Bob Brackett, Bernstein senior E&P analyst, expects 12 Bcf/d of additional gas demand for U.S. power generation into 2030—growing at a rate of 2 Bcf/d more per year beginning this year as more power-hungry AI data centers come online. (Source: Shutterstock)

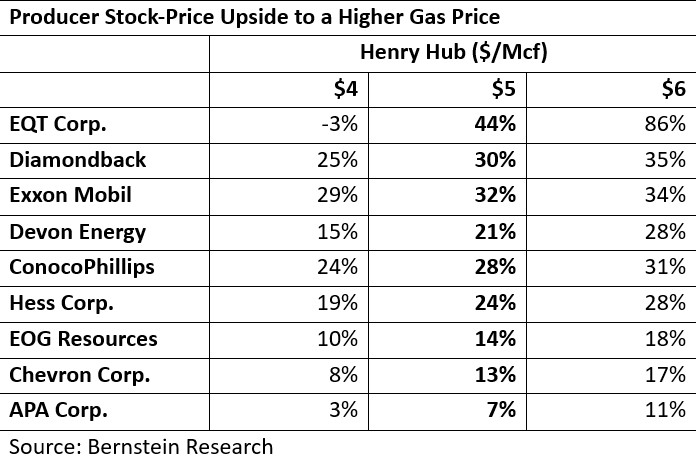

U.S. natural gas will be $5/Mcf this and next year and that’s “conservative, in our view,” Bernstein Research analysts report in describing “a coming U.S. gas super-cycle.”

Bernstein’s 2025 and 2026 forecast had been $3. The 12-month strip for gas delivered to Henry Hub was $3.99 at press time, according to real-time CME Group data. The 24-month strip was also $3.99.

Bob Brackett, Bernstein senior E&P analyst, expects 12 Bcf/d of additional gas demand for U.S. power generation into 2030—growing at a rate of 2 Bcf/d more per year beginning this year as more power-hungry AI data centers come online.

“We acknowledge that extraordinary claims require extraordinary evidence, yet nonetheless embrace strong conviction in a new U.S. gas landscape at higher mid-cycle prices,” Brackett wrote.

150 Bcf/d U.S. gas market

The team’s revised-price modeling expects slight change in natgas demand in industrial, commercial, residential and transportation applications.

But U.S. LNG exports, which are currently 14.5 Bcf/d, will grow another 10 Bcf/d by 2030 from projects already working toward completion, Brackett reported. Little consideration in the Bernstein math is given to projects not already underway, he added.

Net of powering higher-intensity data centers, filling more LNG tankers and other factors used in the modelling, U.S. gas demand that was roughly 120 Bcf/d in 2024 “would thus rise to approximately 150 Bcf/d in 2030,” Brackett concluded.

Marcellus, Haynesville

Appalachia’s Marcellus Shale gas producers will benefit the most from data-center demand growth, the team expects.

Meanwhile, Haynesville Shale producers will benefit the most from LNG-export and other Gulf Coast demand growth.

Brackett added, “Appalachian gas is the lowest-cost source of dry gas with significant inventory. If Appalachia doesn’t source half of the gas to meet power-demand growth, gas prices will be higher than we forecast.”

As for the Haynesville, he called it “the poster child for a well-located—i.e., near LNG and Henry Hub—and low-cost—earning good returns at $3.5/Mcf and amazing returns above $4.5/Mcf—shale-gas basin.”

But Brackett and the team don’t expect the Haynesville alone will answer the Gulf Coast call. “We feel it will be less reactive,” he wrote.

Based on past gas-price response from the Haynesville, the prologue would “predict 10 Bcf/d growth in the Haynesville—roughly a 9% CAGR to 2030. While not impossible, it is more ambitious” than most other models.

“And it still doesn’t meet the entirety of demand growth,” Brackett reported.

Additional supply will have to come from the Midcontinent and other basins, he wrote, adding that he would “argue that if the Haynesville doesn’t meet the entire call on supply, price must rise to incent other basins to grow.”

Slow to respond

Also helping sustain a $5-plus price will be operator restraint, he added.

“Gas supply that can react to price has been slower to respond,” he wrote.

“… The operators have been punished—both by price and ownership—for growing too rapidly in the past and are thus likely to be slow to respond this time.”

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Ovintiv Names Terri King as Independent Board Member

2025-01-28 - Ovintiv Inc. has named former ConocoPhillips Chief Commercial Officer Terri King as a new independent member of its board of directors effective Jan. 31.

Independence Contract Drilling Emerges from Chapter 11 Bankruptcy

2025-01-21 - Independence Contract Drilling eliminated more than $197 million of convertible debt in the restructuring process.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.