For a time, the Williston Basin seemed left for dead by the industry.

E&Ps have sold off Bakken assets as their attention has been drawn south, to the Permian Basin. Occidental Petroleum Corp. sold its holdings in late 2015 for $600 million. Halcón Resources Corp. parted ways with the Williston in 2017 for $1.4 billion. QEP Resources Inc. continues to shop acreage in its South Antelope and Fort Berthold positions as it shifts to a Permian focus.

Yet at EnerCom’s The Oil & Gas Conference in Denver, E&Ps and deal makers made the case that the Bakken/Three Forks is not quite dead. In fact, it feels fine.

Operators are again experimenting and exploring the Bakken. The pipeline constraints that blunted profits prior to the downturn have eased, lowering differentials to West Texas Intermediate (WTI) prices.

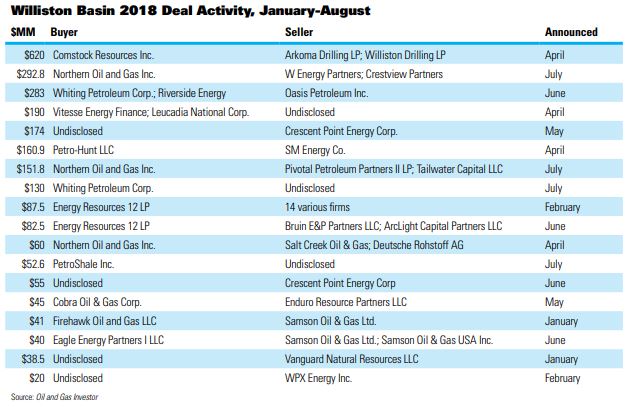

M&A through August 2018 was chugging along with smaller but consistent deals totaling a respectable $2.5 billion, according to Investor data. And months of record production were capped off with an all-time high of 1.27 million barrels per day (MMbbl/d) in July, according to the latest data available from the North Dakota Department of Mineral Resources.

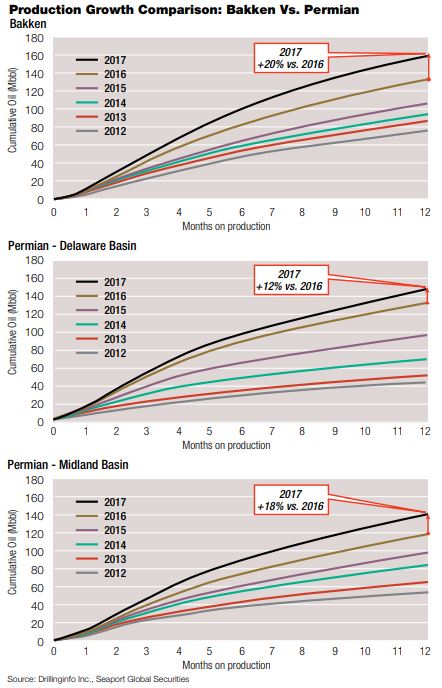

Oil prices, which have fluctuated but generally trended up, are part of the basin’s recovery story. But in a graph shown repeatedly during the August conference, the Bakken’s 2017 productivity gains of 20% outpaced the Midland (18%), Delaware (12%) and Denver-Julesburg (13%) basins, according to Seaport Global Securities Inc.

Whiting Petroleum Corp. CEO Brad Holly wants his company to lead the basin in optimized completions, he said at the conference.

Completion techniques are “where the game is won or lost,” he said.

Whiting in particular has disregarded more blanket approaches to completions and instead employs an area-by-area completion strategy. It then builds calibrated completion models for each, following analysis of multiple variables.

Primitive to prime

Holly pointed to Whiting’s successes with infill drilling tests in Sanish Field, an area Holly said is viewed as a fully developed, mature play

On its McNamara drilling spacing unit (DSU) in Sanish Field, Whiting operates nine vintage wells—two Three Forks and seven Bakken—that were completed in 2007 and 2012.

“We went in and said, can we put six infill Bakken wells in that one drilling spacing unit with our completion techniques that we’ve optimized, and can we generate positive returns?” Holly said.

The results were outstanding: “Since September 2017, from this one drilling spacing unit, we’ve produced 1.2 million barrels of oil [more] than if we hadn’t done anything,” he said.

The six new wells Whiting drilled produced more than 1 MMbbl of oil. The surprise was the parent wells, which were shut in and pressurized as the offset wells were stimulated. Those wells have since produced 150,000 bbl more than Whiting’s decline rates suggested.

“Some of these wells are a decade old with very primitive completion techniques,” Holly said. “We were actually able to stimulate the parent wells with the offset wells” without fracks.

Whiting projected the McNamara DSU would recover 10.7% of the oil in place by 2040. The newly drilled wells have not only added reserves but also accelerated production, effectively pumping all of the oil the company expected in the next 22 years.

Whiting now expects to recover 20% of the oil in place. At $60 Nymex oil prices, the McNamara project will generate an estimated internal rate of return of 53%, with payout in 18 months.

“So, we’re approaching payout,” Holly said.

According to a Wood Mackenzie report in September, Bakken operators are also willing to spend new money on an old play.

“Operators are fueling the [Bakken] momentum with nearly $5 billion in planned capex this year,” the report said.

The region has been largely insulated from service cost inflation, according to many Bakken operators. Rebounding oil prices and long-awaited infrastructure have also eased transport costs that once plagued Bakken economics. Permian E&Ps are now facing similar growing pains as takeaway constraints cause price differentials to spike.

While capital spending reflects the industry’s focus on the Permian in 2018, the Bakken’s “mature” status isn’t perceived as a barrier, according to the report.

“We expect operators to spend more than $40 billion in the play over the next five years,” the Wood Mackenzie report said.

However, the Bakken still faces rising gas production as operators focus on the core of the play, which tends to be gassier, according to the report.

North Dakota oil and gas officials said in September that natural gas in the Bakken is not economic at current prices. However, North Dakota officials also noted that natural gas storage has decreased by about 18%, suggesting prices could improve. At current prices, oil is worth 23 times more than gas in the Bakken, and the statewide average of flared gas was about 18% in September.

No steals

E&Ps clearly see the Williston’s value, even if they’re on the way out.

QEP remains committed to selling its South Antelope and Fort Berthold acreage positions. However, several offers submitted to the company failed to meet the company’s value expectations, said Chuck Stanley, QEP’s president and CEO.

“We rejected them all,” he said at the conference. “We continue to negotiate with several parties interested in the totality of the assets, and also, we’re talking to folks who are interested in a portion of the assets.”

QEP’s Williston position could generate proceeds of more than $2 billion, according to Tudor, Pickering, Holt & Co.

In recent years, M&A activity in the Bakken has seemed sluggish relative to the size of the play, the Wood Mackenzie report said. Deals have been generated by private-equity-backed operators entering the play and public E&Ps selling Bakken assets to focus elsewhere.

Typical E&P deals continue, with Whiting adding to its position in July, closing a deal with Oasis Petroleum to bolt on 54,883 net acres in McKenzie County, N.D., for $130 million. The assets include average production of 1,290 barrels of oil equivalent per day (boe/d).

Yet motivated, if atypical, buyers have propped up transactions in the play this year. Through August, Williston companies announced 17 deals at an average of about $144 million, according to Investor data.

Mercer Capital noted that many deals in the Bakken have flown under the radar as the industry remains spellbound by the Permian, according to a September M&A report.

The role of nonoperators in the Bakken has also increased, with private-equity funds such as Angelus Capital, single-family offices and other providers seeing opportunities in the Bakken and either buying acreage or partnering with operators.

More than a quarter of this year’s Bakken deal value has flowed through companies buying nonoperated interests. Most prominent among these is Northern Oil and Gas Inc., which announced three deals through August totaling about $500 million. Similar companies such as Energy Resources 12 LP have also closed or announced deals worth $170 million to take on 5.4% of nonop working interest in acreage drilled by WPX Energy Inc., Marathon Oil Corp., EOG Resources Inc. and Continental Resources Inc.

At the EnerCom conference, Northern CEO Brandon Elliott said the company’s larger acquisitions are performed in tandem with its ongoing “ground game” to buy working interest in DSUs or wells a piece at a time.

“It seems insignificant at times, because we’re talking about acquiring additional acreage or small pieces of additional working interest,” he said. “But over time that’s obviously the ground game that built Northern to the 145,000 acres we now have.”

Some of the drilling units brought online by Continental this year justify the approach. The company has gradually increased its interest in some of Continental’s wells to 12% from 7%.

“The small, incremental ground game stuff … adds value over time,” he said.

Northern is evaluating what Elliott said are billions of dollars’ worth of potential nonoperated acquisitions in the Williston Basin. Northern relies on a database of about 35,000 gross wells that it has participated in to date.

“That represents 20% to 25% of every Bakken, Three Forks well that’s been drilled,” he said. “We really do think we are the natural consolidator of nonop interest in the Williston Basin,” Elliott said.

Unappreciated

Not all Permian companies are running out of the Williston just yet.

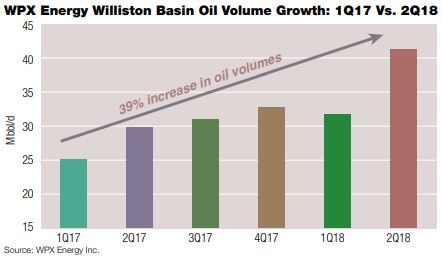

While WPX Energy has made two large-scale Delaware Basin purchases since 2015 for more than $3.5 billion, the company’s Williston Basin assets continue to improve, with second-quarter volumes up and edging out the company’s premiere Delaware holdings.

In the Williston Basin, where WPX runs three rigs, production averaged 50,600 boe/d in second-quarter 2018, up 28% from the previous quarter. In the Delaware, WPX runs seven rigs and produced an average 74,400 boe/d. In both basins, the company made strides in oil production.

“The Williston is generally an underappreciated asset,” said Clay Gaspar, president and COO. “All Williston is not created equal. I will grant you that.”

However, the company’s 85,000 net acres are producing blistering results, with wells coming on at 3,000 to 4,000 bbl/d at a drilling cost of about $6.5 million to $7 million.

“It doesn’t take much of a mathematician to figure out that’s absolutely world class,” Gaspar said.

Gaspar said the Williston holds promise for the next several years but lacks the scale and opportunity that the company’s Permian assets hold.

Nevertheless, the Williston, “from an oil production, cash-flow perspective … is a very large piece of the business and critical to our business today.”

Gaspar said that the Williston’s production continues to support its Permian assets, allowing them to grow “into the monster we believe it will be in a few years.”

More roadblocks

While the conference paid attention to discussions of the Permian’s infrastructure bottlenecks, T. Mason Hamilton, a petroleum market analyst for the U.S. Energy Information Administration (EIA) came with a warning: more choke points are ahead.

Hamilton said that U.S. crude exports in 2017 grew at a rate that had not been seen since the 1920s.

“Nothing really compares to both the year-over-year change and the absolute 1.1 MMbbl/d of U.S. crude oil exports that occurred in 2017,” he said.

Through May of this year, U.S. exports were up even more, to 2 MMbbl/d of oil. For the first time, Canada was displaced by China as the single largest destination of U.S. crude exports, followed by Canada and several Western European nations.

The amount of oil exported was staggering, with the U.S. “exporting more crude oil than Venezuela produces since February of this year,” he said.

The dilemma for crude shipments is what happens once they reach the water. The U.S. Gulf Coast lacks ports deep enough to load the largest and most cost-effective crude vessels.

Larger cargoes are particularly important for Asian-bound cargoes, where demand is projected to rise sharply in coming years.

Suitable vessels, called very large crude carriers (VLCC), are designed to carry about 2 MMbbl of oil to Pacific Rim nations—about what the U.S. now exports daily.

To safely navigate ports, however, VLCCs require a wide berth and deepwater ports of about 100 to 110 feet, Hamilton said.

“The only place you can fully load such large vessels is at the Louisiana Offshore Oil Port,” he said. “Otherwise, the ports along the U.S. Gulf Coast, where a majority of U.S. crude oil exports leave from, are located along inland waterways or harbors with relatively shallow water.”

U.S. Gulf Coast ports, such as Houston and Corpus Christi, Texas, are roughly 40 to 50 feet deep, allowing them to accommodate vessels with about 500,000 bbl of crude.

Some exporters have resorted to partial loadings of ships that are then met in deeper waters by where oil is transferred to larger vessels.

“Although much of the current focus has rightly been on pipeline constraints limiting the amount of crude oil that can reach the U.S. Gulf Coast, potential shipping limitations are also relevant,” Hamilton said.

While several projects have been announced to load large crude oil tankers, Hamilton said that for now the question is, “What’s going to happen to all that crude oil once it hits the Gulf Coast?”

Recommended Reading

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Haslam Family Office: ‘We Need Hydrocarbons’

2025-01-29 - The managing director of HF Capital—the office for Tennessee's Haslam family—says that as long as oil, gas and other energy sources are lacking capital, there’s an investment opportunity.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.