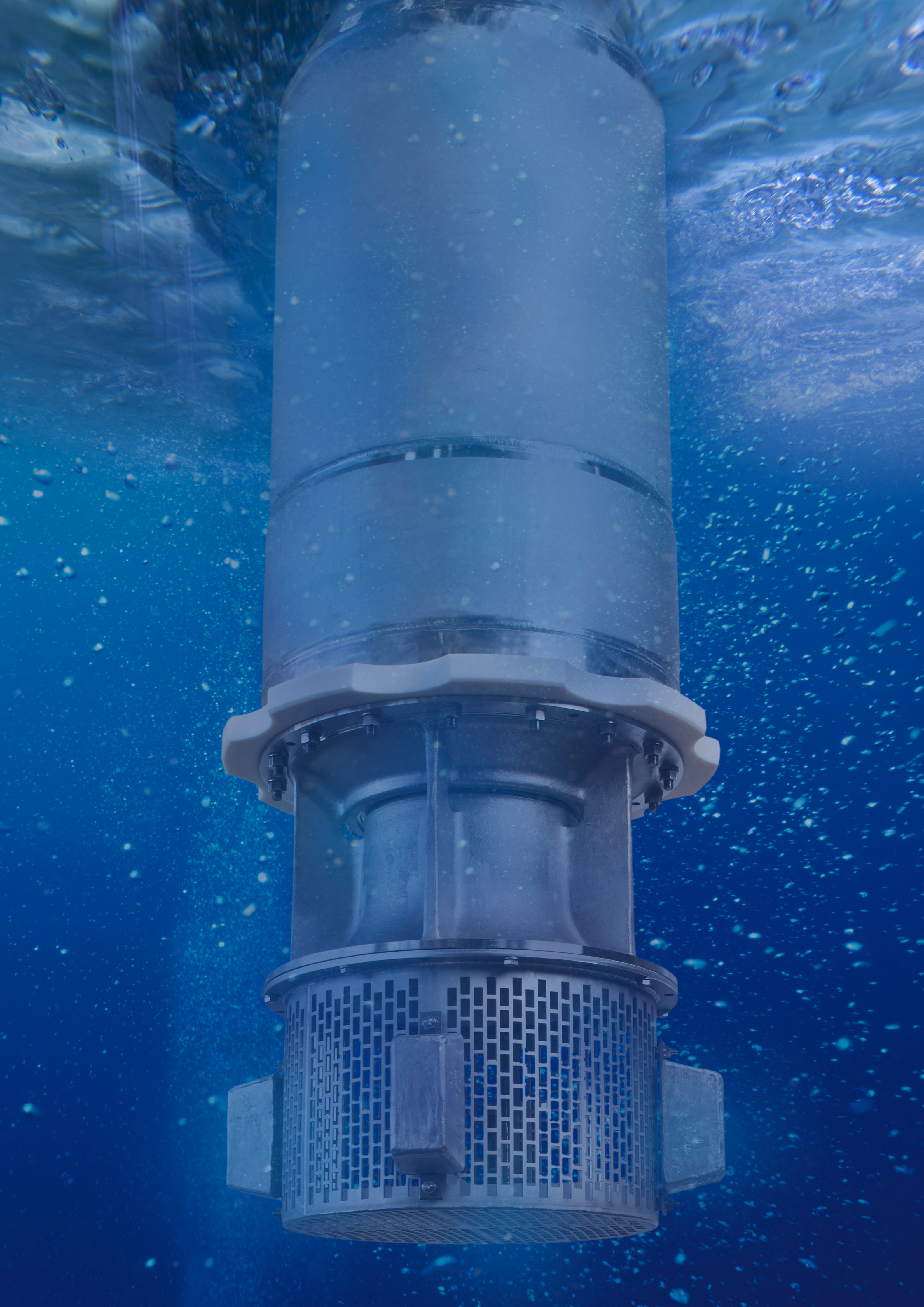

Aker BP’s Ivar Aasen platform in the Norwegian North Sea uses Framo-manufactured seawater lift pumps. (Source: Aker BP)

The idea of paying service companies or equipment manufacturers for performance rather than equipment is not entirely new. It has been used in the airline industry, which pays for performance of jet engines rather than buying them, for years. But a major hurdle for oil and gas firms has been giving access to operational data to vendors.

There are versions of this model in the industry. Downhole electric submersible pumps have been run on a bonus/penalty model for a number of years; equipment manufacturers can see how pumps are operating to make sure they don’t fail early. But more models are emerging.

In 2016, Diamond Offshore (NYSE: DO) started to offer a pressure control by-the-hour service. This saw Baker Hughes, a GE Company, (NYSE: BHGE) retain ownership of the pressure control equipment it had produced and work with Diamond to reduce downtime to less than 1%, as a service-based model.

“It requires you to operate differently,” John Kerr, vice president and chief technology officer ofengineering and technology, oilfield equipment, for BHGE, said on the sidelines of the ONS conference and exhibition in Stavanger in late August. “In a [traditional] service model you send equipment out and they rent it. Now, you don’t get paid unless you get uptime. You have to think about spares strategies, predictive modeling and maintenance.”

Other firms are adopting these models and taking them further. During ONS, Norwegian oil and gas producer Aker BP announced it had agreed to a so-called “smart service contract” with data platform provider Cognite and Norwegian pump technology firm Framo.

The contract, expected to be the first of more, focuses on eight Framo-manufactured seawater lift pumps used on the Ivar Aasen platform, which came onstream in 2016 in the Norwegian North Sea. These pumps are used in many offshore oil and gas installations to provide cooling water for process equipment. If one or more fail, perhaps because they’ve been operated outside their normal parameters, production has to be curtailed because process equipment can’t be cooled.

By giving Framo access to real-time data from the pumps, showing how they’re performing and their operating conditions, the firm, which sold its first seawater lift pump in 1982 (and has sold 635 since), can help improve operating conditions so that they can last longer and operate more efficiently. Any issues or maintenance requirements can be spotted earlier.

The next step is to scale up what’s being monitored—expanding from the pumps on Ivar Aasen to the 550 operating globally, which would give Framo even more data with which to help further enhance their pumps. Framo hopes this model could then extend to all its pumps, from fire water to water injection pumps.

The challenge is getting hold of the operating data.

“Framo has been trying to get data from our clients for six to seven years, but doors have been quite closed,” Sigve Gjerstad, sales manager for oil and gas pumping systems for Framo, told Hart Energy at ONS.

Petter Jacob Jacobsen, head of oil and gas vertical for Cognite, said “The oil industry has a very complex value chain and notoriously misaligned incentives. In the last few years, with the downturn, cost savings have been made, but while keeping the status quo in terms of business models. If we want to move further now, we have to align some of this.”

Aker BP has been pushing alignment with vendors for a number of years and described the contract with Framo as a “data liberation contract.”

“Aker BP opened up their data for us to learn more about the pump, how it behaves in operation,” said Trond Petter Abrahamsen, managing director at Framo. “With the data upfront, working with Cognite, we can do machine learning to better understanding of what’s going on, see signs of a need for a service.”

This work can help reduce false alarms, move from a time-based maintenance regime to condition based, and help run the pumps more efficiently.

“At some stage, the raw data won’t be presented to the operator; 70-80% of alarms will be filtered before they reach the operator,” Abrahamsen added. This could help reduce manpower or unable unmanned facilities.

Framo’s contract with Aker BP is a step away from a full performance contract, but Abrahamsen doesn’t think it will be too long before that happens.

“The next step is they want to buy the water on deck,” saidAbrahamsen. “Like cars, everyone owned them, but now it’s more typical to lease them and there are different types of lease contracts. For some it’s more convenient. In this industry, that approach has not been mainstream. We are maybe gradually moving towards that.”

What’s more, he said, is this could help the industry move away from all the detailed specification companies like Framo have to address on a project by project basis.

“We have made this pump for 25 years. We think it’s the most reliable, but we still have to go through 50 to 100 specifications for every project we are doing,” he said. “For every client and every project. Aker BP started out as Det norske, a smaller player that had to choose vendors and trust vendors and I think they have brought that philosophy in to Aker BP.”

For Framo, this is just the start. “This is just the beginning, we will take it from here and make it more advanced,” and apply it to more products, Abrahamsen said.

Recommended Reading

Origis Secures $1B in New Investments from Brookfield, Antin

2025-01-15 - Brookfield Asset Management is joining Origis Energy’s investor group alongside existing investor and majority owner Antin Infrastructure Partners.

Dividends Declared Week of Feb. 17

2025-02-21 - 2024 year-end earnings season is underway. Here is a compilation of dividends declared from select upstream, midstream, downstream and service and supply companies.

Dividends Declared Week of Dec. 16

2024-12-20 - As fourth-quarter 2024 nears its end, here is a compilation of dividends declared from select upstream, midstream and service and supply companies.

Apex Locks in Financing for North Carolina Wind Farm

2024-12-05 - Apex Clean Energy said commercial operations at a 189 megawatt wind farm are expected to begin by year-end 2024.

Pinnacle Midstream Execs Form Energy Spectrum-Backed Renegade

2025-02-03 - Renegade Infrastructure, led by Permian-centric Pinnacle Midstream developers Drew Ward and Jason Tanous, have received a capital commitment from Energy Spectrum Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.