The all-stock transaction valued at about $649 million is set to create an E&P exclusively focused on oil-weighted rural areas in the D-J Basin. (Source: Hart Energy)

Bill Barrett Corp. (NYSE: BBG) and private equity-backed Fifth Creek Energy Co. LLC have agreed to an all-stock merger intent on creating a new player in the heart of the Denver-Julesburg (D-J) Basin, the companies said Dec. 5.

The merger, valued at $649 million by the companies, includes Fifth Creek’s assumption of $54 million in debt. The deal more than doubles Bill Barrett’s position and adds nearly 14% in oil-weighted production.

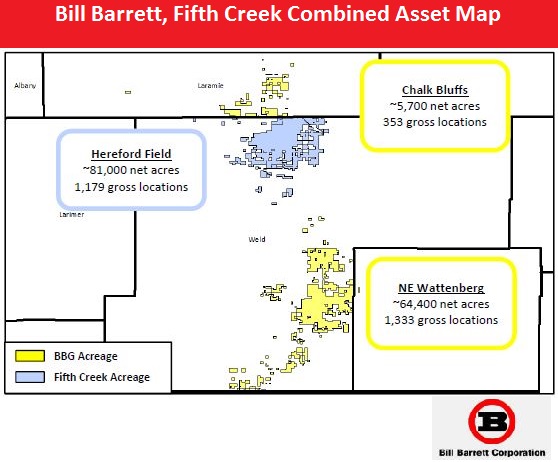

Following the transaction, Bill Barrett and Fifth Creek said they will become subsidiaries of a newly formed public E&P exclusively focused on oil-weighted rural areas in the D-J Basin. The company’s position will include about 151,100 net acres and an inventory of 2,865 undeveloped drilling locations—about 95% of which are suitable for extended-reach laterals (XRL), according to regulatory filings.

Fifth Creek’s largely undeveloped acreage is prospective for multiple Niobrara horizons and the Codell Formation, the companies said. On average, the assets can generate returns of 65% at strip pricing and drilling costs of $4.9 million per well.

Fifth Creek produced an average 2,900 barrels of oil equivalent per day (boe/d) in third-quarter 2017, of which 72% was oil. Combined with Bill Barrett’s volumes, the company expects pro forma third-quarter production of about 24,000 boe/d.

Fifth Creek, backed by private-equity firm Natural Gas Partners, holds roughly 81,000 net acres in the D-J Basin. Fifth Creek’s assets include 62 standard-length lateral wells and seven XRL wells.

‘Right Acquisition’

Fifth Creek’s acreage position includes the Hereford Field in rural northern Weld County, Colo. At the close of 2016, the area was about 3% proved developed with estimated proved reserves of 113 million boe, according to Netherland, Sewell & Associates Inc. The area offers running room for modern completion designs to enhance well returns, Bill Barrett said.

Scot Woodall, president and CEO of Bill Barrett, said the company had been seeking opportunities to expand its core D-J Basin asset base though with the “right acquisition.”

Over the past several years, Bill Barrett has been unwinding its portfolio as it sought to become a pure-play D-J Basin E&P. Most recently, the company agreed to sell its remaining noncore assets in the Uinta Basin for $110 million, which it expects to close by year-end 2017.

The combination with Fifth Creek provides Bill Barrett with “a unique opportunity to add a large, undeveloped acreage position at an attractive cost, with the potential for decades of high-return drilling locations located in a rural area that is highly complementary to our legacy position,” Woodall said in a statement.

The new, combined company will maintain operational control in the Hereford Field, where all net acreage is operated and largely HBP with minimal near-term lease expirations.

“The transaction creates a compelling long-term growth platform that will allow us to deliver strong company-wide margins as we maximize capital efficiency and concentrate on the highest return project areas,” Woodall said. “We expect to immediately begin employing our operational expertise on the acquired acreage as we implement enhanced completion and flowback techniques.”

Preliminary 2018 plans for the new company include running three drilling rigs with anticipated production of 11 million boe to 12 million boe (about 65% oil) with capex between $500 million and $600 million, the release said.

Fifth Creek was formed in 2015 by Michael Starzer and Patrick Graham, who were also founders of Bonanza Creek Energy Inc. (NYSE: BCEI). In January, Bill Barrett had been in talks to merge with then-bankrupt Bonanza Creek, according to regulatory filings. No deal was reached and Bonanza later entered a merger agreement with SandRidge Energy Inc. (NYSE: SD) in November.

Terms

Under the combination agreement, Bill Barrett’s stockholders will exchange their common stock for the new stock on a one-for-one basis. Additionally, Fifth Creek’s current sole owner will receive 100 million shares of the new stock. As of Dec. 4, Bill Barrett had about 76.3 million shares outstanding.

Bill Barrett also agreed to a privately negotiated exchange of $50 million of its 2022 notes for newly issued shares of the company’s common stock plus the accrued and unpaid interest in cash. The value of the bonds will be at 102% of par.

Additionally, Bill Barrett said it intends to sell 21 million shares of its stock in an underwritten public offering for total gross proceeds of $105 million. Following the offering, which has a 3.15 million share greenshoe option, the company will have at least 97.3 million shares outstanding. J.P. Morgan is serving as the sole book-runner for the offering.

The boards of Bill Barrett and Fifth Creek unanimously approved the terms of the merger agreement, the release said.

Bill Barrett said it expects the merger to close by early second-quarter 2018. The transaction is subject to regulatory review and approval by Bill Barrett stockholders.

Following closing, Woodall will serve as CEO and president of the combined company and Jim W. Mogg will continue as chairman of the board. The board of directors of the combined company will be comprised of 11 members, including the six members of Bill Barrett’s current board and five members to be designated by Fifth Creek.

Tudor, Pickering, Holt & Co. was financial adviser to Bill Barrett and Wachtell, Lipton, Rosen & Katz was its legal adviser. Credit Suisse was Fifth Creek’s financial adviser. Vinson & Elkins LLP was legal adviser to Fifth Creek.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.