As Berry Corp. continues its aggressive hunt for growth opportunities outside of California, the E&P made a second bolt-on acquisition in Kern County in the fourth quarter.

Berry Corp. bolted on “highly synergistic” working interest in its core California operating area at year-end 2023, the E&P disclosed in its fourth-quarter 2023 earnings.

The Dallas-based company tapped its reserve-based loan (RBL) facility for about $30 million to finance its latest acquisition in Kern County, California, Berry reported March 6. The company aims to pay down the new RBL borrowings during the first half of this year.

M&A was a key theme last year for Berry, which has assets in Kern County and in the Uinta Basin in Utah. Berry replaced 176% of its California production with additional proved reserves from acquisitions and field extensions last year.

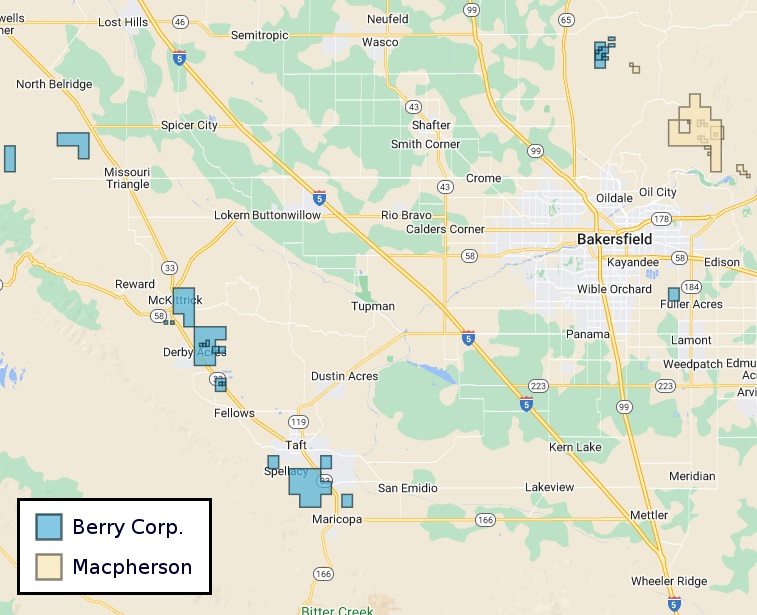

In September, Berry closed on a $70 million takeover of Macpherson Energy Corp., a privately held E&P with assets in Kern County.

Fourth-quarter production in California increased 5% to 21,500 boe/d from the prior quarter, with the increase largely tied to the Macpherson acquisition.

Company-wide production averaged 25,900 boe/d in the fourth quarter; full-year production averaged 25,400 boe/d.

The company anticipates production to average between 24,600 boe/d and 25,800 boe/d this year.

RELATED: California New Oil Well Approvals Have Nearly Ground to a Halt, Data Show

Drill chill

More than 80% of Berry’s total crude oil production comes from Kern County. But after a ruling by a California’s intermediate courts of appeal, permitting activity for new drilling in Kern County has been effectively halted since late January 2023.

Berry’s 2024 capital program was developed under the assumption that the company will not receive additional new drill permits in California this year. Berry holds approved drilling permits and expects to receive other approvals for planned activities in a timely fashion.

Berry managed to extend its production runway in Kern County by scooping up Macpherson last year. But the current constraints on Berry’s plans in California are causing the E&P to search outside of the Golden State for growth opportunities, CEO Fernando Araujo reiterated in the company’s earnings release.

“We will continue to seek scale and growth through bolt-ons or other opportunities in and outside of California, all while being mindful of optimizing our capital structure,” Araujo said.

RELATED: Searching for Scale, Berry Corp. ‘Aggressively’ Hunting More M&A

Consolidating Kern

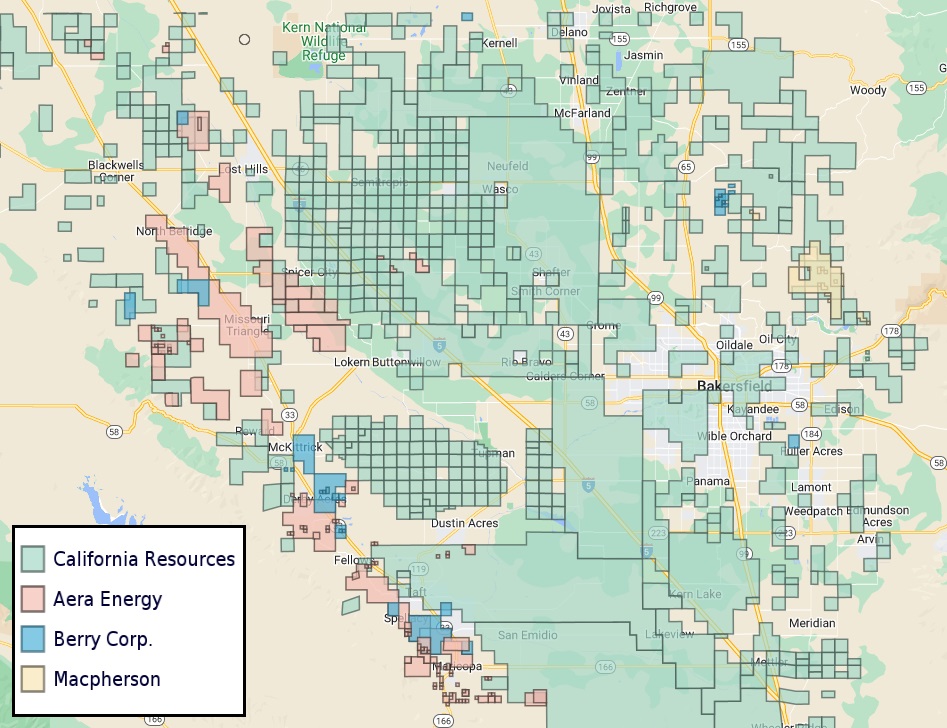

Berry and Macpherson aren’t the only Kern County operators merging recently.

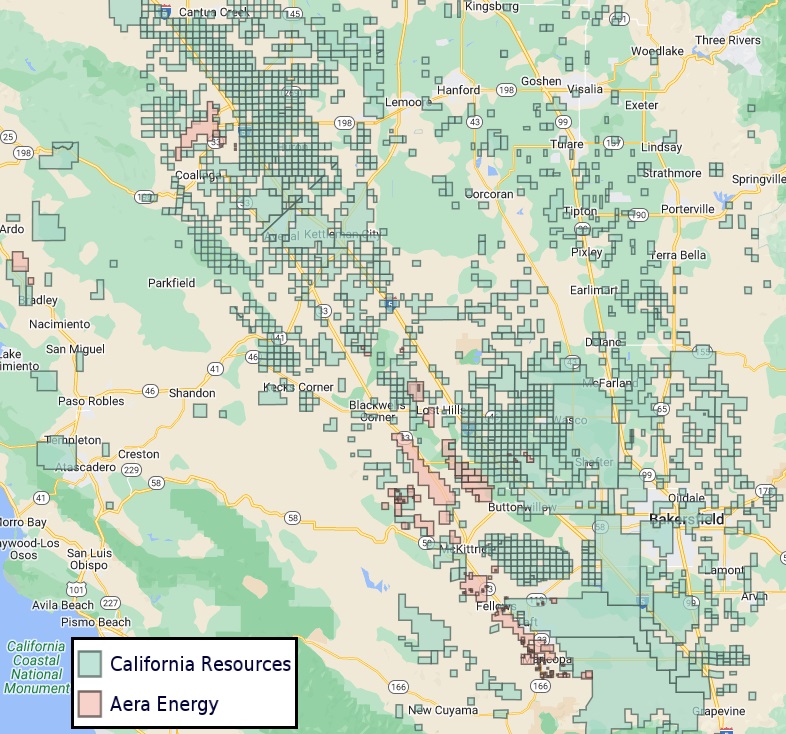

In early February, California Resources Corp. agreed to acquire Aera Energy, a joint venture created by Shell Plc and Exxon Mobil Corp., in a $2.1 billion all-stock merger.

California Resources said the transaction adds large, conventional, low decline, oil weighted, proved developed producing reserves and sustainable cash flow. In third-quarter 2023, Aera averaged 76,000 boe/d, 95% oil. The company had estimated proved reserves of approximately 262 MMboe at year-end 2024.

The moratorium on new drilling activity in Kern County is also affecting California Resources and Aera, which both have sizable footprints in the county.

California Resources own pro forma development plan assumes “a successful resolution to the Kern County [Environmental Impact Report] litigation” and “resumption of a normalized level of permit approvals” in the second half of 2024.

Should litigation be resolved and permitting activity be resumed, the company plans to operate between four and five rigs after closing the Aera acquisition.

RELATED: California Resources Corp., Aera Energy to Combine in $2.1B Merger

Recommended Reading

Viper to Buy Diamondback Mineral, Royalty Interests in $4.45B Drop-Down

2025-01-30 - Working to reduce debt after a $26 billion acquisition of Endeavor Energy Resources, Diamondback will drop down $4.45 billion in mineral and royalty interests to its subsidiary Viper Energy.

Mach Prices Common Units, Closes Flycatcher Deal

2025-02-06 - Mach Natural Resources priced a public offering of common units following the close of $29.8 million of assets near its current holdings in the Ardmore Basin on Jan. 31.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-09 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.