The line will move natural gas out of West Texas to pipeline networks along the Gulf Coast. (Source: Shutterstock)

The latest Permian Basin natural gas pipeline project is poised to win the race for the next line to be built and could wipe some other proposals off the table, an analyst said.

On July 31, WhiteWater Midstream announced that a final investment decision (FID) had been reached for the Blackcomb Pipeline, answering the natural gas takeaway question Midland and Delaware basin E&Ps had been asking for months.

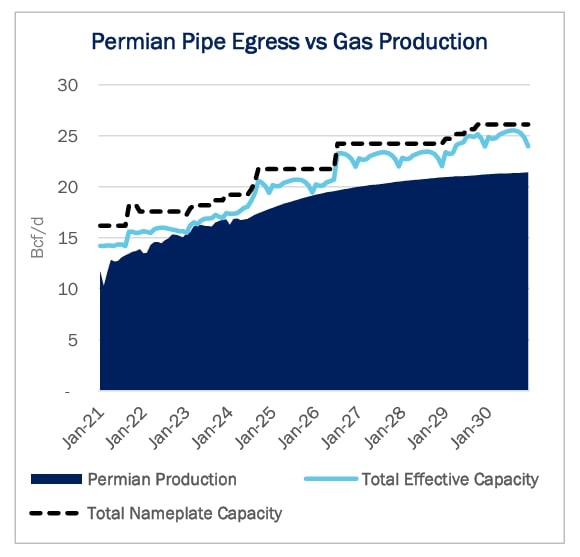

With the WhiteWater-operated Matterhorn Express coming online in 2024 with 2.5 Bcf/d of capacity, the region's natural gas egress is not expected to hit capacity again until 2026. Matterhorn has an in-service date in September.

Blackcomb will take up the slack from there. The line will move natural gas out of West Texas to pipeline networks along the Gulf Coast. With 2.5 Bcf/d capacity, the line will be able to handle the additional natural gas the region is expected to produce in the 2026 timeframe.

At least four other projects had been publicly proposed to do roughly the same thing, but none had reached an FID before July 31. Since building a large intrastate pipeline in Texas takes about two years to build, the decision to make an FID this year was crucial in order for a line to be ready by 2026.

The other proposed projects were Energy Transfer’s Warrior, Targa’s Apex, private company Moss Lake’s DeLa Express and Kinder Morgan’s Gulf Coast Express (GCX) expansion project.

“This FID makes these projects unlikely, aside from potentially GCX’s expansion opportunity,” said Alex Gafford, an analyst at East Daley Analytics.

One further potential advantage of the Blackcomb pipeline will be the route. The line is expected to follow a path similar to WhiteWater’s Whistler pipeline, meaning the partners behind Blackcomb already have expertise on the terrain and installation in the area, Gafford said.

Whitewater, MPLX and Enbridge, the consortium that owns the Whistler Pipeline, along with an affiliate of Targa Resources, are part of a joint venture (JV) to build the pipeline.

Of the remaining projects, the GCX expansion is most likely to still happen by 2026 because it’s a smaller-scale project. The expansion would add 500 MMcf/d of natural gas capacity to a line already in place. According to East Daley, Kinder Morgan has stated that talks with GCX customers are ongoing, but no final decision has been made.

The other lines are much less probable over the next two years, Gafford said. “Targa’s partnership on this project makes Apex especially unlikely.”

Prior to the Blackcomb announcement, Targa had proposed the Apex Pipeline. Executives at the company had noted earlier in the year that they expected a pipeline to reach FID this summer, but that it wouldn’t not necessarily be for Apex.

Energy Transfer’s Warrior Pipeline is a shorter project that would deliver gas to the North Texas area and connect with the company’s extensive network. The other large pipeline project that has been proposed, the DeLa Express, is not slated for an in-service date until 2028, meaning it wasn’t part in the running this year for an FID.

Blackcomb followed a different development approach than the other projects. The companies backing other pipelines had discussed their plans publicly, in some cases, for years.

Hart Energy was unable to find a mention of the Blackcomb project further back than May 2024, meaning the JV running the project quietly secured its customers before moving forward with a public announcement, Gafford said.

The expected price for Blackcomb was not announced with the project. During the company’s second quarter earnings meeting, Targa executives said they did not expect to spend more than $200 million for their share of the line’s capital investment because the pipeline is expected to be project financed.

One other major project in the Permian, ONEOK’s 2 Bcf/d Saguaro Pipeline, isn’t necessarily competing with the other projects. The proposed line would deliver Permian natural gas to the Mexican border, where it would then be piped to a proposed LNG export terminal on Mexico’s west coast.

The proposed LNG plant has not reached FID. Gafford said he did not expect Saguaro to come online until 2029.

During ONEOK’s second-quarter earnings call on Aug. 6, executives said the company did not expect any capex spending on the project in 2024. However, they felt the line remains a good opportunity.

“This really is a commercially strong project with world-class customers, and it makes great commercial sense,” said Charles Kelley, ONEOK’s senior vice president of commercial natural gas pipelines. “You've got Permian supplies. LNG demand pull is competitively advantaged to the Asian markets.”

Recommended Reading

Venture Global’s Calcasieu Pass Begins Shipments to Long-Term Customers

2025-04-15 - Venture Global’s Calcasieu Pass LNG export facility has begun shipments to the project’s long-term customers following an arbitration process that began in 2024.

Excelerate Energy, Petrovietnam Gas Sign MOU to Secure US LNG

2025-03-19 - Excelerate Energy Inc. and Petrovietnam Gas Joint Stock Corp. are collaborating to secure LNG from the U.S. as early as 2026.

Golar LNG Signs $1.2B FLNG Gimi Debt Facility with Chinese Consortium

2025-03-20 - Golar has agreed to a $1.2 billion sale leaseback facility with a consortium of Chinese leasing companies for the refinancing of its existing FLNG Gimi debt facility.

NextDecade, Aramco Agree to 20-Yr LNG Offtake Deal for Rio Grande Train 4

2025-04-08 - Aramco will buy 1.2 mtpa from NextDecade Corp. upon completion of its Rio Grande Train 4 at a price indexed to Henry Hub.

Petrobras Signs on for 15 Years of LNG from Centrica

2025-02-20 - Petróleo Brasileiro SA has signed a 15-year purchase and sale agreement with British global natural gas supplier Centrica.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.