BKV Corp., the largest producer in the Barnett Shale, IPO’d on the New York Stock Exchange on Sept. 26. (Source: BKV, Shutterstock)

BKV Corp. IPO’d Sept. 26, nearly two years after the Barnett Shale’s top gas producer first filed to go public.

BKV shares opened at $18.55 per share on the New York Stock Exchange, up from an IPO price of $18 per share. The company originally expected to sell 15 million shares priced between $19 and $21 per share.

The company’s first day of trading closed at $18 per share, according to Yahoo Finance.

The IPO launch heralds the end of a nearly two-year holding period for BKV, which filed preliminary paperwork to go public in November 2022. But BKV’s IPO plans have been mired by persistently low natural gas prices, elevated interest rates and geopolitical volatility ever since.

In an exclusive interview with Hart Energy, BKV CEO Chris Kalnin said the company was encouraged by several factors to move forward with an IPO, including falling interest rates and improvements in the gas-price forward curve.

But the momentum around artificial intelligence power demand was the top driver for BKV’s IPO, Kalnin said.

“One of the things that really played to our strength is the whole AI data center boom,” Kalnin said. “Our ability to offer gas, power and decarbonize that energy mix in the form of carbon sequestration is unparalleled in Texas, and I think the market appreciates that.”

BKV isn’t just a natural gas producer. The company and its financial sponsor, Thai energy firm Banpu Plc, own interests in gas-fired power plants in Texas. BKV operates a retail electric business, BKV Energy, to sell power to Texas customers.

The Barnett Shale E&P is also working to integrate carbon capture, utilization and storage (CCUS) projects to reduce emissions associated with upstream gas production.

That’s attractive to the hyperscaler technology companies and AI data center builders working to decarbonize their already intense, and growing, power demands.

Players all along the AI value chain are searching high and low for cleaner, low-cost and reliable sources of power. Microsoft Corp., as part of that quest, is backing a plan to restart the Three Mile Island nuclear plant, a site made infamous from a partial nuclear reactor meltdown in 1979.

Kalnin said this concept of “guilt-free gas”—pairing natural gas power generation with CCUS—is resonating with the power-hungry AI players.

“If you think about the promises they’ve made to their market, shareholders and stakeholders and you think about their solution space, I think it’s inevitable,” Kalnin said. “We are having conversations with them already.”

Other gas producers, midstream operators and landowners in gassy regions see opportunity to hop on the AI gravy train. LandBridge Co., which IPO’d on the NYSE this summer, has a land-lease agreement with a data center developer in the Delaware Basin.

Producers are vying for data center projects to be sited in basins with significant stranded gas output, including the Permian Basin and the Marcellus Shale in Appalachia. Kalnin says the Barnett can also check the necessary boxes for AI power demand.

“We’re having deep conversations with data center companies saying, ‘Look, we can do it all in one stop,’” Kalnin said. “’You guys need electricity; you need gas, and you need to decarbonize it. BKV offers you a solution unlike any other company.’”

RELATED

Behind the Hype: The 'Jaw-dropping' Expectations for AI, Natural Gas

Gas glut

BKV might do more than produce natural gas, but gas production is a huge part of BKV’s business. And natural gas prices “have decreased significantly” since the start of 2023, reducing BKV’s cash flows and putting financial pressure on the company, according to investor filings.

Banpu stepped in last year, agreeing to provide funding for BKV to meet its financial obligations through June 30, 2025. Banpu will own a 75.9% stake in BKV upon completion of the IPO.

Banpu CEO Sinon Vongkusolkit told Hart Energy that the company will continue to support BKV going forward.

“We’re a strong supporter on gas,” Vongkusolkit said. “I think what BKV has built is a very unique story.”

BKV plans to use $230 million in proceeds generated through the IPO to reduce debt outstanding from a term loan and a reserve-based credit agreement.

“[The IPO] gives us access to capital, it delevers the balance sheet further with giving us headroom,” Kalnin said. “It gives us a currency to grow as we look at acquisitions in the future.”

Natural gas prices are still low: Henry Hub spot prices averaged $1.98/MMBtu in August, down 23% from $2.58/MMBtu in August 2023. However, Nymex prices have steadily climbed through September.

Henry Hub prices had averaged $8.81/MMBtu in August 2022, following the Russian invasion of Ukraine and an ensuing energy crisis across Europe. Prices started to come down in the back half of 2022, when BKV began to pursue an IPO.

BKV revenue and profitability are still highly dependent on natural gas and NGL prices, the company noted in regulatory filings.

But BKV also doesn’t need to deploy huge amounts of capex to maintain, or slightly grow, gas production from its low-decline assets.

Compared to the Haynesville and Marcellus shales and even the Permian Basin—where gas is a byproduct of drilling oil wells—the Barnett is a mature basin with shallow declines.

BKV’s corporate one-year decline is around 11% without spending a dime of development capex, Kalnin said.

“The last 12 months, we spent on average around $42 million in capex and declined maybe 4% on an annualized basis,” he said. “Our business is about responding to where commodity prices are and generating cash in all environments.”

BKV reported adjusted free cash flow of $67.1 million during the six months ended June 30, 2024, compared to negative free cash flow of $11.4 million over the same six-month period in 2023.

RELATED

BKV Prices IPO at $270MM Nearly Two Years After First Filing

Barnett keeps rolling

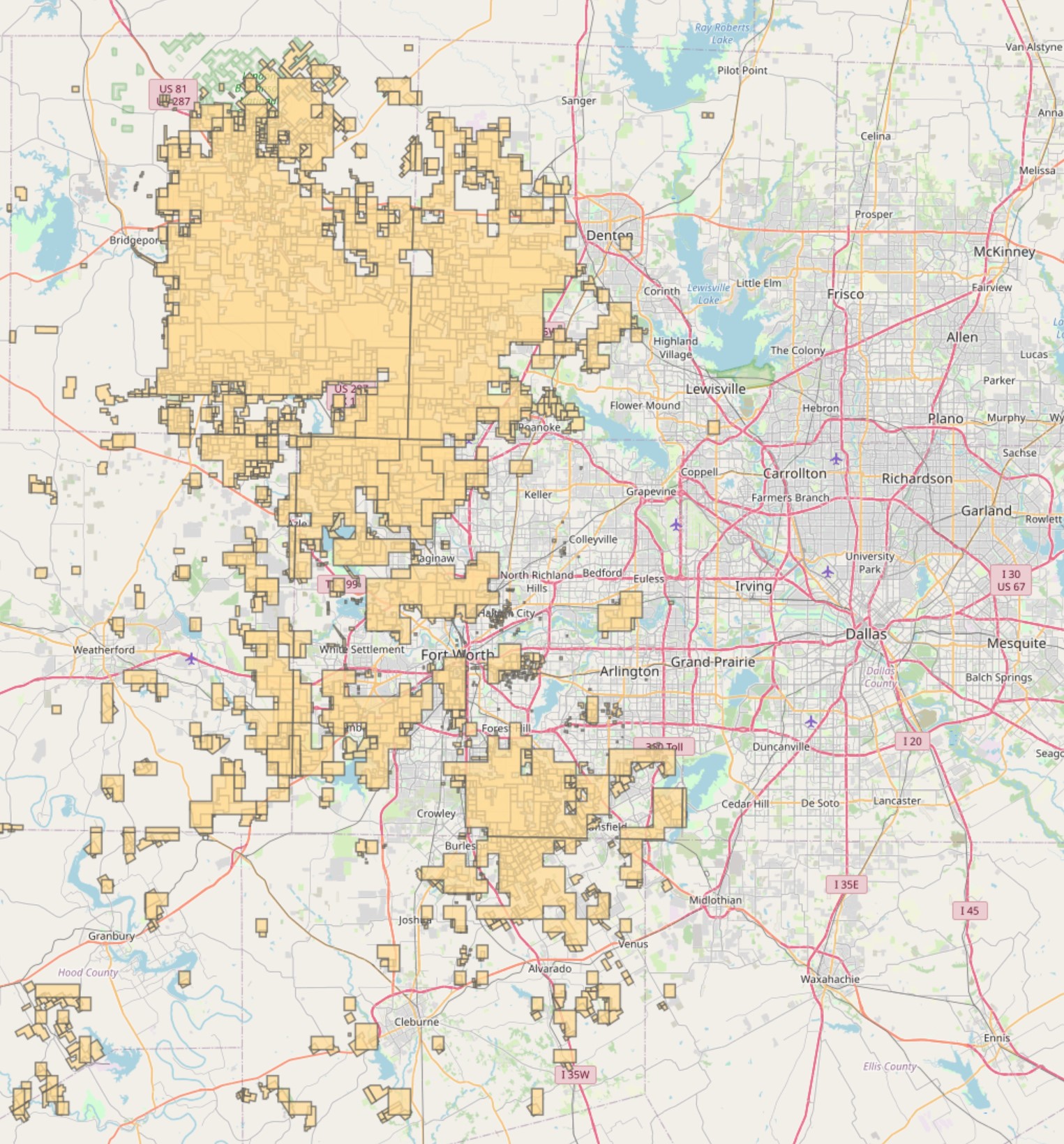

BKV is the largest gas producer in the Barnett, the pioneering shale-gas play northwest of Fort Worth, Texas. George Mitchell and Mitchell Energy are credited for pioneering the economic production of shale gas from the play.

As of June 30, BKV held 479,000 net acres in the Barnett. Gas production averaged 807.6 MMcfe/d (80% gas, 20% NGL) during the first six months of 2024, according to Securities and Exchange Commission filings.

BKV also retains a smaller Marcellus footprint in northeast Pennsylvania, where the company holds around 19,480 net acres.

This summer, BKV sold non-operated Marcellus interests for proceeds of approximately $132 million.

The sales in Appalachia center BKV’s current portfolio even more on the Barnett Shale—a play where BKV sees opportunities for M&A, growing domestic production and supplying U.S. LNG exports in the future.

BKV is keeping a close eye on the buildout of LNG export projects along the industrial Gulf Coast corridor. The company sells gas into hubs around the Gulf Coast but hasn’t dedicated a percentage of its gas volumes toward LNG exports.

“You could imagine over time that as we’re starting to do a portfolio approach with our gas sales, we probably will look to sell some toward LNG and get that international pricing,” Kalnin said. “But a percentage of our portfolio, not the whole thing.”

Banpu also sees linking BKV’s gas production to international LNG markets as a future possibility. The company has operations across the Asia-Pacific and Southeast Asia region, where demand for LNG is expected to grow.

“Definitely in the future there will be opportunities,” Vongkusolkit said. “I think for now, BKV will focus on the domestic market.”

RELATED

Ryan Lance: ConocoPhillips Wants to ‘Double’ LNG Project Portfolio

Recommended Reading

Diversified Energy Closes $1.3B Maverick Acquisition, Enters Permian

2025-03-16 - Diversified Energy Co. Plc completed its $1.3 billion acquisition of EIG-backed Maverick Natural Resources.

Camino Reportedly Seeking $2B Sale as Midcon M&A Heats Up

2025-01-30 - Oklahoma producer Camino Natural Resources—one of the Midcontinent’s largest private E&Ps—is reportedly exploring a sale in the range of $2 billion.

Report: Will Civitas Sell D-J Basin, Buy Permian’s Double Eagle?

2025-01-15 - Civitas Resources could potentially sell its legacy Colorado position and buy more assets in the Permian Basin— possibly Double Eagle’s much-coveted position, according to analysts and media reports.

Atlas Energy Solutions to Acquire OFS Power Company Moser for $220MM

2025-01-27 - Atlas Energy Solutions said it will purchase Moser Energy Systems in a cash-and-stock deal that adds power services in the company’s core Permian Basin operating area.

Excelerate to Buy LNG, Power Assets from New Fortress for $1.055B

2025-03-27 - Excelerate Energy will buy a New Fortress Energy’s Integrated downstream LNG and power platform in Jamaica in a $1.055 billion cash acquisition.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.