Black Stone’s single largest deal to date expands its Permian presence with 15,500 net royalty acres in the Midland and Delaware basins. (Source: Hart Energy)

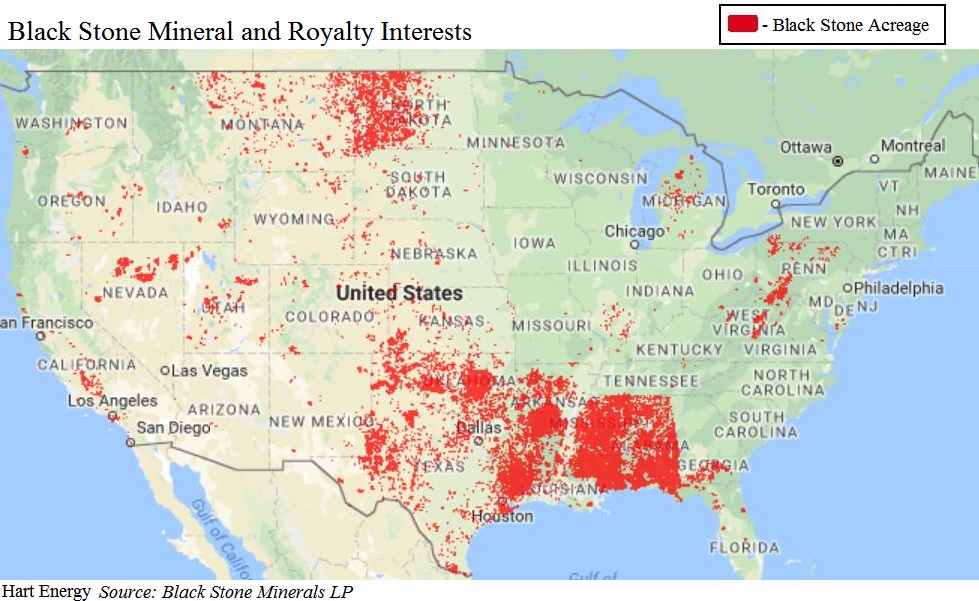

Adding to its larder of mineral and royalty interests, Black Stone Minerals LP (NYSE: BSM) said Nov. 27 it agreed to acquire 140,000 net mineral acres in 20 states from Noble Energy Inc. (NYSE: NBL), including 15,500 net acres of royalty interests in the Permian Basin.

Blackstone will pay $340 million for the interests, with 90% funded through a private placement of new cumulative convertible preferred units to an affiliate of private-equity firm The Carlyle Group, the company said.

For Noble Energy, the deal is the second announced sale in November. On Nov. 8, the company agreed to sell about 30,200 net acres in the Denver-Julesburg (D-J) Basin for $608 million.

Noble’s D-J Basin divestiture was seen as a way to further strengthen its balance sheet for 2018 and ultimately realize free cash flow. The company appears likely to conduct more asset sales as it focuses on share repurchase or debt reduction, Charles Robertson II, an analyst at Cowen & Co. said in a Nov. 17 report.

Thomas L. Carter Jr., president, CEO and chairman of Black Stone, said the deal with Noble is the largest single acquisition the company has made. The transaction primarily targets assets in Texas, Oklahoma and North Dakota.

“It has all the characteristics of what we have found drives success long-term in the mineral business,” Carter said on a Nov. 17 conference call. “With this transaction we are meaningfully expanding position in the greater Permian Basin. There’s also a high-quality Williston Basin position that will add over 10,000 net royalty acres, bolstering the oily side of our portfolio.”

Black Stone’s acquisition includes overall average daily production for November of 2.6 million barrels of oil equivalent per day, of which 56% was oil. At the asset level, the interests generate about $34 million in annual cash flow, Carter said.

The company will acquire about 8,300 net royalty acres in the Midland Basin and 7,200 net royalty acres in the Delaware Basin. In addition, Black Stone will add positions in Wyoming’s Powder River Basin, the Oklahoma Scoop play and the Texas Granite Wash.

In the increasingly competitive mineral interests sector, Black Stone has entered or closed on 135 deals in 2017 worth about $500 million—including $428 million cash and $72 million in equity.

Through the first three quarters, the company purchased mineral and royalty interests in the Haynesville and Bossier, East Texas and the Anadarko Basin worth about $160.7 million in cash and equity. Black Stone even bought the Angelina County Lumber Co. in Lufkin, Texas, to acquire mineral and royalty interests.

For the Noble transaction, Carlyle’s financing agreement requires a 7% distribution for six years, said John Freeman, an analyst at Raymond James.

“Black Stone also entered into a farm-out agreement with Pivotal Petroleum Partners, which covers Black Stone’s remaining working interest share in the XTO Energy-operated Shelby Trough wells,” he said. “Black Stone has now minimized its future capital obligations to these Shelby Trough wells through its farm-out agreements with Pivotal today and Canaan Resource Partners earlier this year.”

Freeman added that the $340 million acquisition gives Black Stone “greater exposure in the Permian, Scoop and Bakken/Three Forks plays.”

The deal has an effective date of July 1. Black Stone executives said the production and revenues gained from that time are included in the sales price and that they expect to begin booking production from the assets in December.

Darren Barbee can be reached at dbarbee@hartenergy.com.

Recommended Reading

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Inside Ineos’ US E&P Business Plan: Buy, Build, Buy

2025-01-27 - The E&P chief of U.K.’s Ineos says its oily Eagle Ford Shale acquisition in 2023 has been a profitable platform entry for its new U.S. upstream business unit. And it wants more.

Oxy CEO: US Oil Production Likely to Peak Within Five Years

2025-03-11 - U.S. oil production will likely peak within the next five years or so, Oxy’s CEO Vicki Hollub said. But secondary and tertiary recovery methods, such as CO2 floods, could sustain U.S. output.

Watch for Falling Gas DUCs: E&Ps Resume Completions at $4 Gas

2025-01-23 - Drilled but uncompleted (DUC) gas wells that totaled some 500 into September 2024 have declined to just under 400, according to a J.P. Morgan Securities analysis of Enverus data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.