In the U.S., APA ran an average of six rigs in the Midland Basin and five rigs in the Delaware Basin during the second quarter. (Source: Shutterstock)

APA Corp. expects to boost U.S. oil production by 8% between now and the fourth quarter as the company grows its Permian Basin production at a “strong clip,” CEO John J. Christmann IV said during the company’s second quarter earnings call on Aug. 1.

“In the Permian Basin, we had outstanding second-quarter oil production performance and are raising our outlook for the back half of the year after adjusting for asset sales,” Christmann said in APA’s quarterly earnings press release.

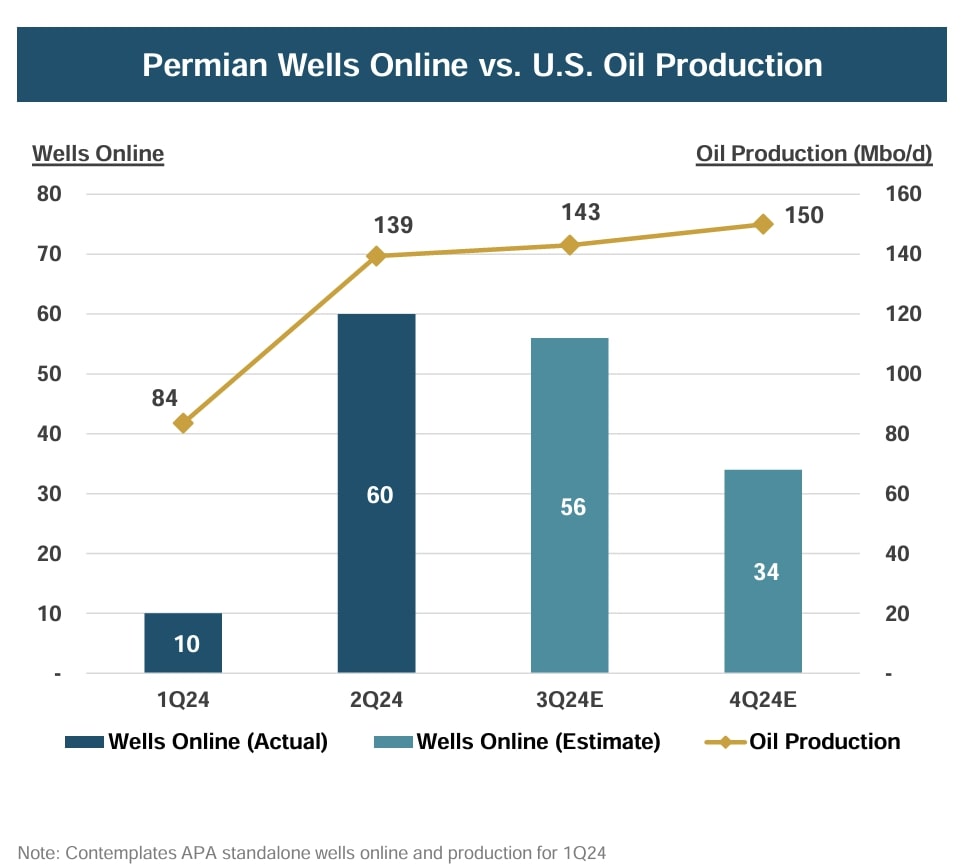

APA’s overall production averaged 473,409 boe/d in second-quarter 2024, up 19% from 398,930 boe/d in second-quarter 2023. Production climbed in the quarter with a U.S. output of 139,500 bbl/d— up 83% compared to the second quarter 2023 following the acquisition of Callon Petroleum.

In the U.S., APA ran an average of six rigs in the Midland Basin and five rigs in the Delaware Basin during the quarter. The 11 Permian rigs helped APA drive U.S. oil production above guidance — the sixth consecutive quarter APA has met or exceeded its guidance.

In the second half of 2024, APA plans to run an average nine to 10 Permian rigs and three to four frac crews. In the Delaware, APA expects to run five rigs with the other four deployed in the Midland Basin, the company said.

APA expects U.S. oil production will average 143,000 bbl/d in third-quarter 2024, rising to 150,000 bbl/d in the fourth quarter. In the second quarter, APA brought 60 wells online. APA plans to bring 56 wells online in the third quarter and 34 in the fourth.

In the second half of 2024, U.S. production is expected to increase 31% as APA brings on nearly 29% more wells compared to the first half of the year.

“Despite the impact of asset sales and significant natural gas and NGL curtailments in response to pricing extremes in the Permian Basin, total U.S. volumes on a BOE basis were in line with company guidance for the quarter,” APA said in the release.

APA expects natural gas production curtailments of 90 MMcf/d and NGL cuts of 7,500 bbl/d in the third quarter. APA said third quarter production would also be impacted by platform maintenance turnaround after Hurricane Beryl.

RELATED

APA Corp. Latest E&P to Bow to Weak NatGas Prices, Curtail Volumes

“During the first half of the year, our focus was on the smooth integration of the Callon assets,” Christmann said. “[We] are now poised for a strong second half where we will deliver significant organic oil production growth in the Permian Basin and expect to see a meaningful increase in free cash flow.”

Along with its Permian rig program, APA expects to run 11 rigs in Egypt. At that activity rate, the company’s full-year (FY) capital spending will be at or below its company guidance of $2.7 billion.

“A number of factors could contribute to this including further synergy capture from the Callon combination: lower service costs, improving capital efficiency, potential minor reductions in the planned activity set, mostly in the U.S.,” APA CFO Stephen J. Riney said during the Aug. 1 earnings call.

“2024 guidance was largely unchanged as capital spend guidance is now at or below prior $2.7 billion and FY24 production is slightly lower after adjusting for curtailments/sales though still above Truist Securities/consensus estimates,” Truist Securities said July 31 in a research report.

Callon integration ahead of schedule

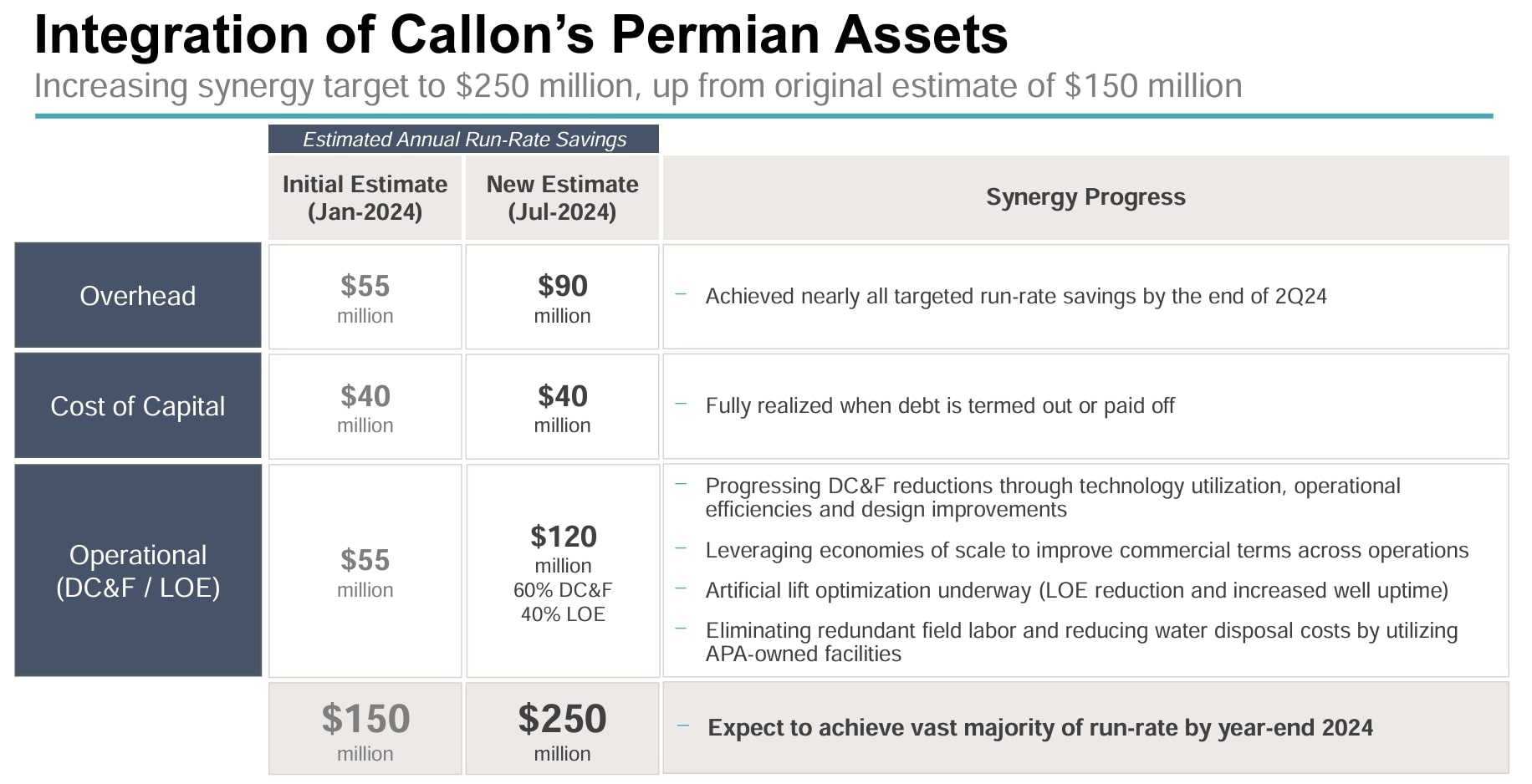

APA closed its acquisition of Callon on April 1, and APA said integration of the E&P’s assets is moving ahead of schedule. As a result, APA revised its annual cost synergies estimate to $250 million — up $100 million from initial estimates of $150 million.

APA expects to achieve the vast majority of run-rate by year-end 2024 and expects capital productivity uplift will provide significant incremental value after 2025.

“We are realizing greater than expected cost savings from the Callon acquisition and have a clear pathway and plan to improving capital efficiency on those assets,” Christmann said during the Aug. 1 webcast. “[This comes] as we leverage economies of scale of the combined APA and Callon Permian businesses."

“More importantly, we are just beginning to implement drilling unit designs and operational changes that we expect will create substantial value on the Callon acreage via improved well performance and capital efficiency,” Christmann said. “Our preliminary estimate is that we can drill a standardized 2-mile lateral for roughly $1 million less than Callon was spending in 2023.”

Recommended Reading

Diamondback in Talks to Build Permian NatGas Power for Data Centers

2025-02-26 - With ample gas production and surface acreage, Diamondback Energy is working to lure power producers and data center builders into the Permian Basin.

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.