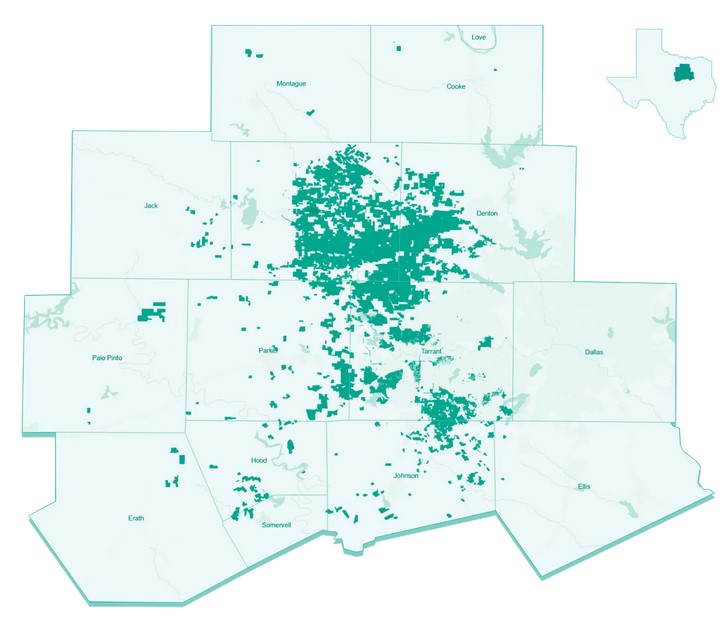

BKV Corp.'s Barnett Shale operations in Wise County, Texas. BKV has positioned itself as an LNG supplier near Gulf Coast markets with production averaging 718 MMcfe/d across about 460,000 Barnett acres, supported by 778 miles of associated gas gathering pipelines and 65 compression units. (Source: BKV Corp.)

Natural gas E&P BKV Corp., with operations centered in the Barnett Shale, has launched its long delayed IPO for 15 million shares, the company said on Sept. 16.

The company, the Barnett’s largest producer of natural gas and condensates, said it expects to price its IPO at between $19 to $21 per share, with proceeds ranging between $285 million to $315 million.

The offering is on the IPO calendar to begin trading Sept. 26, according to the Edgar Online service.

BKV has positioned itself as an LNG supplier near Gulf Coast markets with production averaging 718 MMcfe/d across about 460,000 Barnett acres, supported by 778 miles of associated gas gathering pipelines and 65 compression units. The company also owns an amine gas processing unit.

The company has also focused on carbon capture and sequestration, with plans to reach net zero carbon emissions by the 2030s. In June the company announced a deal to provide carbon sequestered gas at a premium to Henry Hub prices.

BKV, which also holds Marcellus Shale producing assets, first filed for paperwork for a public offering with the Securities and Exchange Commission in November 2022, but natural gas prices have trended from bad to abysmal since. Henry Hub spot prices in November 2022 averaged $5.45/MMBtu, according to the U.S. Energy Information Administration. Last month, prices averaged $1.98/MMBtu.

BKV has positioned itself as a source for LNG, noting that its operations are about 300 miles from major Gulf Coast industrial centers and export markets.

BKV said its underwriters will have a 30-day option to purchase an additional 2.25 million shares from the company at its initial IPO price, less underwriting discounts and commissions.

Company shares have been approved for listing on the New York Stock Exchange under the ticker symbol “BKV.”

Citigroup and Barclays are acting as lead book-running managers for the offering. Evercore ISI, Jefferies and Mizuho are acting as joint book-running managers. KeyBanc Capital Markets, Susquehanna Financial Group, LLP, TPH&Co., the energy business of Perella Weinberg Partners, and Truist Securities are acting as senior co-managers. Citizens JMP and SMBC Nikko are acting as co-managers for the offering.

RELATED

Recommended Reading

BlackRock’s Fink Calls for Reliable US Power Grid—Now

2025-03-31 - “That starts with fixing the slow, broken permitting processes in the U.S. and Europe,” Larry Fink, the co-founder, chairman and CEO of $12 trillion investment-management firm BlackRock Inc., told shareholders March 31.

E&P Highlights: March 31, 2025

2025-03-31 - Here’s a roundup of the latest E&P headlines, from a big CNOOC discovery in the South China Sea to Shell’s development offshore Brazil.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2025-03-28 - The oil and gas rig count fell by one to 592 in the week to March 28.

BP Earns Approval to Redevelop Oil Fields in Northern Iraq

2025-03-27 - The agreement with Iraq’s government is for an initial phase that includes oil and gas production of more than 3 Bboe, BP stated.

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.