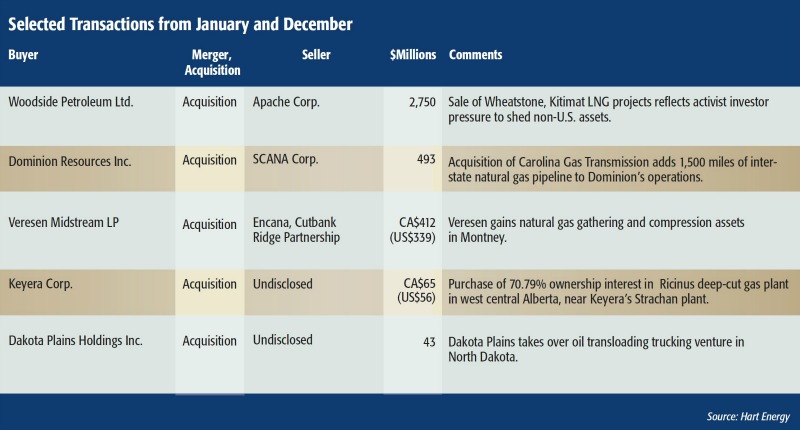

Just under the wire for 2014, Houston-based Apache Corp. kept its midyear’s resolution to shed LNG assets, moving interests in Canada’s Kitimat LNG and Australia’s Wheatstone LNG projects to Woodside Petroleum Ltd.

The $2.75 billion deal also includes about $1 billion in reimbursement for net expenditure on the projects between June 30, 2014, and an expected first-quarter closing. Apache expects its net proceeds to be around $3.7 billion.

Investors, who had not shown much love to either company in 2014, boosted Apache’s stock price by 13.1% and Australia-based Woodside’s by 10.2% between the mid-December announcement and the end of trading for the year. Down by more than one-third in value until the deal was announced, Apache stock still suffered a 25.7% loss for the year.

The capital infusion and departure from the LNG sector mostly pleased analysts.

“Capital spending requirements on two LNG projects in Canada and Australia remain a millstone around the neck of APA,” Iberia Capital Partners’ Eric Fox had fretted in a November note.

But Fadel Gheit, an analyst at Oppenheimer & Co. in New York, disagreed that selling Wheatstone was a good move for Apache.

“This seemed to be a very good project long-term,” he told Bloomberg at the time. “This project is running ahead of schedule, within budget, so I’m not sure why Apache wants to monetize international assets.”

Benjamin Wilson, who covers Woodside for J.P. Morgan, saw the price as reasonable given the high value of Wheatstone, which is expected to ship first gas in 2017, and the unknown quantity that is Kitimat. The Western Canadian export facility awaits a final investment decision and permitting approvals for site and pipelines. Wilson also calls the acquired unconventional exposure to Canada’s Horn River and Liard Basin shale plays a “step out” for Woodside, though an unavoidable one in today’s resource market.

“For now,” he wrote, “we consider Kitimat to be a growth option that needs significant further work to materialize.”

Joseph Markman can be reached at jmarkman@hartenergy.com or 713-260-5208.

Recommended Reading

Operators Look to the Haynesville on Forecasts for Another 30 Bcf/d in NatGas Demand

2025-03-01 - Futures are up, but extra Haynesville Bcfs are being kept in the ground for now, while operators wait to see the Henry Hub prices. A more than $3.50 strip is required, and as much as $5 is preferred.

Dividends Declared Week of Feb. 24

2025-03-02 - As 2024 year-end earnings wrap up, here is a compilation of dividends declared from select upstream and midstream companies.

KNOT Offshore Partners Conducts Shuttle Tanker Asset Swap

2025-03-02 - KNOT Offshore Partners LP subsidiary KNOT Shuttle Tanker AS is trading shuttle tanker assets with Knutsen NYK Offshore Tankers AS, the company said Feb. 27.

NextDecade Plans 3 More Trains at Rio Grande LNG

2025-02-28 - Houston-based NextDecade continues to build the Rio Grande LNG Center in Brownsville, Texas, as its permits filed with the Federal Energy Regulatory Commission continue to go through the legal process.

EOG Resources to Begin Persian Gulf Wildcatting Onshore Bahrain

2025-02-28 - Multi-decade U.S. shale producer EOG Resources said it is confident the tight-gas resource is there and first gas will come online beginning in 2026.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.