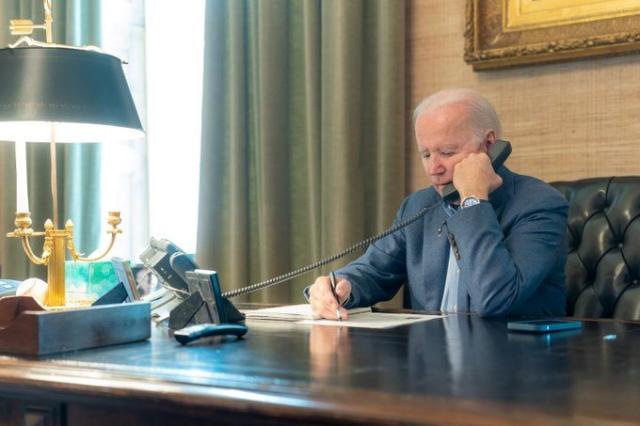

U.S. President Joe Biden seen working from his office in late December. (Source: The White House)

U.S. President Joe Biden unveiled tax credits for new clean vehicles acquired in 2023.

“Thanks to the Inflation Reduction Act, folks who purchase electric vehicles can receive a tax credit of up to $7,500 per vehicle, allowing millions of consumers to ditch the pump and easily switch to an EV,” Biden wrote Jan. 3 in a Twitter post.

The credit applies to a new qualified plug-in electric vehicle (EV) or fuel cell vehicle (FCV) bought and put in service on Jan. 1, 2023 or later and meets certain income limitations.

The vehicles are currently eligible for a credit provided other requirements are met from the following qualified manufacturers: Audi, BMW, Ford, General Motors, Hyundai, Jaguar, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Proterra, Rivian, Stellantis, Subaru, Tesla, Toyota, Volkswagen, and Volvo.

The greater affordability of EVs is likely to steer drivers and consumers away from current sources of energy for transportation, such as gasoline or diesel, and toward more environmentally friendly technology, the International Monetary Fund said in a statement on its website about the electric takeover in transportation.

Who qualifies

The credit is available to individuals and their businesses, according to details on the Internal Revenue Service (IRS) website.

To qualify for the credit under Internal Revenue Code Section 30D, the acquirer must buy the EV for personal use and not for resale and use it primarily in the U.S.

Additionally, the acquirer’s modified adjusted gross income (AGI) cannot exceed $300,000 for married couples filing jointly, $225,000 for heads of households or $150,000 for all other filers.

“You can use your modified AGI from the year you take delivery of the vehicle or the year before, whichever is less,” according to the IRS. “If your modified AGI is below the threshold in one of the two years, you can claim the credit.”

Qualified vehicles

Approximately 19 qualified manufacturers are offering new EV or FCV models, spanning from the Audi Q5 TFSI e Quattro (PHEV) to the Lincoln Aviator Grand Touring and Tesla Model Y Performance.

To qualify, a vehicle must have a battery capacity of at least 7 kilowatt hours (kWh), have a gross vehicle weight of less than 14,000 pounds, be offered by a qualified manufacturer and undergo final assembly in North America.

Additionally, the manufacturer suggested retail price can’t surpass $80,000 for vans, sport utility vehicles and pickup trucks or $55,000 for other vehicles.

Vehicles bought in 2022

Used EVs and FCVs as well as new ones bought in 2022 or earlier are also available for a tax credit beginning Jan. 1.

To qualify for the used clean vehicle credit, the vehicle must come from a licensed dealer with a price of $25,000 or less. The credit equals 30% of the sale price up to a maximum credit of $4,000, according to the IRS.

Also, new qualified plug-in EVs bought in 2022 or before may also qualify for a clean vehicle tax credit up to $7,500 under Internal Revenue Code Section 30D. The credit equals $2,917 for a vehicle with a battery capacity of at least 5 kWh, plus $417 for each kWh of capacity over 5 kWh.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.