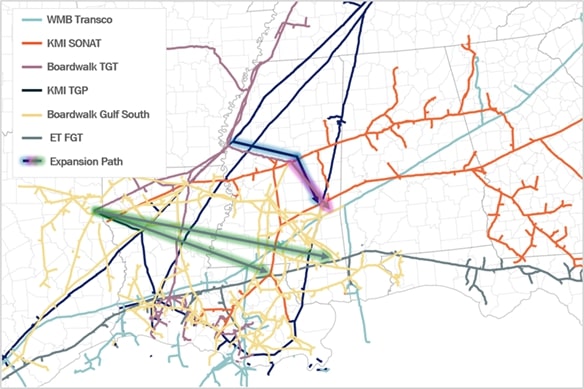

The project “directly competes” with proposals on the table from Kinder Morgan (KMI) and Energy Transfer, said TPH Energy analyst Zack Van Everen in a Dec. 12 article. (Source: Shutterstock)

Boardwalk Pipelines’ Kosciusko Junction project ups the ante in a growing market several competitors are fighting over, analysts said.

On Dec. 11, Houston-based Boardwalk announced it had reached a final investment decision (FID) on the 1.16-Bcf/d Kosci Junction natural gas pipeline project. The pipeline is a 110-mile, 36-inch diameter greenfield project tying in supplies from the Haynesville and Fayetteville shales and Appalachian Basin to southeastern U.S. markets.

The target in-service date is the first half of 2029. The company plans to acquire a permit from the Federal Energy Regulatory Commission as early as third quarter 2025.

In the announcement, Boardwalk leaders said the project is needed to support growing data center and power generation demand in the Southeast, but especially in Mississippi. It’s a region that several other midstream companies have already noticed and are in the midst of creating their own pipeline projects.

The project “directly competes” with proposals on the table from Kinder Morgan (KMI) and Energy Transfer, said TPH Energy analyst Zack Van Everen in a Dec. 12 article.

In the project’s first open season, Boardwalk stated that the junction project would add compression to the Texas Gas Transmission Greenville Lateral and build an 80-mile greenfield pipeline to connect to Southern Natural Gas and an additional 19-mile line to connect into Gulf South, Everen said.

Boardwalk’s minimum reservation rate listed in the open season was $0.42 per 1,000 cf.

KMI’s Mississippi Crossing project has a proposed capacity of 1.5 Bcf/d with connections into Tennessee Gas, Southern Natural Gas and Transco networks. KMI held a binding open season for the project in September.

Energy Transfer has also proposed its own South Mississippi project, which would connect gas from Carthage, Haynesville and Perryville to interconnects that include Southern Natural Gas, Tennessee Gas and Florida Gas. ET has put a minimum capacity on the project of 1 Bcf/d but says it’s scalable to 2 Bcf/d. The company held its open season on the project in October.

Neither KMI nor ET have announced FID on their respective projects.

“Boardwalk may have beaten these competitors to the punch to capture new market,” East Daley Analytics wrote in a Dec. 11 analysis of the move.

Boardwalk said in its announcement that the Kosci Junction build is supported by a 20-year agreement with an anchor customer. The company is negotiating with others for the remainder of capacity, which Boardwalk estimated at 1.58 Bcf/d.

“The Kosci Junction Project provides a critical artery of gas supply needed to support the growth of data centers and industrial demand that is fueling the economic development of our country,” said Boardwalk President and CEO Scott Hallam in the announcement.

Recommended Reading

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Diversified, Partners to Supply Electricity to Data Centers

2025-03-10 - Diversified Energy Co., FuelCell Energy Inc. and TESIAC will create an acquisition and development company focused on delivering reliable, cost efficient net-zero power from natural gas and captured coal mine methane.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Analysts’ Oilfield Services Forecast: Muddling Through 2025

2025-01-21 - Industry analysts see flat spending and production affecting key OFS players in the year ahead.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.