(Source: Shutterstock.com)

APA Corp.’s sale of Midland Basin, Austin Chalk and Eagle Ford Shale assets closed earlier than the company expected and for about $40 million less anticipated, APA said in its July 11 operations update.

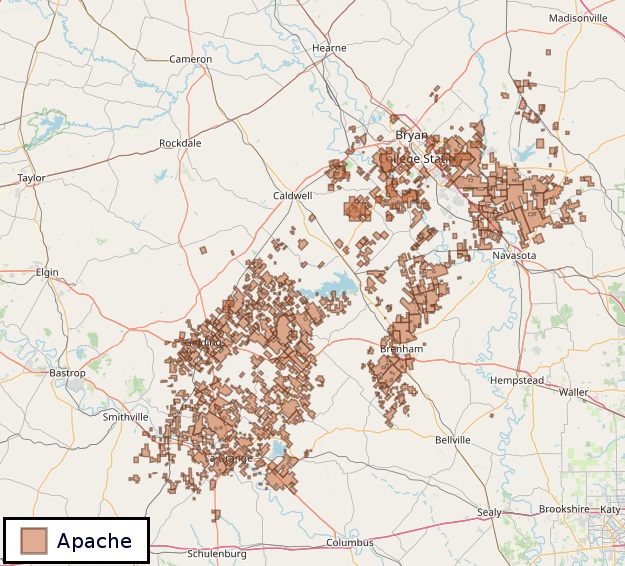

APA said in May that it would sell about 24,000 net royalty acres across several counties in the Midland and 237,000 net acres in the East Texas Austin Chalk and Eagle Ford plays. The company initially said the sale price would total more than $700 million. The buyers were not disclosed.

The deals, which were expected to close in the third quarter, were completed in June for an aggregate of approximately $660 million.

APA said the assets would result in reduced U.S. production of 2,000 boe/d, of which 30% was oil. APA said in May the properties represented an average 13,000 boe/d.

Following the close of APA’s $4.5 billion acquisition of Callon Petroleum in April, the company has looked at non-core asset sales for debt reduction.

Barclays served as the financial adviser on the Midland Basin transaction, which has an effective date of April 1, 2024. TD Securities served as financial adviser for the Eagle Ford asset sale, which has an effective date of Jan. 1, 2024.

Recommended Reading

Venture Global Asks FERC to Open Next Plaquemines LNG Block

2025-03-03 - The additional train start-up of Venture Global’s Plaquemines LNG facility would bring the overall project halfway to completion.

DOE Secretary Wright Grants Delfin LNG Extension for Exports

2025-03-10 - Delfin LNG's floating LNG export project in the Gulf of Mexico is authorized to export up to 1.8 Bcf/d, U.S. Energy Secretary Chris Wright said at CERAWeek.

Venture Global’s Calcasieu Pass LNG Project Gets Boost from FERC

2025-02-07 - The Federal Energy Regulatory Commission released a report responding to an appellate court’s questions over Venture Global LNG’s Calcasieu Pass 2 project.

DOE Approves Non-FTA Permit Extension for Golden Pass LNG

2025-03-05 - Golden Pass LNG will become the ninth U.S. LNG export facility following the U.S. Department of Energy’s approval for an extension of its non-free trade agreement permit.

Dell: Folly of the Forecast—Why DOE’s LNG Study Will Invariably Be Wrong

2025-01-07 - Kimmeridge’s Ben Dell says the Department of Energy’s premise that increased LNG exports will raise domestic natural gas prices ignores a market full of surprises.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.