APA Corp. and subsidiary Apache are selling more than $700 million in non-core assets in the Permian Basin and Eagle Ford Shale—part of a plan to reduce debt after a $4.5 billion acquisition of Callon Petroleum.

APA Corp. sold non-core Texas interests and leasehold in the Permian’s Midland Basin and Eagle Ford Shale plays, the company said on May 20.

Houston-based APA, parent company of Apache Corp., sold producing Texas properties and assets for an aggregate of more than $700 million. Buyers for both transactions were undisclosed.

APA has prioritized debt reduction since closing a $4.5 billion acquisition of Callon Petroleum in April.

The divested properties represent estimated net production of 13,000 boe/d, with about one-third of the volumes oil, APA said.

In the Midland transaction, Apache Corp. and its subsidiaries agreed to sell around 24,000 net royalty acres across several counties in the basin.

The Midland mineral and royalty interests primarily included non-operated properties producing an average 2,000 boe/d net to Apache during the first quarter.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

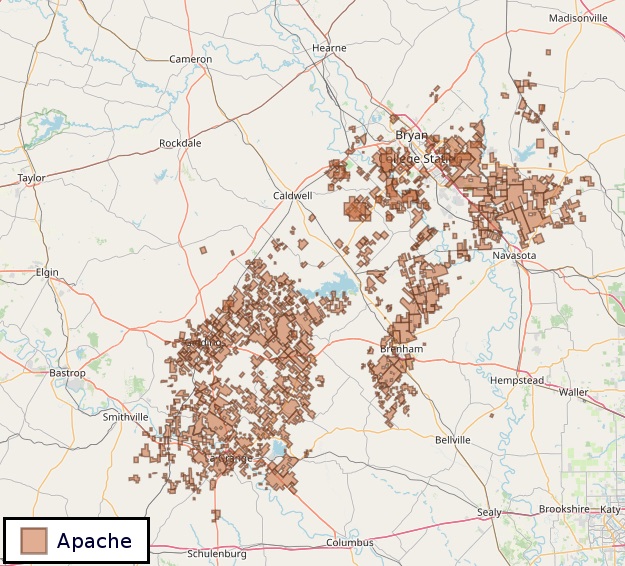

In a second transaction, Apache agreed to sell 237,000 net acres in the East Texas Austin Chalk and Eagle Ford plays.

Net production from the Eagle Ford and Austin Chalk assets was approximately 11,000 boe/d during the first quarter.

APA debt reduction

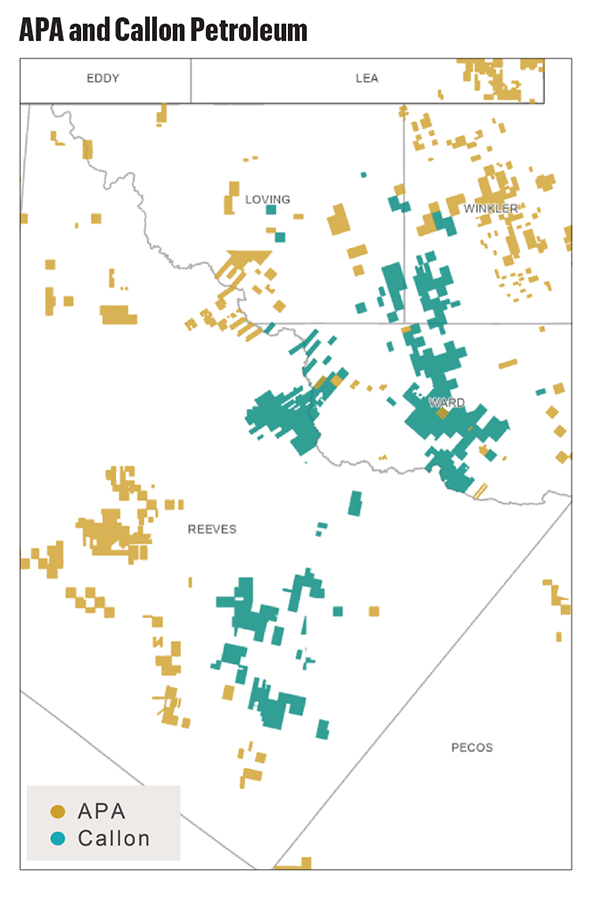

The Callon acquisition added a much deeper portfolio on the Delaware side of the Permian Basin.

Callon brought to Apache about 119,000 net Delaware acres across Ward, Reeves, Winkler and Loving counties, Texas, according to RRC data. Callon also held a smaller 26,000-acre footprint in the northern Midland Basin, including Andrews, Borden, Dawson, Howard, Midland and Martin counties, Texas.

APA was “looking at non-core asset sales as a source of debt reduction,” President and CFO Steve Riney said on a May 2 earnings call.

Both sales are expected to close early in the third quarter.

“These transactions are consistent with our active management of the portfolio, and we will continue to look for opportunities to exit assets that are unlikely to compete for capital within our portfolio or to monetize non-core assets at attractive prices,” said APA CEO John Christmann IV.

Barclays served as the financial adviser on the Midland Basin transaction, which has an effective date of April 1, 2024. TD Securities served as financial adviser for the Eagle Ford asset sale, which has an effective date of Jan. 1, 2024.

RELATED

Apache CEO: Longer Laterals Expected as Permian Enters New Era

Recommended Reading

AIQ, SLB Collaborate to Speed Up Autonomous Energy Operations

2025-03-16 - AIQ and SLB’s collaboration will use SLB’s suite of applications to facilitate autonomous upstream and downstream operations.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Diamondback in Talks to Build Permian NatGas Power for Data Centers

2025-02-26 - With ample gas production and surface acreage, Diamondback Energy is working to lure power producers and data center builders into the Permian Basin.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.