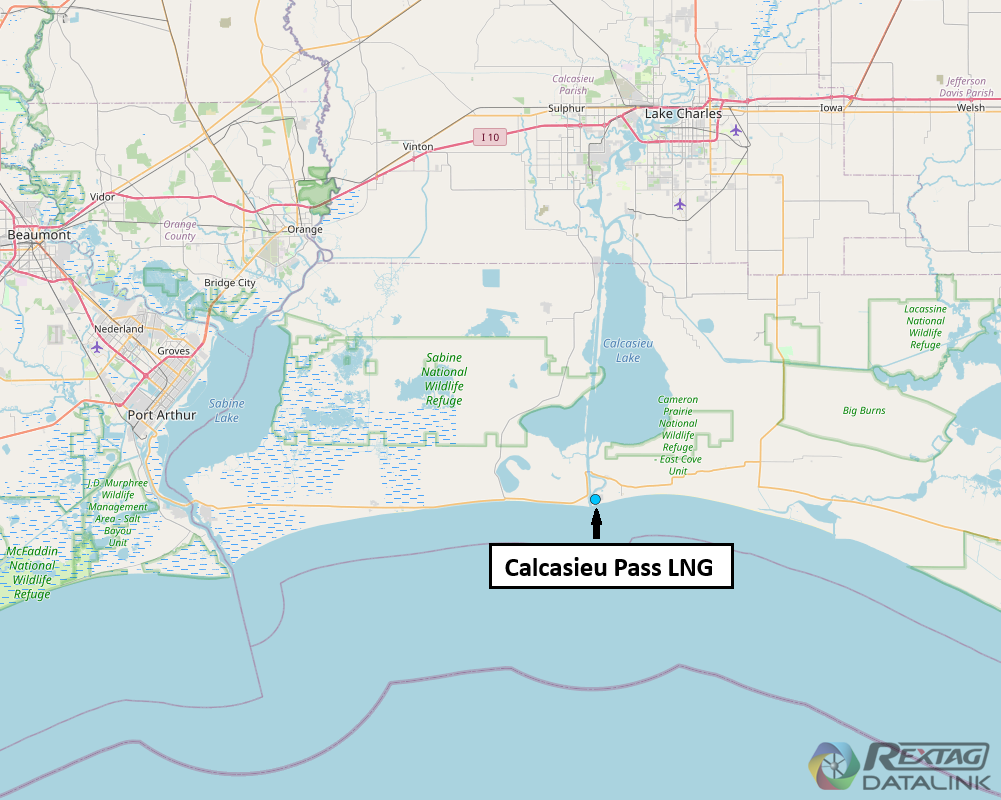

Claims against Venture Global LNG’s Calcasieu Pass could cost up to $5.4 billion over 6 mtpa of disputed LNG sales, according to Jefferies Group analysts. (Source: Shutterstock.com)

Venture Global LNG faces claims of about $5.4 billion in a customer dispute over its Calcasieu Pass facility, which is headed for arbitration before the end of the year, according to an analytical firm.

Jefferies Group assessed the potential damages to four firms involved in arbitration over disputed sales of about 6 million tonnes per annum (mtpa).

The arbitration hearings over the dispute are expected to start before the end of the year, according to comments Shell’s CEO made to investors at the end of October. Shell (SHEL) is seeking arbitration along with others including BP, Galp (GLPEF) and Repsol (REPYY).

Shell CEO Wael Sawan told investors that the company has made little progress in its dispute with Venture Global.

“On Venture Global, I've talked about it enough times. I wish I had something new to say on it,” Sawan said. “Frustratingly, we have got no volumes against our term agreement—a term agreement, of course, which underpinned the financing for that project. We’re going to go through the arbitration hearings this quarter.”

The dispute centers on the definition of “commissioned.” The companies seeking arbitration were part of the original guarantors of Calcasieu Pass. According to Jefferies, Shell and BP each signed offtake contracts for 2 mtpa, while Galp and Repsol signed for 1 mtpa.

The Calcasieu Pass facility has been selling LNG on the world market since 2022. However, Venture Global says the project remains in the commissioning phase and requires “substantial testing and a phased commissioning process” before it can meet its obligations to its pool of customers. The company says the LNG facility requires further testing compared to other LNG facilities because of the unit’s unique design, but that the facility will be fully operational by the end of 2024.

In September, the U.S. Federal Energy Regulatory Commission ruled Venture Global was taking adequate steps to build the facility.

According to Jefferies, BP and Shell could potentially claim $1.8 billion each, while Galp and Repsol could each claim $900 million. The firm calculated the potential damages using TTF futures price at which the companies would have been able to sell the LNG cargoes; sourcing costs based on Henry Hub prices; plus $2.5/MMBtu, less transport costs.

Bloomberg, quoting an anonymous source, reported Nov. 20 that total damages could reach $5.9 billion if all companies filing for arbitration are successful. The International Chamber of Commerce and the London Court of International Arbitration will hear the cases, according to Bloomberg.

Venture Global did not immediately respond to a request for comment from Hart Energy on Dec. 4.

Busy winter for Venture Global

Besides the arbitration dispute, Venture Global is closing out 2025 with a lot on its plate, according to several reports.

The company is reportedly preparing an IPO, Bloomberg reported in November. The move could raise as much as $3 billion, according to the report, which stated that the company’s enterprise value could be more than $100 billion.

As of Dec. 4, the SEC had not recorded a filing from the company.

Venture Global is also close to selling cargoes from its Plaquemines LNG terminal, which is near completion. The FERC gave the site permission to introduce feedgas into the Plaquemines liquefication units on Nov. 21, an indication that the start of production is near. The company’s LNG tanker Venture Bayou has been docked at the site since Nov. 18.

S&P Global reported Nov. 28 that Venture Global has sold the initial LNG cargoes from the Plaquemines terminal at a rate of four to five cargoes a month. S&P attributed the information to anonymous sources.

Recommended Reading

Shale Outlook: E&Ps Making More U-Turn Laterals, Problem-Free

2025-01-09 - Of the more than 70 horseshoe wells drilled to date, half came in the first nine months of 2024 as operators found 2-mile, single-section laterals more economic than a pair of 1-mile straight holes.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.