Today, the LNG plant on the Norwegian island of Melkøya is the sole alternative for delivering gas from the Barents Sea. (Source: Helge Hansen/Equinor)

The Barents Sea holds significant hydrocarbons — likely more gas than oil — but only three options exist for exporting more gas from the area, the Norwegian Petroleum Directorate (NPD) said on Dec. 8.

One option is a pipeline connecting the Barents Sea to the pipeline system that that runs from the Norwegian Sea to the south and west. According to the NPD, this option would tie together the Norwegian shelf into a single petroleum province.

A second alternative is to expand capacity in the LNG plant on the Norwegian island of Melkøya. The third: ammonia production.

Currently, the LNG plant on Melkøya is the sole alternative for delivering gas from the Barents Sea, but gas from the Snøhvit Field will keep the facility at full capacity through 2040. Without new gas transport capacity, projections indicate the plant’s capacity will be capped through 2050, based on already proven resources in fields and discoveries.

The NPD, which on Jan. 1 will become known as the Norwegian Offshore Directorate, said a third option would use gas from the Barents Sea to produce ammonia, which would then be exported by ship.

Increasing gas transport from the Barents is likely to be profitable from a socio-economic perspective, according to a Gassco and NPD study presented in April 2023.

On the other hand, there is a call for assurances of larger gas volumes before initiating a process to lay new gas export pipelines, which means a need for more exploration and more discoveries, the NPD said.

Some companies have stated ambitions in the Barents Sea and plan a number of exploration wells in the years to come.

If export pipelines or increased LNG capacity is added, the NPD said that could trigger more exploration activity in the north. If the planned exploration wells make major discoveries, it will probably be easier to secure funds for investment in new infrastructure, the NPD added.

According to the NPD, the geology in areas open to exploration in the Barents Sea indicate that it is not likely that large enough discoveries will be made to warrant establishing new export capacity on an independent basis.

This means that new export capacity is more reliant on coordination of resources.

Undiscovered gas

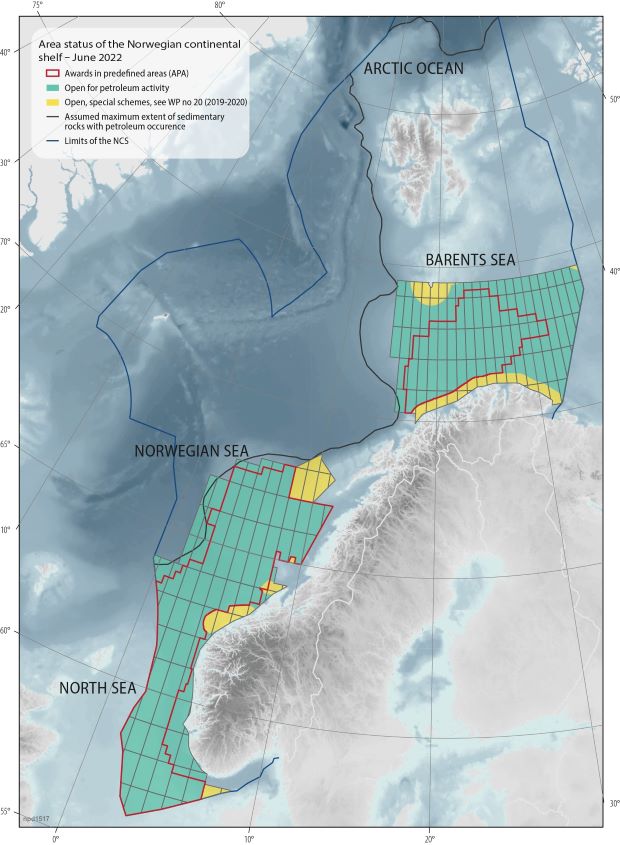

In August 2022, NPD released Resource Report 2022, which indicated about two-thirds of undiscovered gas resources are expected to be in the Barents Sea. At the time, the NPD urged the industry to invest in the frontier areas on the Norwegian Continental Shelf (NCS).

Based on the NPD’s projections, an increasing share of production from 2030 and beyond will have to come from undiscovered resources, mostly from smaller discoveries.

According to the NPD’s estimates, half of the undiscovered gas resources on the NCS are found in the southern part of the Barents Sea. Including the northern Barents Sea, which has not been opened for petroleum activity, the undiscovered gas resources in the Barents Sea account for two-thirds.

Estimated undiscovered resources in the Barents Sea are 2.4 Bcm of oil equivalent (15.1 Bboe), with gas accounting for 1.12 Tcm of that figure.

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Feb. 3, 2025

2025-02-03 - Here’s a roundup of the latest E&P headlines, from a forecast of rising global land rig activity to new contracts.

Aris Water Solutions’ Answers to Permian’s Produced Water Problem

2024-12-04 - Aris Water Solutions has some answers to one of the Permian’s biggest headwinds—produced water management—but there’s still a ways to go, said CEO Amanda Brock at the DUG Executive Oil Conference & Expo.

Coterra Takes Harkey Sand ‘Row’ Show on the Road

2024-11-20 - With success to date in Harkey sandstone overlying the Wolfcamp, the company aims to make mega-DSUs in New Mexico with the 49,000-net-acre bolt-on of adjacent sections.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.