BKV’s Cotton Cove CCS project, which also reached FID, is on track for first injection in the first half of 2026. (Source: Shutterstock)

Barnett Shale natural gas producer BKV has commissioned a study to explore building more combined cycle units to help bridge the gap between growing power demand and baseload energy supply needs, its CEO said Feb. 26.

The company, which continues to grow its carbon capture and power businesses, said the units would be similar to its Temple I and Temple II natural gas-fired power plants in Texas. Together, the power plants—operated by a joint venture (JV) between BKV and Banpu Power US Corp.—have a capacity of nearly 1.5 gigawatts (GW) in the fast-growing Electric Reliability Council of Texas (ERCOT) market.

Electricity needs across the U.S. are expected to soar as industrial and manufacturing facilities along with data centers and other consumers crave more power. ERCOT’s 2024 long-term load forecasts estimates total demand could hit nearly 150 GW by 2030, compared to its 86 GW base forecast in 2024. Data centers account for about half of the growth.

“During the fourth quarter, our power JV took proactive steps to enhance operational readiness of the Temple complex, which involve maintenance on our combined cycle turbines and our steam turbine units,” BKV CEO Chris Kalnin said. “Through these activities, we have positioned ourselves to maximize uptime during peak demand periods, especially during the winter and summer months. In the near term, we have seen prices moderate due to benign weather conditions in Texas and new renewable additions to the grid. However, overall, we remain bullish about ERCOT’s long-term demand growth and scarcity pricing as demand growth is projected to outpace supply additions, particularly baseload supply.”

BKV has the ability to increase utilization of its existing assets through higher capacity factors to help meet demand, Kalnin said. Moreover, “BKV is active in the M&A markets and expects significant opportunities for transactions in the next few years.”

The new power plant study is focused on what customers want. Customers, including data centers, have among their power options private use networks and behind-the-meter solutions.

“There’s some specific customers out there that want new generation assets as part of doing deals. They don’t want to be seen as taking power off the grid,” Kalnin said. “Our ability to kind of offer both is actually super compelling to them.”

Kalnin sees lots of deals being struck in the ERCOT and broader U.S. market by power players. BKV is uniquely positioned in the ERCOT market with 1,500 undedicated megawatts.

“We’re active. We can decarbonize it, and we have those assets today. So, we feel very excited about the momentum we see in the market,” Kalnin said. “You’re hearing that not just from us but other producers of gas and power.”

Carbon capture

BKV has the ability to decarbonize natural gas combusted at power plants via its carbon capture business.

“In the U.S., carbon capture enjoys strong bipartisan support, including from the current presidential administration,” Kalnin said. “The economic incentives driving its development, such as the 45Q tax credit enacted by Congress and codified in the Internal Revenue Code, have demonstrated resilience across multiple administrations. BKV is solidifying our leadership position in this business.”

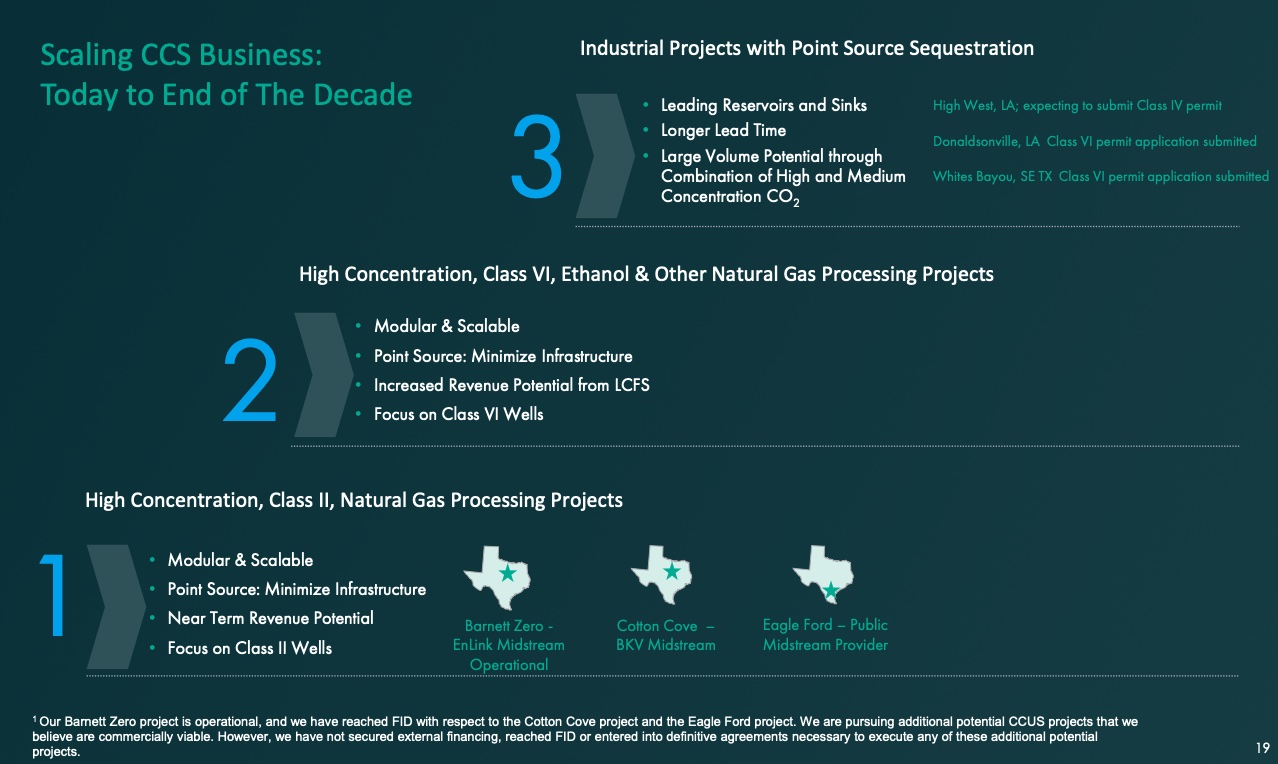

Earlier this month, the company announced a partnership with an unnamed “leading diversified midstream energy company” for a project that aims to capture and sequester about 90,000 metric tons of CO2e in the Eagle Ford Shale. A final investment decision (FID) for the project was reached in mid-December 2024, marking the BKV’s third CCS project to reach FID.

Barnett Zero, the company’s first CCS facility, has been operating in the Barnett Shale for more than one year and has injected about 173,325 metric tons of CO2 since startup, said Eric Jacobsen, president of BKV’s upstream operations. Injection volumes for 2025 are expected to range from 120,000 metric tons to 170,000 metric tons of CO2 per year.

BKV’s Cotton Cove CCS project, which also reached FID, is on track for first injection in the first half of 2026. Also located in the Barnett, the project has a forecasted peak injection rate of 42,000 metric tons of CO2 per year.

The monitoring, reporting and verification (MRV) plan for Cotton Cove was submitted to the U.S. Environmental Protection Agency (EPA) in November 2024, Jacobsen said, and the Class II injection well permit was approved by the Texas Railroad Commission (RRC). Plans are for drilling to begin in the third quarter of 2025.

The RRC has also approved two Class II injection well permits for the Eagle Ford CCS project and the MRV plan has been submitted to the EPA.

“The announcement of the Eagle Ford area CCS project accelerates our progress and gives us a line of sight to achieving our goal of injecting over 1 million tons of CO2 by the end of 2027, largely from NGP [natural gas processing] and ethanol,” Jacobsen said.

BKV plans to spend between $130 million and $170 million on its power business as well as about $90 million on CCUS in 2025.

“We’ll look to further develop the FIDs that we’ve announced. We anticipate there’ll be more FIDs coming and we’ll be quite active in starting to develop these projects for startup in early 2026,” Jacobsen said.

Recommended Reading

The Wall: Uinta, Green River Gas Fills West Coast Supply Gaps

2025-03-05 - Gas demand is rising in the western U.S., and Uinta and Green River producers have ample supply and takeaway capacity.

Bracewell: Many Await Updates to Existing CO2 Pipeline Safety Regulations

2025-01-15 - Pipeline proponents are facing challenges and have been hampered by the lack of clarity regarding CO2 pipeline safety regulations.

Burgum: Feds ‘Will Step In’ to Build Marcellus-to-New England Pipeline

2025-03-12 - Trump administration officials want to greenlight a pipeline to carry Marcellus Shale gas from Pennsylvania into New England states, says U.S. Interior Secretary Doug Burgum.

Greenpeace Files Suit Against Energy Transfer in Dutch Court

2025-02-12 - Environmental group Greenpeace made the move to sue the midstream company in Europe prior to an upcoming hearing brought by Energy Transfer.

Northwind Midstream Puts Delaware Basin Plant Expansion in Service

2025-03-13 - Northwind Midstream, backed by Five Point Energy, plans to continue growing its gathering and processing and amine treatment facilities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.