The enormous boom in production from shale oil and gas is having huge economic, political and social consequences. In a period of geopolitical uncertainty and conflict in many parts of the world, when energy prices would be expected to skyrocket, they’ve instead remained fairly stable and, as of fourth-quarter 2014, fallen. Shale oil dominates the economies of some cities and even entire states (like North Dakota), as evidenced by unemployment rates substantially below U.S. averages.

At the same time, environmental concerns about hydraulic fracturing—real and significant, say green activists; unsupported and overblown, say industry participants—have become a major political issue, especially in producing states.

These trends are reflected in the 2014 Grant Thornton LLP survey of U.S. oil and gas companies, conducted in partnership with Hart Energy. Responses portray a thriving industry whose challenges—such as how to find and retain quality staff—would be the envy of other businesses. But they also reveal a sector dealing with operational challenges that are testing the management skills and political savvy of company executives.

Regulations are top barriers to growth

“In addition to operational challenges throughout this U.S. energy revolution, the industry continues to face major environmental and regulatory risks,” said Kevin Schroeder, industry managing partner for Grant Thornton’s Energy practice. “The opposition comes from traditional environmental activists, as well as local residents motivated by lifestyle issues such as excessive noise.”

At the federal level—stymied by an administration and Congress that have generally been supportive of shale drilling—activists have turned to the Endangered Species Act to stop or limit production. State governments have mostly encouraged drilling, but there are notable exceptions: New York has a moratorium in place, and in Colorado a compromise was recently effected that muddies the drilling picture. It’s at the local level where many activists are now making their push: Cities and counties have passed some 430 measures to control or ban fracking, according to the Dallas Morning News.

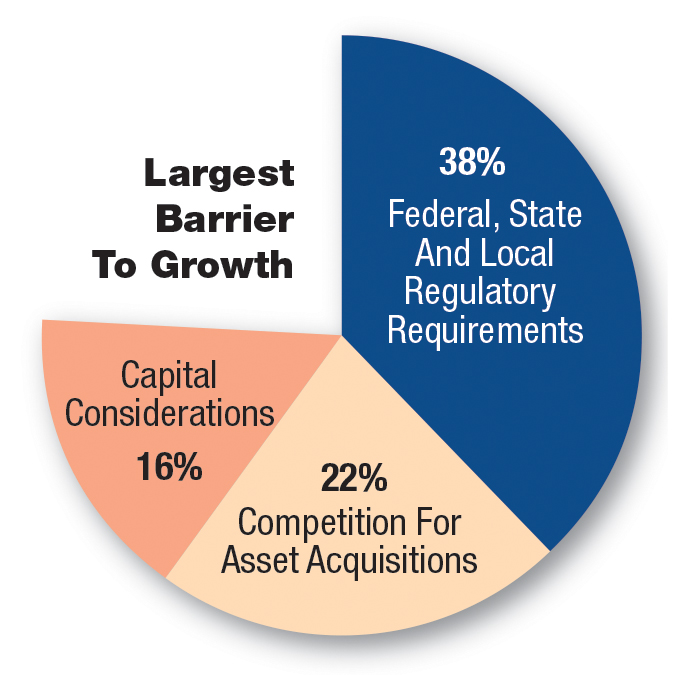

Given the contentious political environment for horizontal drilling in many areas, it’s not surprising that the greatest number of survey respondents—38%—cited federal, state and local regulatory requirements as the largest barrier to growth. “That sizeable response also likely reflects concerns about state and local taxes, both in terms of magnitude and complexity,” noted John LaBorde, State and Local Tax practice leader at Grant Thornton.

Competition for asset acquisitions (22%) and capital considerations (16%) also were judged significant barriers. In comparison, systems infrastructure, contracts/administration, policy support and public perception were low on the list of obstacles to growth.

M&A competition intensifies

Over the past several years, energy companies have been buying land and making investments in the top shale plays as well as applying new technology. But the amount of recoverable oil and gas becomes apparent only as an area is further explored and developed. More and more, the industry has identified the best places to drill to achieve high returns—the so-called sweet spots that, while not scarce, are finite. Some companies are now ready to cash out their holdings, and there appears to be no shortage of buyers.

The competition for shale properties is occurring not only among traditional industry players but also from private-equity funds that are intensely focused on identifying opportunities for the nearly $1 trillion of dry powder (funds raised but not invested) they hold.

“The private-equity investments have skyrocketed,” said Schroeder. “Just recently, deals were on a scale of $50 million to $300 million, but now investments can top $1 billion.”

Financing from capital markets is also readily available. Overall, the ready supply of capital is helping to fuel an upturn in upstream M&A. According to an analysis by Evaluate Energy, total deal value in the second quarter of 2014 was $51.3 billion, the highest single three-month total since 2012.

It is against this background that the greatest number of survey respondents (31%) said their largest M&A challenge involved high costs driven by competition. A closely related challenge—“the quality of projects and assets available on the market”—was selected by 17%. Access to capital, mitigating risks and conducting due diligence were generally considered less significant. Only 5% felt the speed and efficiency of conducting M&A deals was the most significant hurdle.

Capex plans

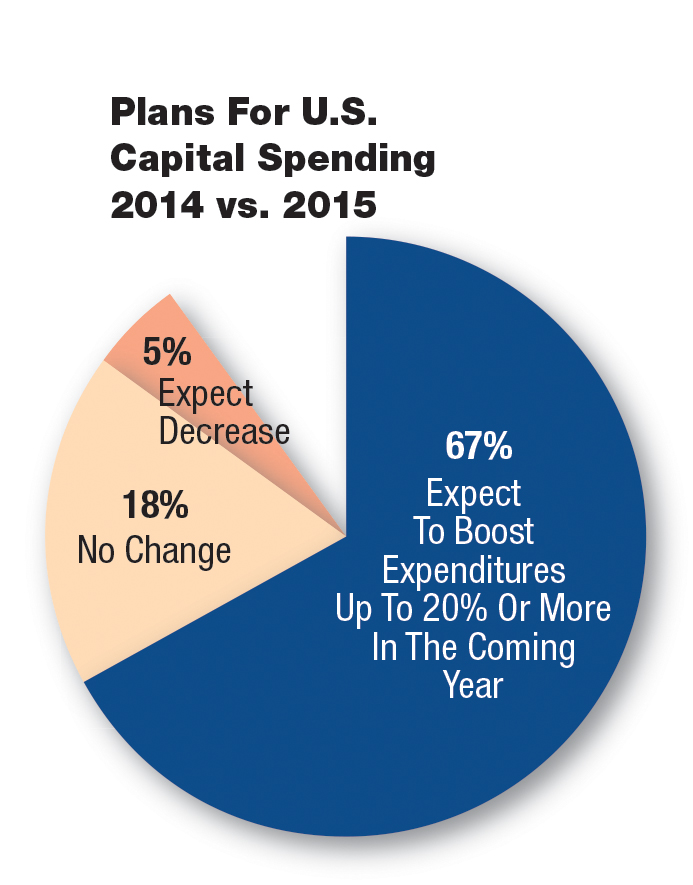

At the time of the survey, July 2014, commodity prices had not yet dropped. When asked about their plans for U.S. capital spending in 2014 vs. 2015, 67% of respondents said they expected to boost expenditures up to 20% or more in the coming year. Just 18% forecast no change, and only 5% expect a decrease.

The oil and gas industry expected U.S. capital outlays to continue to increase steadily because of several factors: With the price of oil sufficiently high and public companies eager to show growth to Wall Street, companies are drilling more wells. The fever to acquire land seen in 2009 to 2012 has subsided, and most shale plays have now been staked. With leases now in hand, and the experience they have gained from previous horizontal drilling, companies are high up on the learning curve, and they are drilling more and more wells each year.

Not only are companies drilling more, but also wells are becoming more expensive and more complex. Wells now require longer horizontal legs, and “frack intensity” (the number of frack stages) is increasing as well. Multistage hydraulic fracturing and multifracks for each stage have become standard in the Bakken and other shale plays. Although these trends push up costs, they also increase production.

On the other hand, when asked about plans for capital spending in 2014 vs. 2015 for foreign expenditures, 62% of respondents said this question was not applicable to their business over the next year. Of those responding, 17% expect no change and 16% expect to increase foreign expenditures up to 20% or more in the coming year. The relative lack of interest may reflect the predominance of smaller, more U.S.-oriented firms among the respondents. At the same time, it’s likely that the success of U.S. plays has decreased current interest in foreign investment opportunities, Schroeder said.

A shortage of qualified staff

The boom in the oil industry has created tremendous demand for workers at all levels, from geologists to welders to truckers. Compared with 2014, some 63% of the respondents expect their company will hire more in 2015; just 2% said hiring would decline. Some 34% believe employment will stay at current levels. The responses were similar for expectations for 2016 and 2017 staffing.

The states with large shale plays are among those with the lowest unemployment rates: As of June 2014, the Bakken and Three Forks in North Dakota had pushed the state’s unemployment rate down to 3.5%. Aggravating the industry’s labor shortages is the aging of its workforce; many geologists and engineers are expected to retire over the next few years. At the blue-collar level, because of the lack of skilled workers, many companies conduct their own training programs and are partnering with community college programs to give staff the skills they need.

Energy exports

Under present federal law, refined petroleum products like gasoline can be exported—but not crude oil itself, except under limited circumstances.

The issue of liberalized oil exports divides the upstream and downstream sectors. U.S. refiners of light crude now enjoy an abundance of domestic supply; they naturally want to keep export restrictions in place. In much of the country, however, refineries can handle only heavier crude, so producers have insufficient buyers for their product and seek new markets.

Answering charges that more light crude exports would raise U.S. gasoline prices, producers can point to the several studies showing that lifting the ban would, in fact, reduce prices. Increased crude supply in the global market would cut world oil prices, and lower quotes for refined products would follow.

Export proponents also note that many of the world’s top oil-exporting nations are in areas of political instability or are not necessarily U.S. allies. They therefore argue that additional U.S. supply helps stabilize the fickle global energy balance.

There has been some movement toward loosening the rules: The Commerce Department has allowed two companies to export condensate, ultralight oil that can be made into motor and jet fuel. Approvals have also been received recently for natural gas facilities directed at exports. And there have been more calls by both industry leaders and economists to lift the ban. For the time being, however, U.S. crude oil exports are allowed only to Canada.

Takeaways shaping the industry

The survey identified five takeaways that are shaping the industry today and into the future:

Regulations are seen as excessive, complicated and unpredictable. Against the backdrop of a U.S. political system that has oversight at federal, state and local government levels—and with drilling opponents opportunistically exploiting every level—a majority (55%) of respondents said that the volume, complexity and uncertainty of regulations were the biggest challenges they face. Another 20% responded that it was the resulting inability to accurately forecast economic consequences. Response time by the government to assist companies with compliance once a new regulation is established was cited less often (10%).

Rapid growth tests technology infrastructure. The effects of operations expansion through M&A, along with the organic growth firms are experiencing, was reflected in respondents’ opinions. Some 43% said the technology infrastructure issues creating the most concern were either systems integration and compatibility or costs of implementing new technology. About 29% said limited access to relevant decision-making data because of outdated technology is impeding growth.

Tight labor markets threaten operations. Given the difficulties of finding qualified staff, it’s not surprising that the operational infrastructure challenge most cited was finding and retaining qualified personnel (45%). An additional 5% of respondents said the pool of potential employees is insufficient. Some 15% cited the uneven quality of service providers, either because of inexperience or lack of personnel. Another 11% said that maintaining efficient processes while facing growth was their major concern.

Operational risks vary by level of company maturity. In terms of operational risks, respondents gave a variety of responses, suggesting that energy companies are at different maturity levels. Availability of acquisitions and divestitures (i.e., M&A) transactions and safety/environmental concerns were almost of the same importance (31% and 33%, respectively).

Possibly reflecting the pressing need to comply with the new Committee of Sponsoring Organizations (COSO) framework, ineffective internal controls and processes were mentioned by a significant 20%. However, fraud and corruption were rarely cited as a top concern (2%).

Legal and tax operational strategies support drilling. When asked what organizational structuring strategies were most important from a legal and tax perspective, 32% of respondents cited MLPs, LLCs and private companies. A significant 24% said the top issue is ensuring legal and operational structures are in place, and 11% cited succession planning and wealth planning. Deciding whether to sell or go public was not viewed as most important.

Ensuring compliance and managing the volume of obligations were the two biggest challenges in administrating contracts and agreements, totaling 53% of the responses. Dealing with ineffective processes and/or systems to automate contract administration was mentioned by 17%. Detecting contract fraud was the No. 1 concern of only 3%.

The 2014 Grant Thornton LLP survey of U.S. oil and gas companies is based on answers from 564 respondents collected in July 2014. Respondents were C-suite and senior executives from U.S. independent producers, midstream operators, oilfield service companies and financial companies. Participant titles included CEO, COO, CFO, CIO, senior vice president, board member, general counsel, and tax and finance professional.

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.