An unusual reduction in producer hedging found in a Haynes and Boone survey suggests banks are newly open to negotiating credit terms, a signal of market rewards for E&P thrift. (Source: Shutterstock.com)

Domestic oil and gas producers are exercising newfound freedom to roll the dice on price after years of diligent spending restraint, measured growth and debt reduction.

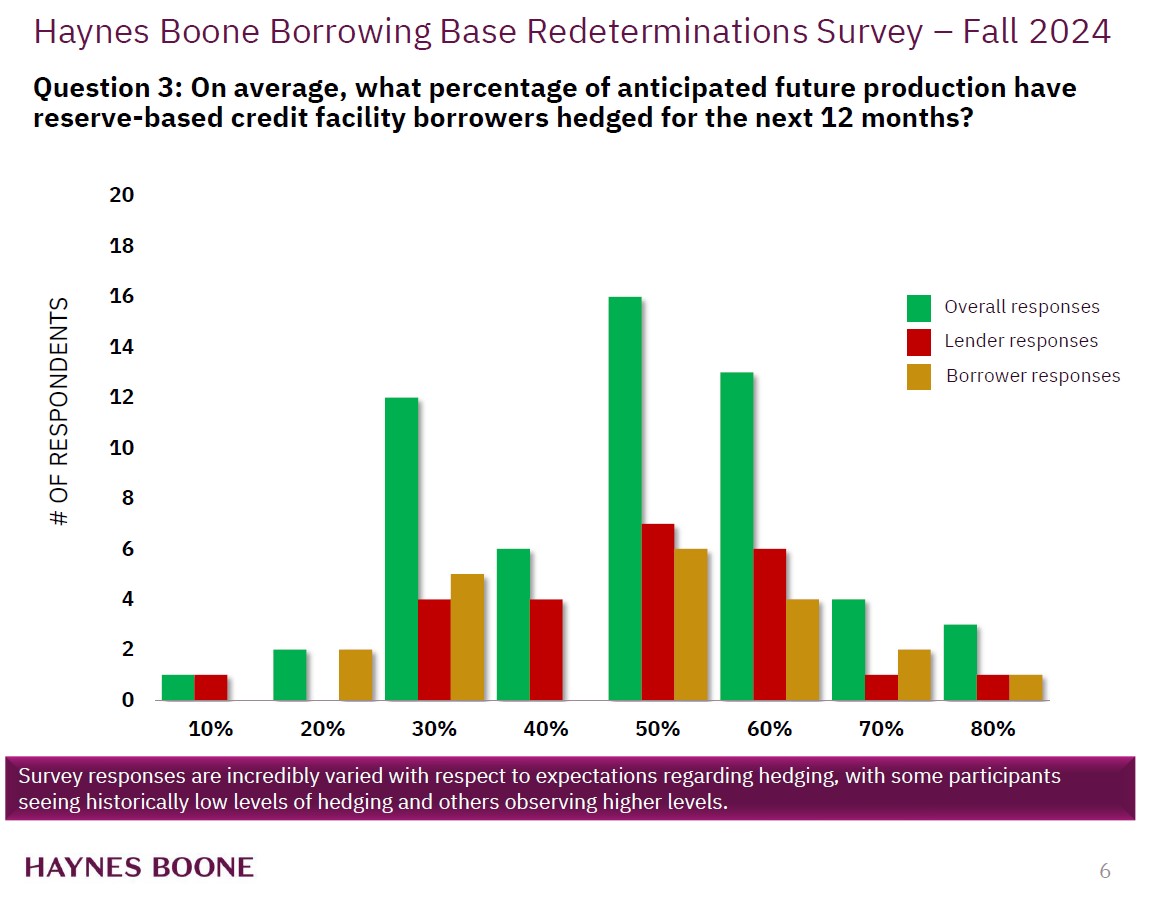

“For the first time in a while, we’re actually seeing reductions in hedging percentages,” said Kraig Grahmann, partner at Haynes and Boone and lead author of the firm’s Fall 2024 Borrowing Base Redeterminations Survey (BBR).

Hedging on a minimum percentage of production is a common criterion in reserve-based lending (RBL). But in the absence of bank or board dictates, producers can run the table on price if they’d rather take a longer view. It includes some risk, but lenders and other investors appear increasingly willing to take their chances on U.S. producers again.

Mired in debt and investor ire over reckless spending during the first half of the shale revolution, the backlash reached an inflection point in 2017. E&Ps in need of cash “were kind of forced to hedge”—even if the market wasn’t good for it—to appease banks’ strict minimum requirements for capital access, Grahmann told Hart Energy.

But quarter-after-quarter, public E&Ps have paid down billions of dollars’ worth of debt. Increasingly, their leverage is dropping below minimum thresholds. Changing the corporate spending dynamic made E&Ps an investible business again, Grahmann said. That’s inserted flexibility into their credit agreement negotiations, which includes a holiday from hedging.

Indeed, most RBL borrowers operate at low leverage, Grahmann said. On the unsecured debt side, many companies have cut back the use of sizable borrowing bases to access cash.

“[Producers] don't have whole lot of money actually on that line of credit, and so that's also what's getting the bank comfortable giving them these hedging holidays,” Grahmann said. “If something goes really bad, chances are some of these companies only have 20 to 30 or 40% of their borrowing base even drawn right now. So there's a lot of room to work with.”

Steady as she goes

There’s also evidence that oil-weighted producers’ conservatism is wholesale shaping corporate strategy. Hayne and Boone found that amid market uncertainty, most of those firms are implementing flat—in some cases, reduced—budgets in 2025.

The semi-annual polling of industry lenders and operators took place between Oct. 10 and Nov. 19, accounting for sentiment on Russia’s lingering war on Ukraine, violence in the Middle East, politics in the U.S. and economic concerns around the world. Those concerns likely shaped survey participants’ caution and hold-steady stance, Grahmann said.

“The outlook is one where there could be a lot of opportunities, but there also could be a lot of volatility, and so party participants aren't really moving one way or the other,” he told Hart Energy.

Bankers aren’t jumping to conclusions, either.

“They’re not cutting back or trying to get money off the table. [Bankers are] still continuing to extend credit to lend, but they're not getting overly aggressive either as far as making too much capital available,” he said. “And producers are not trying to get too far ahead of the curve by putting in big drilling budgets for next year. People are being cautious.”

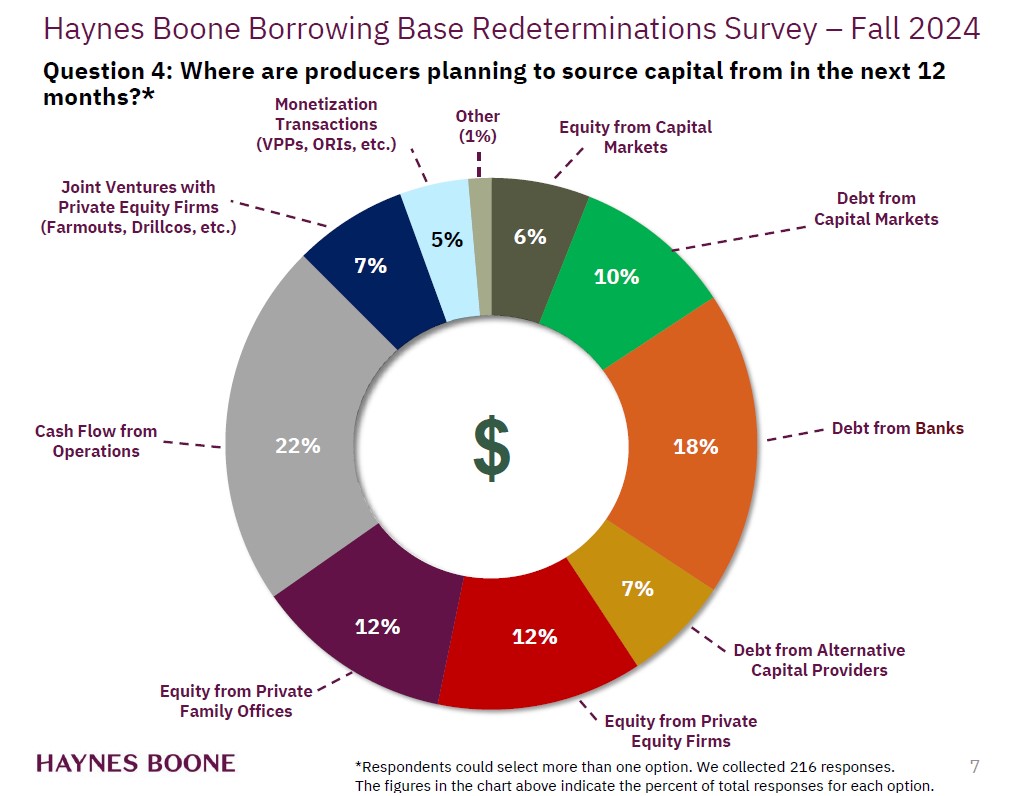

Most of the survey’s 57 respondents checked the steady box for near-term borrowing bases, too. And, respondents showed just a smidge of shift in capital access sources from plans recorded six months ago.

The December survey showed a 2% increase in E&Ps’ belief they will access capital during the next year via monetization transactions, debt from capital markets or debt from alternative capital providers.

Faith in family offices slipped 1% during the last six months, according to participant responses.

Price prognostications

Lenders and producers are generally holding a cautious view that’s closing in on optimism for crude oil prices.

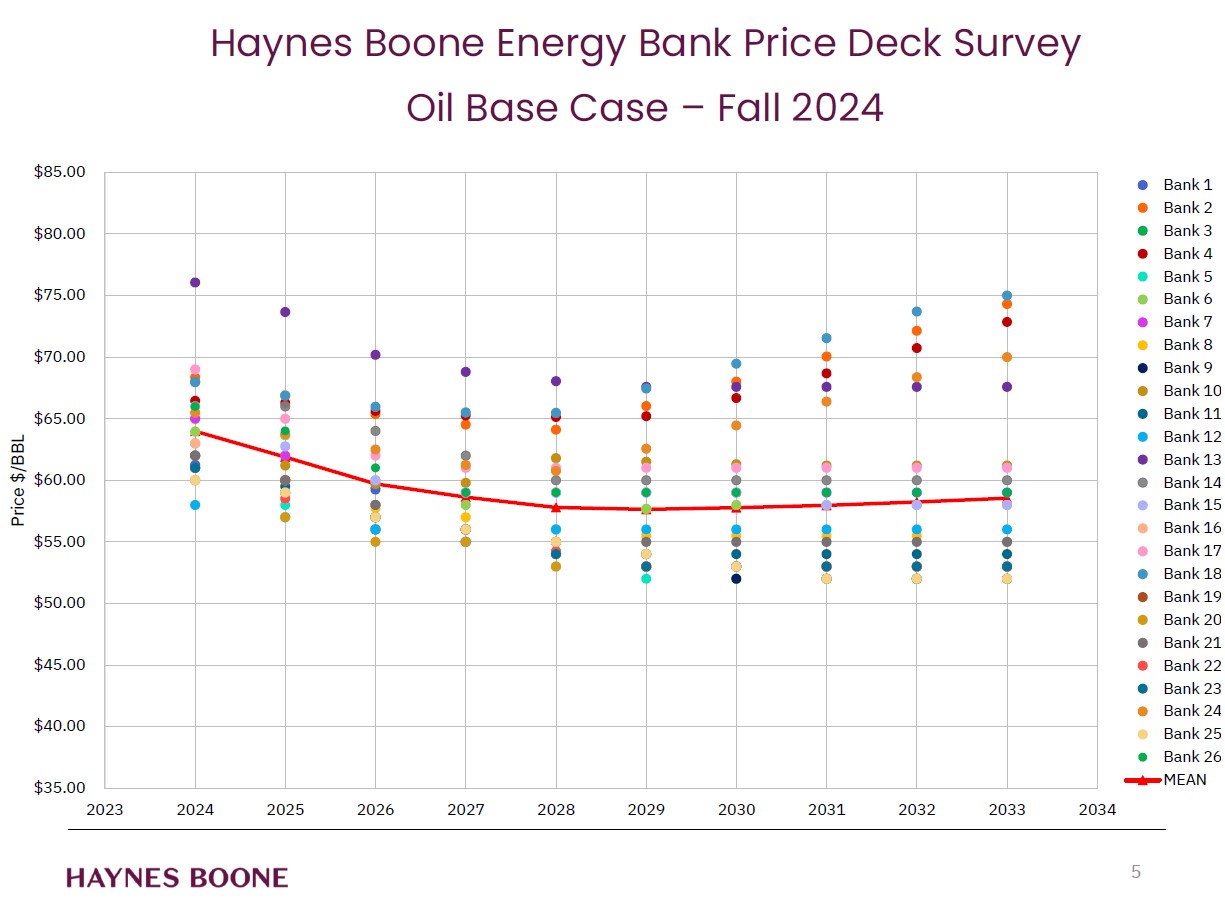

In conjunction with the BBR survey, Haynes and Boone produced a semi-annual Energy Price Deck Survey. The spring report showed expectations of base case oil prices falling through 2027, and then flattening through 2033. Fast-forward six months, and now those polled expect prices to pick up in the short-term through 2027, continue on that trajectory longer-term through 2033 and remain higher than spring estimates.

“Prices have remained steady because there is still a large global demand for oil, with consumption projected to continue to grow well into the next decade—even as wind and solar generation continue to grow as an alternative source of energy,” said the report’s lead author, Kim Mai, an attorney in the Houston office of Haynes and Boone.

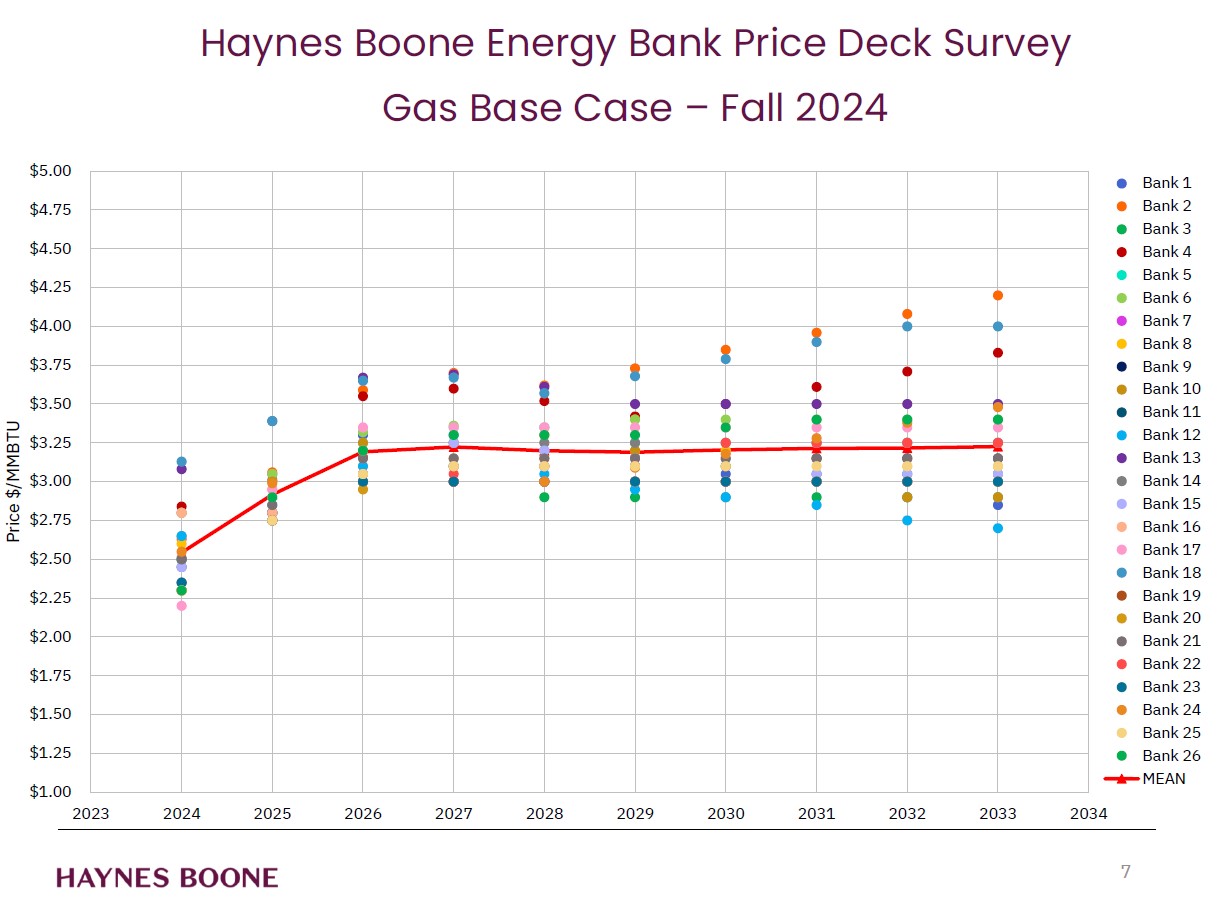

Base case predictions for gas prices in the fall report maintained an upward trajectory long-term, but the price range declined from spring reporting. The previous survey anticipated gas prices would remain between $3.30/MMBtu to $3.45/MMBtu, beginning in 2026 through 2033. That compares to the fall range between $3.19/MMBtu to $3.23/MMBtu.

Haynes and Boone said that while forecasts for global gas demand is still expected to increase based on population growth, infrastructure electrification and data center demand, other factors are at play. Price could be influenced by production increases and a decision by the Trump administration to expedite LNG export facility permitting.

Recommended Reading

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

US NatGas in Storage Grows for Second Week

2025-03-27 - The extra warm spring weather has allowed stocks to rise, but analysts expect high demand in the summer to keep pressure on U.S. storage levels.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

US NatGas Prices Jump 9% to 26-Month High on Record LNG Flows, Canada Tariff Worries

2025-03-04 - U.S. natural gas futures jumped about 9% to a 26-month high on record flows to LNG export plants and forecasts for higher demand.

EIA: NatGas Storage Withdrawal Eclipses 300 Bcf

2025-01-30 - The U.S. Energy Information Administration’s storage report failed to lift natural gas prices, which have spent the week on a downturn.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.