Atlas Resource Partners LP (NYSE: ARP) said May 7 it has acquired total reserves of 47 million barrels of oil equivalent (MMboe), including proved developed producing reserves of 25 MMboe for $420 million.

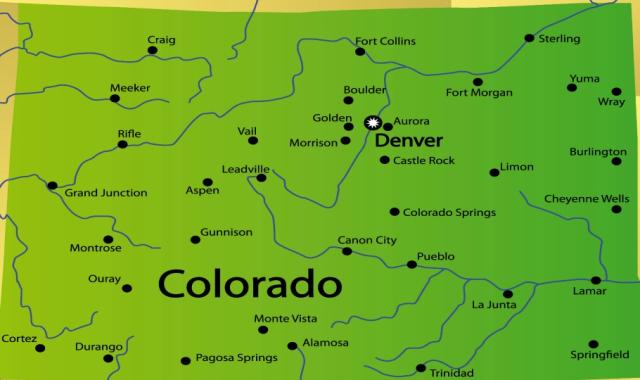

Atlas acquired a position in the Rangely field in northwest Colorado, a mature tertiary CO2 flood with low-decline oil production first discovered in 1933. Chevron Corp. (NYSE: CVX) has long ties to the field and will continue to operate the asset.

The seller was not disclosed.

The acquired assets are expected to provide ARP with a stable, high margin cash flow stream with a low-decline profile. The average annual decline rate during the past 15 years is 3% to 4%.

The position is a tertiary oil recovery project using CO2 activity for enhanced recovery. ARP said the production mix is predominantly oil (90%), with the remainder NGL. Net daily production was about 2,900 boe/d for the first-quarter of 2014 from more than 380 producing wells and 270 injector wells.

ARP will have about 25% nonoperating net working interest in the assets. Material capex and growth projects are subject to ARP’s approval."We welcome the opportunity to work once again with Chevron,” said Edward E. Cohen, ARP chairman and CEO. “These are ideal assets for our MLP – long-lived, low-decline, but with upside potential from over MMboe of undeveloped reserves.”

The deal includes more than 10,000 acres, with 6,100 acres in the Weber Sand Unit in Rio Blanco County, Colo.

The Rangely oil field is one of the oldest and largest in the Rocky Mountain region, according to the Energy and Minerals Field Institute. Since the 1940s, when large-scale development began, it has produced hundreds of millions of barrels of oil.

Chevron has injected carbon dioxide into the reservoir at the Weber Sand Unit since 1986 to increase the total volume of recoverable crude oil.

Current production consists of about 90% oil and 10% NGL. Oil price differentials are about $6.50 to $9.00 below WTI. Long-term CO2 supply contracts are in place.

The newly established position in the Rangely field further de-risks the company’s operations, said Matthew A. Jones, president of ARP.

“We expect immediate benefits from strong cash margins generated from the acquired assets, and we look forward to pursuing growth opportunities in the position with Chevron to further enhance value,” he said.

ARP is currently working with its lending group to expand the borrowing base on its revolving credit facility, based upon the expected increased level of oil and gas reserves resulting from the acquisition.

Atlas is an exploration and production master limited partnership that owns an interest in about 13,000 producing natural gas and oil wells located primarily in Appalachia, the Barnett Shale, the Mississippi Lime, Raton Basin and Black Warrior Basin.

Deutsche Bank Securities Inc. acted as financial advisor for ARP in the transaction and Jones Day served as legal advisor.The transaction is expected to close in the second-quarter of 2014 with an effective date of April 1, 2014.

Recommended Reading

Oilfield Services Outlook Goes from Not Great to Not Good

2025-04-15 - Piper Sandler Analyst Derek Podhaizer studied how the market reacted to previous price shocks to determine the 2025 playbook for the oilfield services sector.

E&P Highlights: April 14, 2025

2025-04-14 - Here’s a roundup of the latest E&P headlines, from CNOOC’s latest production startup to an exploration well in Australia.

BP Makes Gulf of Mexico Oil Discovery Near Louisiana

2025-04-14 - The "Gulf of America business is central to bp’s strategy,” and the company wants to build production capacity to more than 400,000 boe/d by the end of the decade.

E&Ps Posting Big Dean Wells at Midland’s Martin-Howard Border

2025-04-13 - Diamondback Energy, SM Energy and Occidental Petroleum are adding Dean laterals to multi-well developments south of the Dean play’s hotspot in southern Dawson County, according to Texas Railroad Commission data.

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.