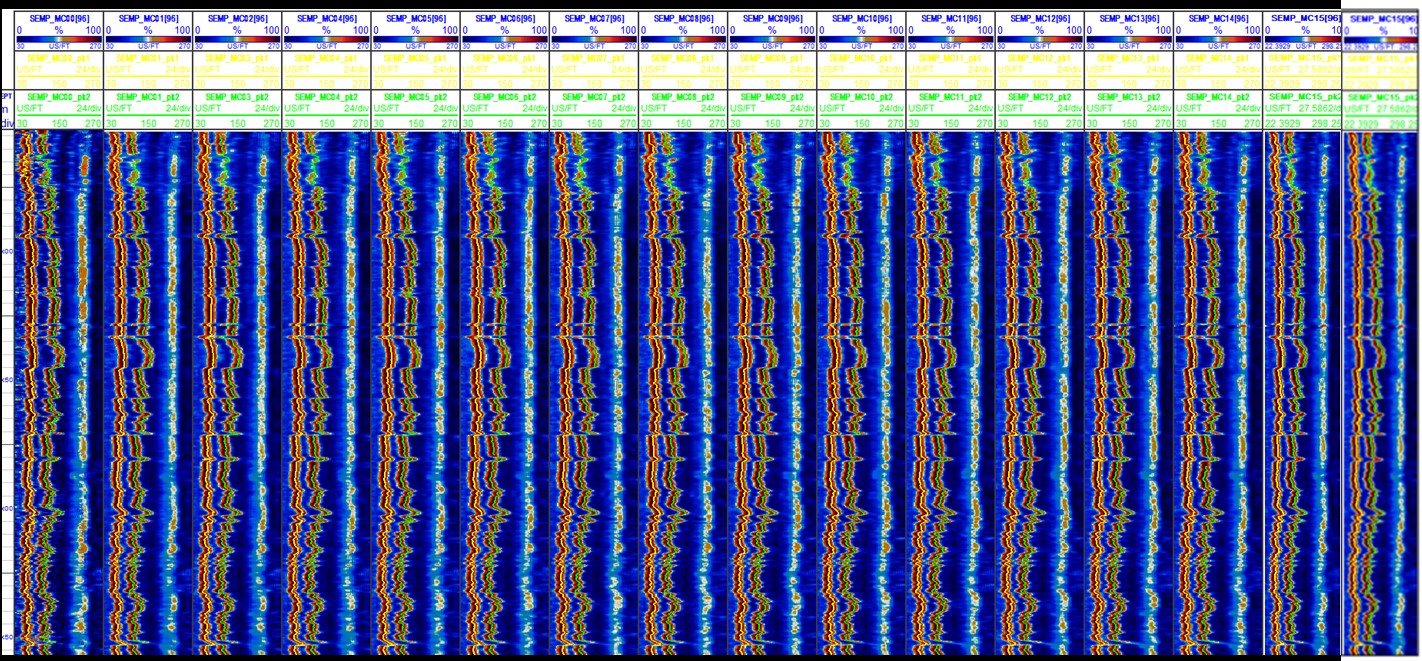

The azimuthal binning capability of the CrossWave azimuthal sonic tool is utilized in providing azimuthal 360-degree sonic borehole images. This azimuthal binning into individual sector measurement is the basis for the standoff enhanced Stoneley measurement.

One of the major difficulties in designing LWD sonic tools is to isolate the receivers so they do not measure sound waves that have traveled directly up the collar from the transmitter to the receivers, known as “tool mode” or “collar mode.” An attenuator must be present between the acoustic wave source and the tool receivers to minimize this effect. The CrossWave sonic tool implements a propriety attenuator section separating the transmitter and receivers, which offers 50 dB of sound isolation.

Workflow

At low-frequency sonic acquisition, the Stoneley wave velocity and attenuation are sensitive to formation and fracture permeability. The novel workflow to Stoneley- derived permeability is in four parts:

- A slowness analysis consists of a raw full CrossWave azimuthal sonic waveform processed at low frequency. The slowness analysis focuses on the critical need to have a good Stoneley wave arrival, which forms the foundation for the ability to achieve an accurate permeability estimation. Data processing is performed for the low-frequency component of the Stoneley;

- Identifying the sector of the wellbore with the strongest Stoneley arrival associated with the appropriate standoff for optimal Stoneley wave generation;

- Obtaining a Stoneley energy- coherence; and

- Deriving a normalized Stoneley loss means Stoneley-wave velocity decreases and its attenuation for increasing permeability. The low- frequency component of the detected azimuthal Stoneley spectrum provided the most sensitivity to the permeability of the primary porosity reservoir.

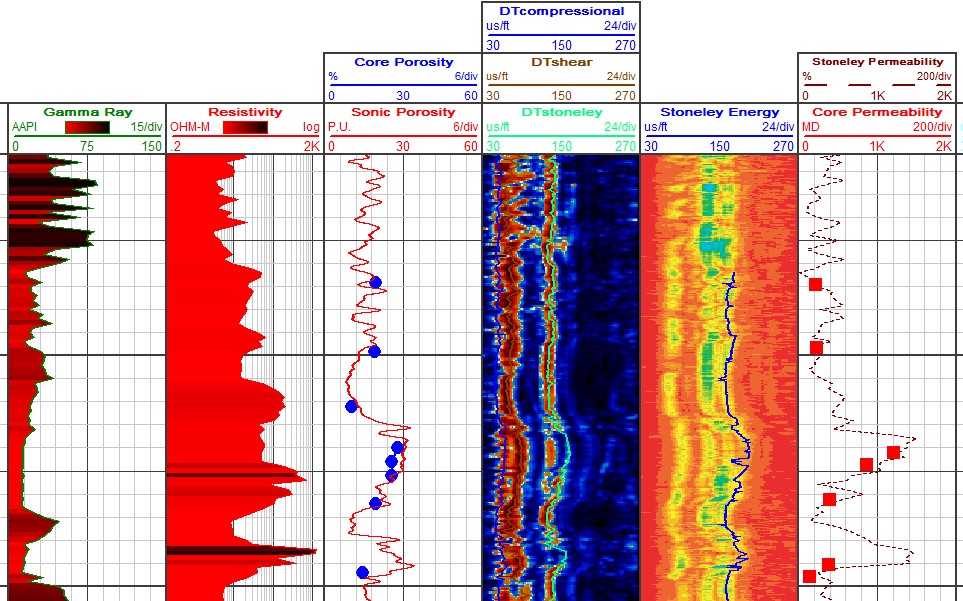

The continuous azimuthal Stoneley wave and energy-derived permeability was compared with permeability from the core in a recent clastic reservoir. Stoneley energy normalization in this example utilized the high- and low-core permeability results. Normalization also can be done using formation test mobility results or known reservoir permeability.

Derived azimuthal Stoneley permeability results respond to permeability changes in the varying porosity intervals. This approach provides a simple, cost-effective technique of providing continuous permeability estimation for qualitative reservoir evaluation.

Recommended Reading

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

Chevron Completes Farm-In Offshore Namibia

2025-02-11 - Chevron now has operatorship and 80% participating interest in Petroleum Exploration License 82 offshore Namibia.

Norway Awards Equinor 27 Production Licenses in Latest Round

2025-01-14 - Equinor ASA, Aker BP ASA, Vår Energi ASA and DNO ASA were selected for the most offshore licenses in Norway’s annual licensing rounds.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

QatarEnergy Joins Joint Venture Offshore Namibia

2024-12-17 - QatarEnergy acquired a 27.5% stake in petroleum exploration license 90 offshore Namibia.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.