Upon closing, Civitas Resources became the largest pure-play energy producer in Colorado’s D-J Basin, operating across more than half a million net acres with an enterprise value of $4.5 billion. (Source: Civitas Resources Inc.)

Bonanza Creek Energy Inc. has officially rebranded as Civitas Resources Inc. following the recent closing of Bonanza Creek’s merger with Extraction Oil & Gas Inc. and subsequent acquisition of Crestone Peak Resources.

“Civitas embodies an E&P model that is poised to deliver value for all of our stakeholders through disciplined capital deployment, operational and cost excellence, and governance standards aligned with the highest expectations—including our status as Colorado’s first carbon-neutral oil and gas producer,” commented Ben Dell, chairman of Civitas, in a company release on Nov. 1.

Earlier this year, Bonanza Creek laid out plans to form Civitas Resources—“to exemplify the new E&P business model for U.S. producers”—through the consolidation of fellow Denver-Julesburg (D-J) Basin operators, first its all-stock merger agreement with Extraction Oil & Gas and later Crestone Peak.

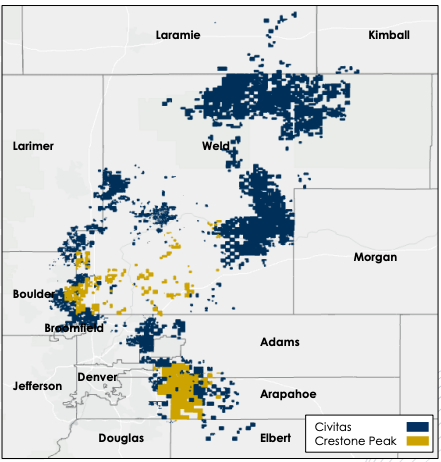

Upon closing, Civitas became the largest pure-play energy producer in Colorado’s D-J Basin, operating across more than half a million net acres with an enterprise value of $4.5 billion. The estimated production base of Civitas was also projected to be approximately 160,000 boe/d with year-end 2020 proved reserves of more than 530 million boe.

“Civitas has the resource quality, low-cost structure, meaningful free cash flow generation, and low financial leverage to deliver sustained shareholder value,” added Eric Greager, president and CEO of Civitas who previously served in the same roles at Bonanza Creek.

Civitas, Crestone Peake Energy Pro Forma D-J Basin Asset Map (Source: Bonanza Creek Energy investor presentation)

The remainder of Civitas executive team includes Extraction CFO Marianella Foschi and COO Matt Owens. Brian Cain was also appointed as chief sustainability officer of Civitas, having previously served as Extraction’s vice president of external affairs and ESG policy.

The Civitas board of directors is now composed of nine members, four from legacy Bonanza Creek including Greager, four from legacy Extraction and one representative from legacy Crestone.

Brian Steck, former chairman of Bonanza Creek and a continuing member of the Civitas board, commented, “I am proud that the values, which galvanized Bonanza Creek’s success over the years—a relentless competitive spirit, safety and environmental responsibility, and a focus on shareholder value—will continue under Eric’s leadership at Civitas.”

“We are poised to lead the way in the E&P market,” he added, “and possess the assets, strategy and people to succeed.”

According to the Nov. 1 company release, the Extraction and Crestone Peak transactions were overwhelmingly approved, with over 99.9% of the votes cast by Bonanza Creek stockholders and over 99.9% of the votes cast by Extraction stockholders voting in favor.

Under the terms of the Extraction merger agreement, Extraction shareholders received a fixed exchange ratio of 1.1711 shares of Bonanza Creek common shares for each share of Extraction common stock owned on the closing date. The Crestone transaction included the exchange of 100% of the equity interests in Crestone for approximately 22.5 million shares of Bonanza Creek common stock.

Upon completion of the transaction, Bonanza Creek and Extraction shareholders were set to each own approximately 37% of Civitas. Crestone shareholders, including Canada Pension Plan (CPP) Investment, Crestone’s primary shareholder which will become Civitas’ largest shareholder, were projected to own roughly 26% of Civitas.

J.P. Morgan Securities LLC was financial adviser and Vinson & Elkins LLP was legal adviser to Bonanza Creek for the Extraction and Crestone Peak transactions. Meanwhile, Extraction retained Petrie Partners Securities LLC as its financial adviser and Kirkland & Ellis LLP served as legal adviser.

As for Crestone, the company retained Jefferies LLC and TD Securities (USA) LLC as its financial advisers and Gibson, Dunn & Crutcher LLP as legal adviser with Jefferies serving as lead financial adviser.

Recommended Reading

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-16 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

SLB’s Big Boost from Digital Offsets Flat Trends in Oil, E&P

2025-01-20 - SLB’s digital revenue grew 20% in 2024 as customers continue to adopt the company's digital products, artificial intelligence and cloud computing.

E&P Seller Beware: The Buyer May be Armed with AI Intel

2025-02-18 - Go AI or leave money on the table, warned panelists in a NAPE program.

PrePad Tosses Spreadsheets for Drilling Completions Simulation Models

2025-02-18 - Startup PrePad’s discrete-event simulation model condenses the dozens of variables in a drilling operation to optimize the economics of drilling and completions. Big names such as Devon Energy, Chevron Technology Ventures and Coterra Energy have taken notice.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.