The Denver-based company will become a pure-play D-J Basin operator following its Uinta exit and plans to use sale proceeds to fund its 2018 drilling program. (Source: Hart Energy)

Bill Barrett Corp. (NYSE: BBG) will break from the Uinta Basin in a $110 million deal that effectively converts it into to a pure-play Denver-Julesburg (D-J) Basin E&P, though at a sacrifice of high oil production.

The Denver-based company plans to use sales proceeds to help cover its 2018 capex to drill the Wattenberg Field, where it has rapidly escalated oil production growth.

As part of an agreement with unaffiliated third parties, Bill Barrett will sell its remaining noncore assets in the Uinta Basin and part with 11% of the company’s total production. The buyers of the assets weren’t disclosed.

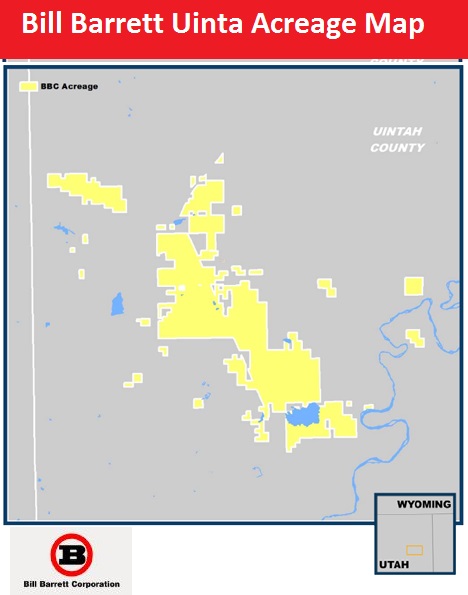

According to its November investor presentation, Bill Barrett held roughly 24,000 net acres in the Uinta’s East Bluebell Field with third-quarter production averaging about 2,300 barrels of oil equivalent per day (boe/d). About 91% of the Uinta production volumes are oil, the company said.

At $35,000 per flowing boe/d, Seaport Global Securities estimates the company received about $1,200 per acre, the firm said in a Nov. 21 report. The company did not specify how much acreage was sold but said it divested 12 million boe of estimated proved reserves—the reserves associated with the company’s entire northeast Utah position.

Following the Uinta exit, Bill Barrett’s portfolio will consist of a 71,900-net-acre footprint in the D-J Basin, where production averaged 18,500 boe/d in the third quarter. The company plans to use sale proceeds to help fund extended-reach lateral horizontal development activity in its Wattenberg assets.

Bill Barrett’s “widely anticipated move” came in at the low end of Seaport’s estimated range of $100 million to $150 million, the firm said. The company said at the end of October it planned to sell its remaining Uinta assets. Proceeds from the sale will improve its year-end 2018 net debt/EBITDA to 2.3x assuming current strip prices, Seaport said.

Pro forma for the sale, Bill Barrett’s liquidity will consist of more than $150 million cash and an undrawn $300 million credit facility supported by an underlying hedge position, the company said.

In the third quarter, Bill Barrett saw production grow 26% sequentially to total 1.92 million boe while maintaining a $57 million capex—20% lower than its guidance range. The company attributed the growth to its D-J Basin program where it currently operates two drilling rigs in the northeast Wattenberg extension.

“We have a top-tier oil position in the D-J Basin with our 2017 capital program underpinning a strong growth profile in 2018 as we expect to generate greater than 30% growth from our northeast Wattenberg assets,” Scot Woodall, CEO and president, said in a statement. “We anticipate that our 2018 capital program will be fully funded as we exit 2017 with a significant cash position and an improved leverage ratio.”

Production from Bill Barrett’s Uinta targeted the Lower Green River Formation.

Bill Barrett said it expects to close the Uinta Basin divestiture by year-end 2017, subject to customary closing conditions and adjustments. Tudor, Pickering, Holt & Co. advised the company on the sale process.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Summit Acquires Moonrise Midstream Assets to Alleviate D-J Constraints

2025-03-10 - A Summit Midstream Corp. (SMC) subsidiary will acquire Moonrise Midstream from Fundare Resources Co. in a cash-and-stock deal valued at $90 million.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

2025-01-27 - Double Eagle IV ramped up oil and gas production to more than 120,000 boe/d in November 2024, Texas data shows. The E&P is one of the most attractive private equity-backed M&A targets left in the Permian Basin.

Howard Energy Partners Closes on Deal to Buy Midship Interests

2025-02-13 - The Midship Pipeline takes natural gas from the SCOOP/STACK plays to the Gulf Coast to feed demand in the Southeast.

Amplify Updates $142MM Juniper Deal, Divests in East Texas Haynesville

2025-03-06 - Amplify Energy Corp. is moving forward on a deal to buy Juniper Capital portfolio companies North Peak Oil & Gas Holdings LLC and Century Oil and Gas Holdings LLC in the Denver-Julesburg and Powder River basins for $275.7 million, including debt.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.