Ajay Bakshani is director of midstream equity at East Daley Analytics.

The midstream sector started the new year with a burst of merger activity, a trend East Daley Analytics expects to continue in 2024. In our recent Dirty Little Secrets annual outlook, we identified several market factors that point to further consolidation ahead.

Sunoco and NuStar kicked off the 2024 dealmaking in January, announcing an all-stock merger valued at $7.3 billion. In February, Western Midstream sold off interests in six assets to multiple buyers for $790 million. Then, in March, leading gas producer EQT Corp. reached a deal to acquire Equitrans Midstream (ETRN) for $5.5 billion.

The recent announcements continue momentum from last year. In 2023, Williams Cos. acquired Cureton Midstream and the remaining 50% stake in Rocky Mountain Midstream, and Kinder Morgan purchased NextEra Energy Partners’ South Texas natural gas pipeline assets.

As the midstream sector transitions into an environment of slower growth and increasing regulations, East Daley expects the pace of merger activity to continue. We expect companies will continue to use mergers to gain scale, better position themselves to take advantage of growing export markets and optimize existing assets in the ground. Larger companies will need to source volumes to keep long-haul transportation assets highly utilized, while small-to-midcap (SMID) companies need downstream exposure to extract more fees as production growth slows.

Midstream is ripe for consolidation

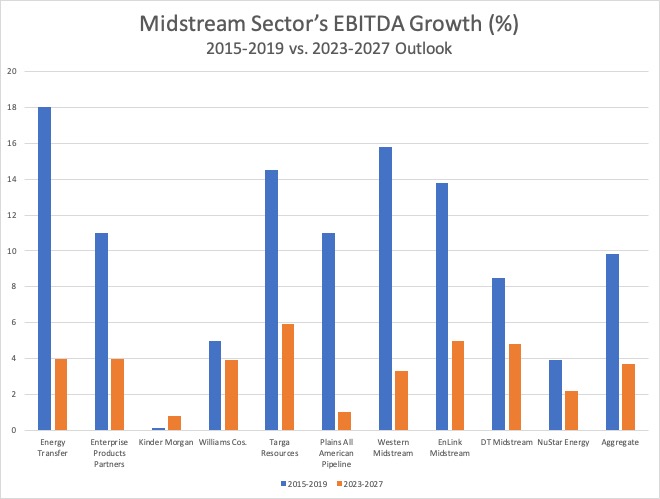

The era of consistent double-digit growth is clearly over for midstream. Production forecasts have re-rated post 2020, and environmental regulations have become more stringent. Even in areas where development is needed, such as the Northeast, onerous permitting makes development unfeasible. The impact to midstream is lower demand for new greenfield projects, and slower growth.

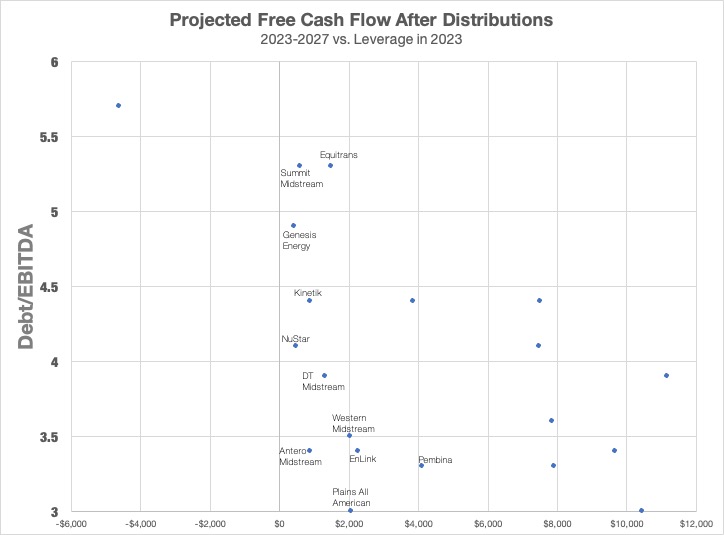

However, this state of affairs does not mean that the industry is in poor financial condition. In fact, it is the opposite case: the midstream sector is generating significant free cash flow. Most companies were on track to generate positive free cash flow after distributions for fiscal year 2023, with the median at $205 million versus to $663 million in 2019.

EDA highlighted this wave of cash flow in 2022. We noted there were fewer opportunities for the sector to spend capital, allowing free cash flow to go to debt reduction and shareholder returns. Since then, leverage ratios in our coverage group declined to 3.8x in 2023. Balance sheets are healthier than ever within midstream. At the same time, distributions have increased 17% since 2021 to $35.6 billion (a 9% increase year-over-year in 2023 alone) and are well above 2019 levels of about $31.8 billion.

In line with lower growth expectations and concerns over terminal value, EV/EBITDA multiples for the companies we focus on are a full turn below 2019 levels. However, with limited new development opportunities, pipes in the ground will only grow in value as production grows (just not as fast) along with demand. Given improved balanced sheets, more stable production growth vs 2019 and lower multiples, the focus of capital allocation is ready to move from debt reduction and dividends to M&A.

Scale, growth, longer-term value

In a slower-growth environment, the midstream sector will need to look to M&A to drive growth and leverage existing assets in the ground. Scale is of utmost importance as the focus shifts from getting a slice of a growing pie to taking market share from other companies.

Vertical integration is one strategy to achieve this scale. We have already seen this happen within the NGL subsector, where major NGL players like Enterprise Products Partners, Energy Transfer and Targa Resources have spent $22.5 billion on acquisitions of gathering and processing (G&P)-focused companies. The moves indicate a shift in strategy from 2015-2020, when midstream focused on reducing price and volumetric risk by investing more in contracted, long-haul infrastructure. G&P assets have become a way to secure flows through the rest of the asset base. Vertical integration also drives the EQT-Equitrans deal, which will see Equitrans return to the fold of the parent company.

Larger companies will need to source volumes to keep long-haul transportation assets highly utilized, while SMID companies need downstream exposure to extract more fees as production growth slows. Enterprise and Targa’s acquisitions of Navitas Midstream and Lucid Energy highlight this trend, as the two companies can leverage dominant Permian G&P positions to drive volume growth through their integrated NGL businesses.

Moreover, lower growth does not mean no growth. Exports, in particular, is one area that is growing across crude, natural gas and NGLs. The midstream sector needs to align its strategies and businesses around export demand growth, and M&A will be key to doing that as greenfield projects become increasingly difficult to build. The sector has already started to use M&A to boost its exposure to this tailwind, such as Williams with its acquisition of Trace Midstream and Energy Transfer with its acquisition of Enable Midstream Partners.

Dirty Little Secrets also highlights EDA’s positive outlook on Tier 2 basins. While the Permian and Haynesville continue to be the main sources of production growth, assets in those basins are fully valued. We believe midstream has an opportunity to bargain hunt in Tier 2 basins that could benefit from higher natural gas and LNG demand. The recent acquisitions by Williams in the Denver-Julesburg and Kinder Morgan in the Eagle Ford indicate that some are already pursuing this strategy.

Separating the sharks and minnows

When looking at which midstream companies could be good acquirers or sellers, East Daley focuses on companies with positive free cash flow and low leverage.

Energy Transfer, Enterprise, Targa and Williams screen as the most likely acquirers, especially given their already large asset bases that could always benefit from bolt-on transactions. Kinder Morgan is an outlier with leverage just above 4x but lacks the same EBITDA growth profile, so we expect it could also be an acquirer. Plains All American also stands out as a potential acquirer, especially given the limited growth capex opportunities.

One thing is certain: midstream is in a position in which the sector can afford to go on a buying spree. Growth capex (ex-M&A) declined 30% from 2019 to 2023, from $42 billion to $29 billion. Free cash flow after distributions has swung from negative to positive, and leverage has trended below 4x across East Daley’s coverage. With excess free cash flow and a reduced need for large greenfield projects, companies can look to M&A to drive growth and improve their competitive positioning.

Recommended Reading

ADNOC, OMV to Merge Petrochemical Firms to Create $60B Giant

2025-03-04 - The merged entity, Borouge Group International, is set to be the fourth largest polyolefins firm by production capacity, behind China's Sinopec and CNPC, and U.S.-based Exxon Mobil, ADNOC Downstream CEO Khaled Salmeen told Reuters.

Crescent Energy Closes $905MM Acquisition in Central Eagle Ford

2025-01-31 - Crescent Energy’s cash-and-stock acquisition of Carnelian Energy Capital Management-backed Ridgemar Energy includes potential contingency payments of up to $170 million through 2027.

Petro-Victory Buys Oil Fields in Brazil’s Potiguar Basin

2025-02-10 - Petro-Victory Energy is growing its footprint in Brazil’s onshore Potiguar Basin with 13 new blocks, the company said Feb. 10.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Apollo Funds Acquires NatGas Treatment Provider Bold Production Services

2025-02-12 - Funds managed by Apollo Global Management Inc. have acquired a majority interest in Bold Production Services LLC, a provider of natural gas treatment solutions.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.