(Source: Hart Energy; Shutterstock.com)

People search for certainty in times of turmoil, but predictions, polls and surveys about oil price decks and borrowing bases fluctuated as experts grappled with rapidly changing conditions due to the COVID-19 pandemic and the oil price crash.

Both factors have had a deep impact on what E&Ps and their lenders expect compared to what they thought last fall, according to a report by Haynes and Boone LLP released early April.

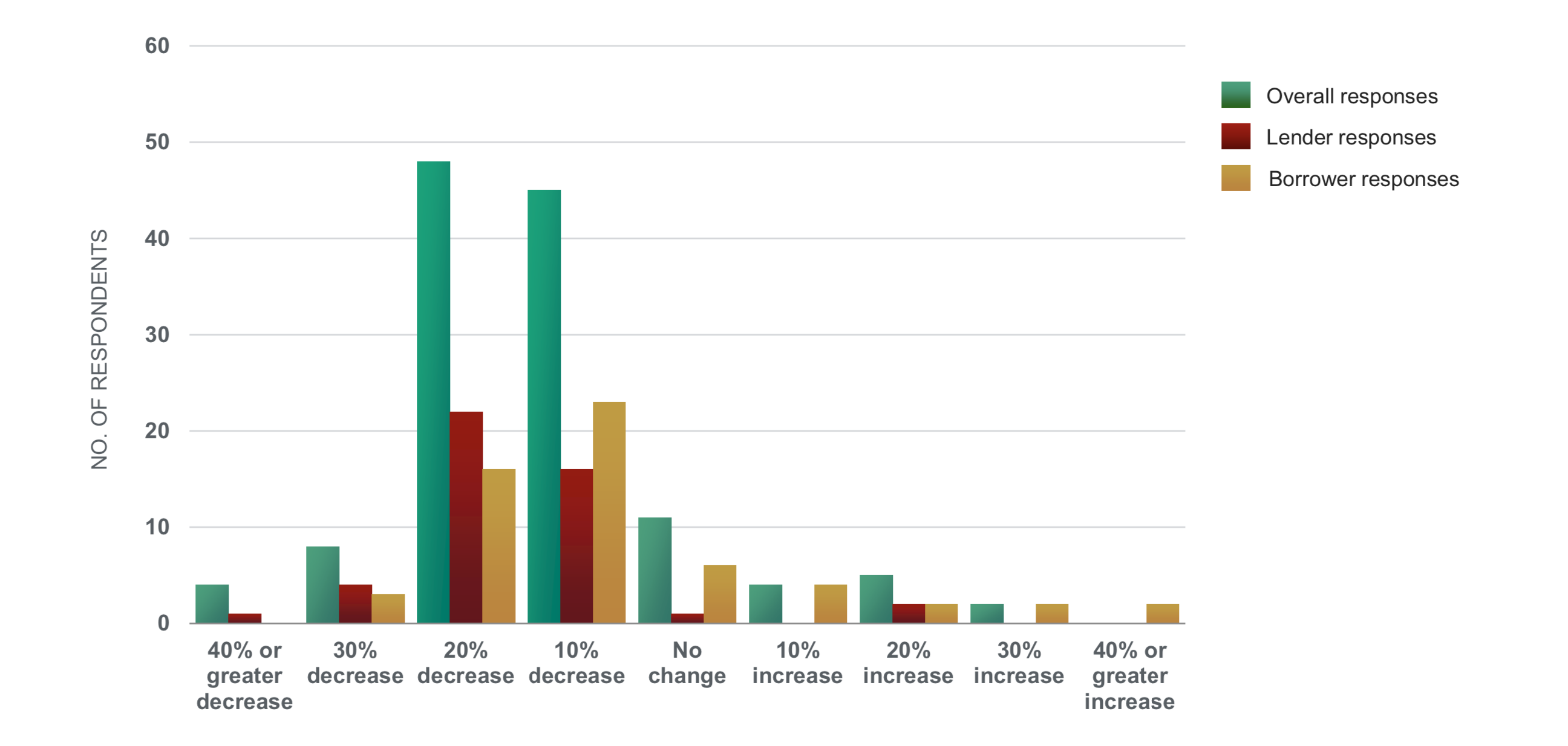

In response to the oil price crash, Haynes and Boone had to conduct its 11th annual survey of borrowing base expectations more than once, first getting answers between Feb. 24 and March 7, then again between March 8 and 25. The 207 respondents included E&P executives who made up 46% of the answers, while financial providers such as lending banks and private equity firms were 34% of the total.

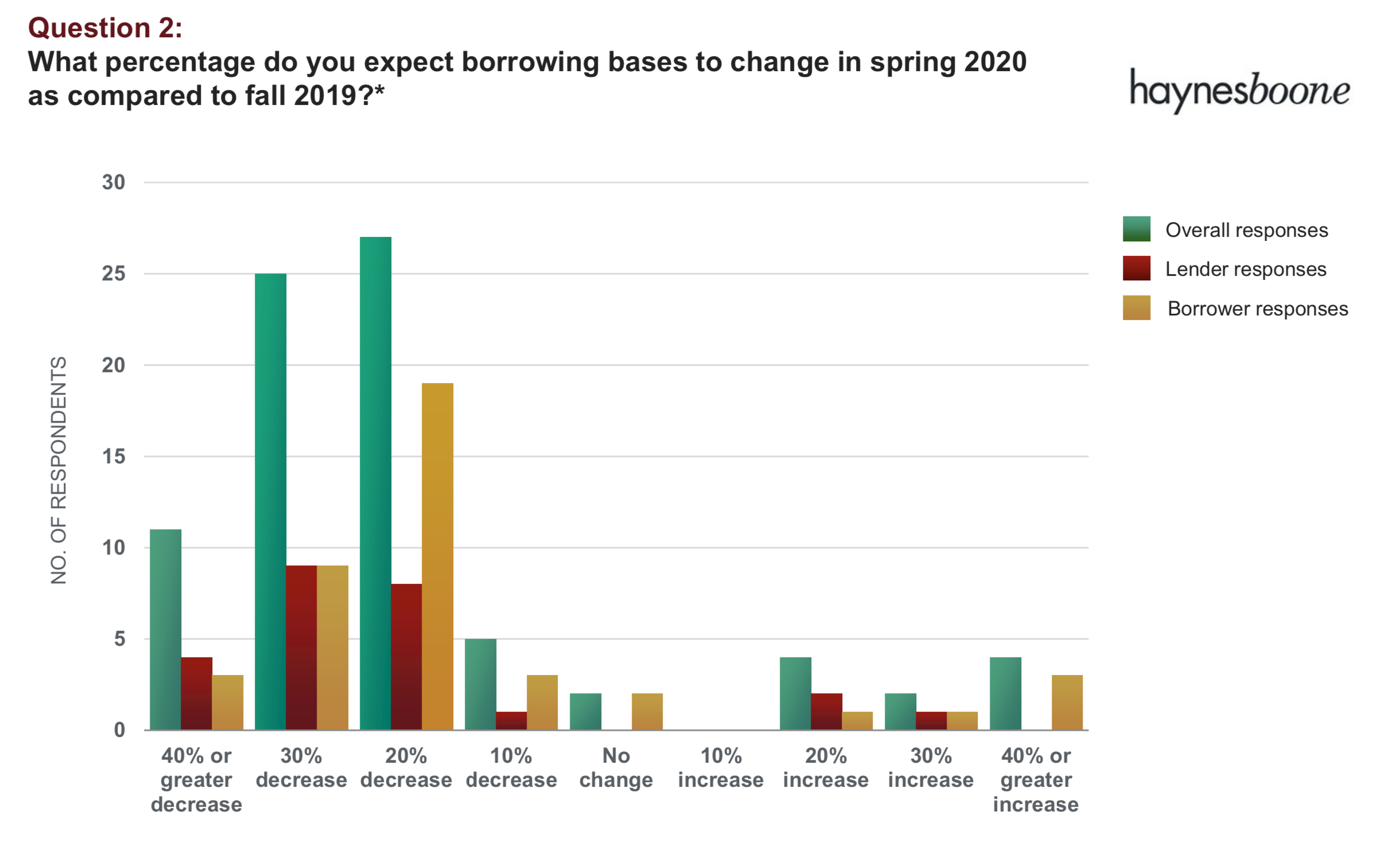

“A sizable majority of respondents expect borrowing bases to decrease by at least 20% in response to the recent freefall in commodity prices, and 45% of respondents expect even deeper cuts, of 30% or more,” the Houston-based law firm said in its report.

“In contrast, the largest share of respondents, 40%, in the firm’s fall 2019 survey said they expected borrowing bases to decrease by only 10% during the redetermination season.”

Oil and gas producers entered this downturn relatively well-hedged, the firm said, “raising a question about whether producers will keep these hedges in place to preserve cash flow, or immediately monetize them to enhance liquidity.”

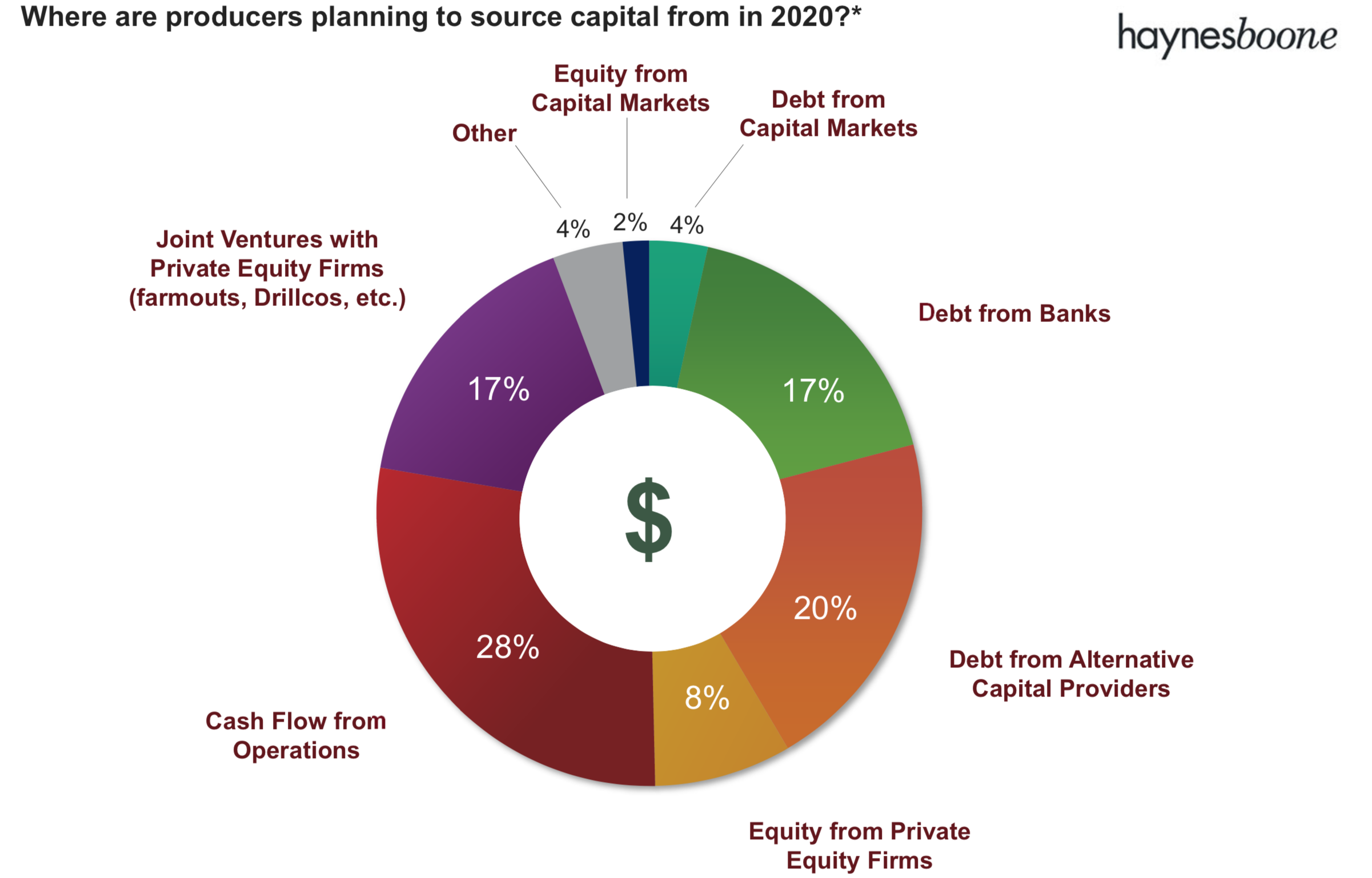

Producers are expected to use cash flow from operations as their primary sources of capital in 2020, followed by debt from alternative capital providers as the next likeliest source of capital.

“When compared to the fall 2019 responses, survey participants who see private equity as a source of E&P capital have dropped by nearly 50%,” said Kraig Grahmann, head of Haynes and Boone’s energy finance practice group.

In a separate survey, Haynes and Boone asked leading banks about their oil and gas price decks to be used for borrowing bases or reserve-based loans (RBL). The firm first asked participating banks in mid-February and reached out to them again in March—after the launch of an oil price war between Saudi Arabia and Russia following the collapse of OPEC+ production cuts. This allowed the banks the opportunity to revise their price decks that had been submitted prior to the resulting crash.

Some of the key takeaways included:

- The average base case for the oil price post-crash is 15.6% lower than the fall 2019 base case; and

- The average base case for gas post-crash is 12.3% lower than the fall 2019 base case.

“The firm initially sent out survey questions in mid-February but then reached out again to industry professionals in early March to ask them if they wanted to revise their predictions in light of the OPEC price war and growing concerns about the coronavirus,” Grahmann said. “The latter responses were far more pessimistic.”

Twenty-one banks responded. The post-crash mean oil price they cited was $32/bbl for the base case. Their pre-crash mean for the base case was about $48. By 2023, they now expect the mean to be $42.

“The rapid deterioration in market conditions that started on March 8, 2020, had an immediate and deep impact on predictions about future borrowing capacity,” Grahmann said.

Buddy Clark, co-chair of the firm’s energy practice, noted the significant drop in value of oil and gas collateral since commodity prices fell. He also said that the turmoil might give bankers an excuse to postpone the borrowing base redetermination reason, although he gave no time frame.

Recommended Reading

Delivering Dividends Through Digital Technology

2024-12-30 - Increasing automation is creating a step change across the oil and gas life cycle.

Exxon Seeks Permit for its Eighth Oil, Gas Project in Guyana as Output Rises

2025-02-12 - A consortium led by Exxon Mobil has requested environmental permits from Guyana for its eighth project, the first that will generate gas not linked to oil production.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Darbonne: The Power Grid Stuck in Gridlock

2025-01-05 - Greater power demand is coming but, while there isn’t enough power generation to answer the call, the transmission isn’t there either, industry members and analysts report.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.