Analysts are skeptical that Aethon’s assets on the Louisiana side of the Haynesville Shale are worth $6 billion. (Source: Hart Energy; MVelishchuk, shurkin_son/Shutterstock.com)

Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

Here is the definitive value of Aethon Energy Management LLC’s northern Louisiana assets: whatever somebody is willing to pay. Don’t forget that you read it here first.

In early January, Aethon let slip that it was exploring a sale of its acreage on the Louisiana side of the Haynesville Shale. There was also a hint that an offer of $6 billion, including debt, should do the trick. Worth it? That depends.

Read: A Peek Inside Haynesville’s Aethon

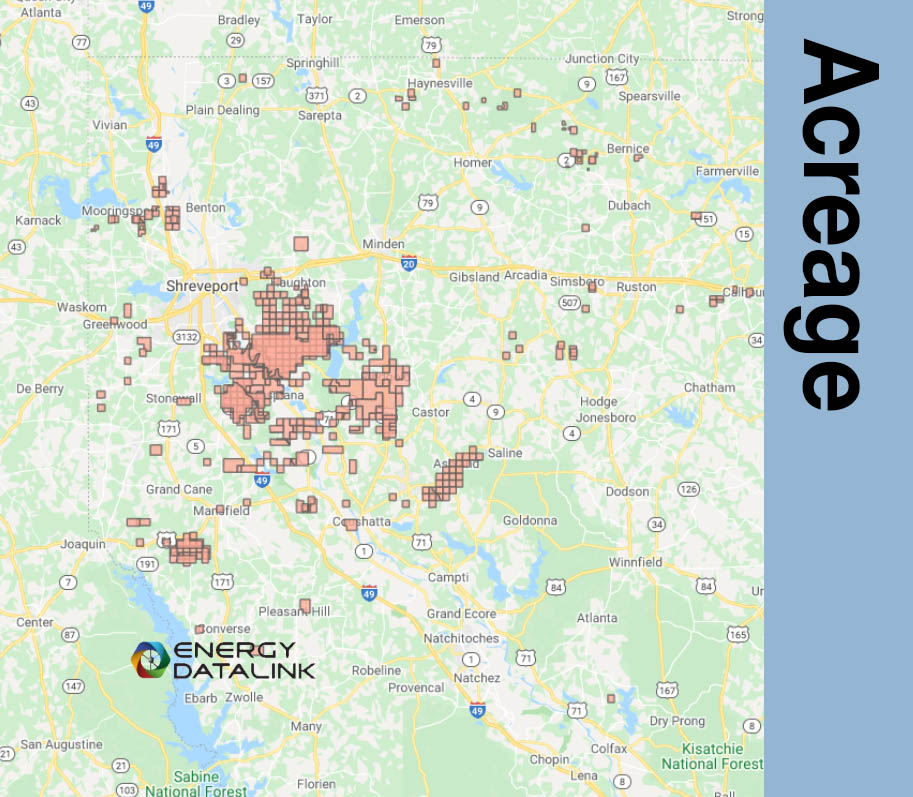

Rextag’s DataLink shows Aethon’s Louisiana presence at 390,000 acres, the bulk of it in clumps due south and southeast of Shreveport. That total jumps to more than 630,000 when its Texas position is included. A little more than 1,000 wells are active in the region.

Wells Fargo noted in an early January research report that, despite the company’s aggressive completion campaign, its well productivity has not fared as well as public producers in the area, nor as well as recent acquisition targets such as Vine Energy Inc.—bought by Chesapeake Energy Corp. in November 2021 for $2.2 billion—and Indigo Natural Resources LLC—bought by Southwestern Energy Co. in September 2021 for $2.7 billion.

A historical comparison, however, shows Aethon’s production increasing each calendar year since 2014. Its drawback is the lack of acreage in the sweetest spots of the prolific De Soto Parish. Wells Fargo examined a three-month stretch of 2020 production and found Aethon lagging the basin average by about 18%. The gap began to narrow, however, 12 months out.

Aethon’s advantage, however, is a shallow decline curve compared to other acquisitions targets in the region. Wells Fargo estimates a proved developed producing (PDP) decline in the range of 38% to 23% for Aethon’s wells. Vine’s rate, however, was in the 46% to 39% range.

“The smaller declines will require a smaller reinvestment ratio in the near term to maintain production levels, which could be attractive to a potential buyer,” Wells Fargo said in the report.

Aethon operates seven rigs in the Louisiana side of the Haynesville (with another seven on the Texas side). Were a potential buyer to ease up on drilling, the purchase could contribute to the longer-term supply-demand balance for natural gas, particularly in the Haynesville.

Wells Fargo’s analysts were skeptical that a buyer could justify ponying up $6 billion, but they also noted that it was unclear if Aethon’s midstream assets would be part of the offerings. Aethon owns about 830 miles of natural gas pipelines in northern Louisiana and about 360 Mcf/d of processing capacity.

The assessment comes out to this: $6 billion implies a price of $22,000 per undeveloped acre, and that’s assuming that all of the acreage is undeveloped, which it obviously is not. That is way out of alignment with valuations for recent purchases of Vine ($7,000 per undeveloped acre) and Indigo ($11,000 per undeveloped acre).

Based on a $3.25/MMBtu Henry Hub strip price, Wells Fargo values Aethon’s northern Louisiana assets at about $2.26 billion. The analysts were careful to note “in the current price environment.”

The price of gas, of course, has been hovering just under $5/MMBtu and briefly eclipsed $6 near the end of January. If this price level proves to be sustainable, would that entice a buyer? It depends…

Recommended Reading

US Drillers Cut Oil, Gas Rigs for Third Week in a Row

2024-10-04 - The oil and gas rig count fell by two to 585 in the week to Oct. 4.

EY: How AI Can Transform Subsurface Operations

2024-10-10 - The inherent complexity of subsurface data and the need to make swift decisions demands a tailored approach.

Bowman Consulting to Manage, Monitor Delaware Basin Wells

2024-10-14 - Bowman Consulting Group’s scope of work includes conducting detailed field surveys of above-ground infrastructure assets across well sites of up to to 8 acres.

E&P Highlights: Oct. 7, 2024

2024-10-07 - Here’s a roundup of the latest E&P headlines, including a major announcement from BP and large contracts in the Middle East.

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

2024-12-02 - Spurned or simply ignored by the big publics, the Permian Basin’s conventional zones—the Central Basin Platform, Northwest Shelf and Eastern Shelf—remain playgrounds for independent producers.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.